Median rents for three-bedroom condos in Orchard hit S$15,000 in November: report

Rents for high-end condo projects are up 13.1 per cent over the last quarter

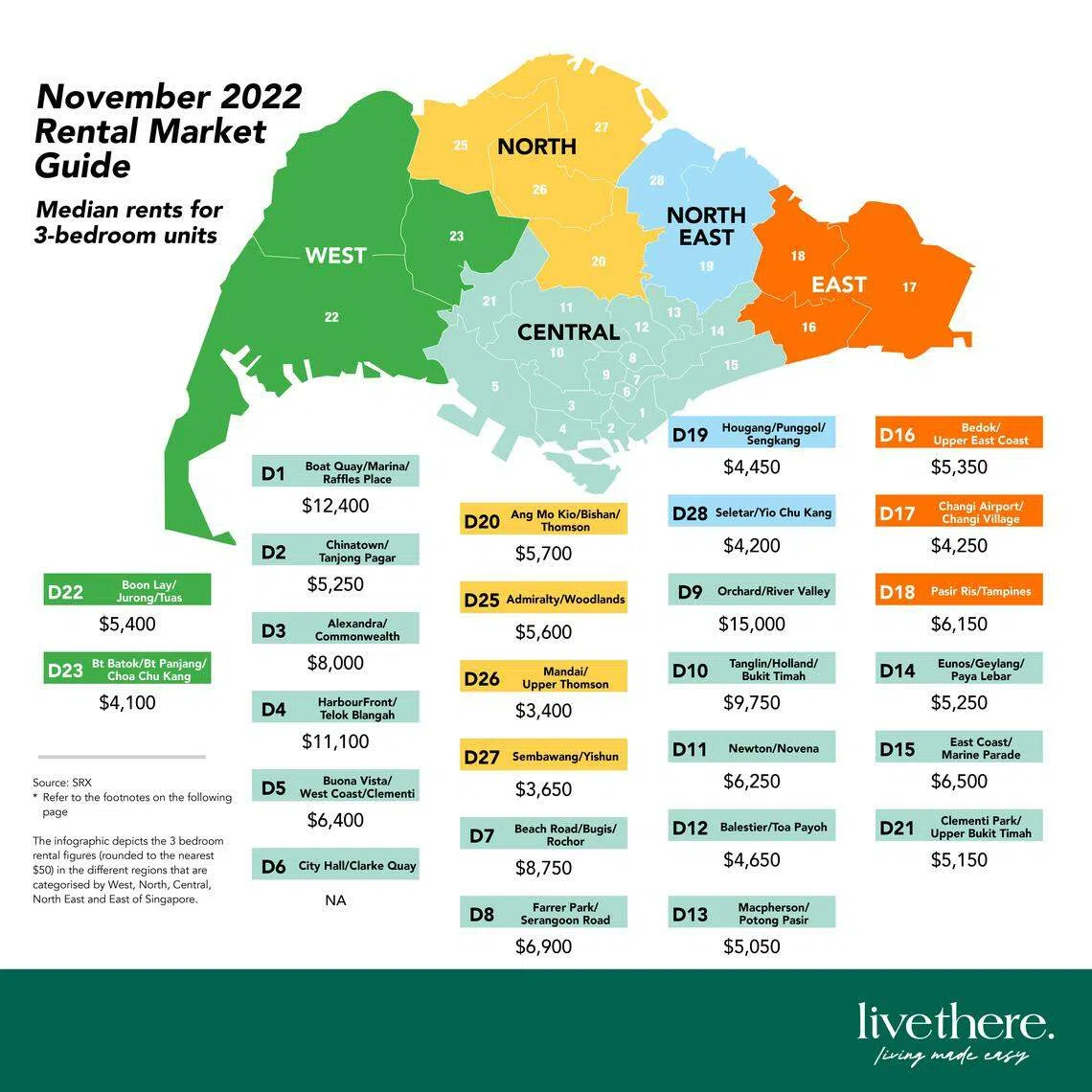

DISTRICT 9 (Orchard, River Valley) has emerged as the top submarket for condominium rents in November, with a median rent of S$15,000 per month for a three-bedroom apartment.

This is followed closely by District 1 (Raffles Place, Cecil, Marina, People’s Park) with a median rent of S$12,400 and District 10 (Tanglin, Holland Road, Bukit Timah) with S$9,750, according to Livethere’s November rental market guide. Livethere is the digital residential marketing arm of Savills Singapore.

In a report released on Friday (Dec 9), Livethere noted that landlords have been pushing rents upwards to meet mortgage payments amid escalating interest rates and a looming recession.

Rents in the rest of central (RCR) and outside central region (OCR) are also rising. In the RCR, District 4 (Telok Blangah, HarbourFront) rents have jumped almost 50 per cent to S$11,000 from a year ago, from S$7,350.

Meanwhile, in the OCR, District 5 (Clementi, West Coast) rents have risen 29 per cent to S$6,400 in November 2022 from S$4,950 in November 2021.

Monthly rents for high-end condominium projects have been climbing since Q2 2011 to reach S$5.41 per square foot per month in Q3 2022. Quarter on quarter, rents have been up 13.1 per cent, according to data from projects tracked by Savills Research.

A NEWSLETTER FOR YOU

Property Insights

Get an exclusive analysis of real estate and property news in Singapore and beyond.

“More high-net-worth foreigners entering Singapore, plus the lack of significant completions and limited stock of larger floor area of homes have resulted in the continual hikes of rents in the prime areas,” Savills noted.

Rents are expected to remain tight until the beginning of 2023, even as 3,619 units reach completion in the fourth quarter of 2022. For 2023, Savills is projecting an increase in supply and vacancies with the completion of 18,234 new residential units.

Alan Cheong, Savills Singapore’s executive director of research and consultancy, believes it will take another 18 months before the property market starts to cool or correct.

This will be when the stock of delayed completions caused by the 2020-2021 pandemic-related disruptions are cleared.

“Even if there is any correction, it may be mild because short of a crisis, rents tend to be sticky,” he added.

When it comes to interest rates, he views the impact for homeowners as more “psychological” with little effect on buyer affordability, as a decade of low interest rates and high liquidity has resulted in wages and savings rising significantly.

“An increase of 2-3 per cent in interest rates would not have as much impact on buying demand compared to a decade ago,” he noted.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Property

China Vanke’s first public commercial Reit falls in early trade on debut

Blackstone in talks to buy Dulwich schools in Singapore, Seoul for US$600 million

China Vanke posts another quarterly loss on sales drought

Miami office tower goes up for sale for more than US$500 million

WeWork cuts new restructuring deal that spurns Adam Neumann

Abu Dhabi builder plans US$6.8 billion luxury housing project