Latest tranche of Astrea PE bonds opens for public subscription

Singapore

THE latest issuance of private equity-backed (PE) bonds by the Azalea Group opens for public subscription today, this time with a larger retail tranche to cater for an expected strong demand.

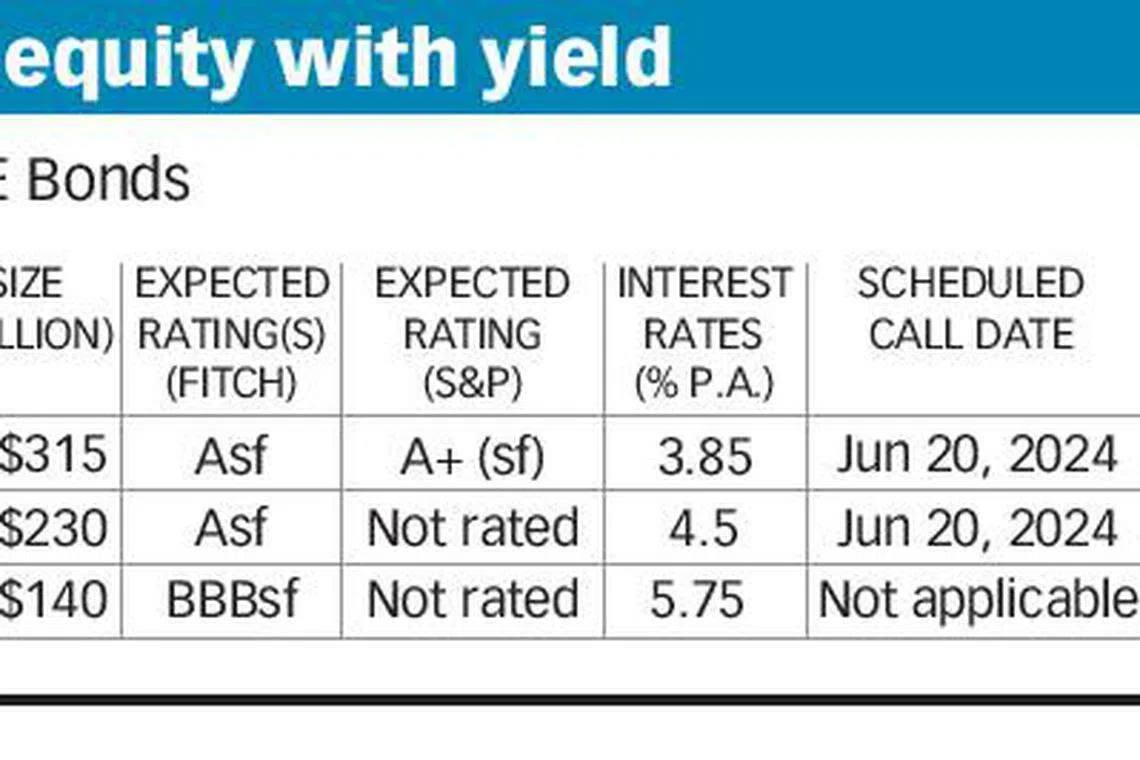

Astrea V PE Bonds are a US$600 million offering of three classes of bonds, with a structure very similar to Astrea IV last year. The bonds are backed by a US$1.3 billion portfolio of 38 PE funds.

Retail investors may subscribe for S$180 million worth of Class A-1 bonds, with a fixed coupon of 3.85 per cent. This is more than half of the total issuance of Class A-1 bonds of S$315 million. The balance is a placement tranche of S$135 million for institutions and accredited investors.

Class A-2 bonds and Class B bonds comprise US$230 million and US$140 million, respectively. All the placement tranches were fully taken up by institutions and accredited investors yesterday. Class A-2 bonds have an interest rate of 4.5 per cent, and Class B 5.75 per cent.

In a statement yesterday, Azalea said the placement tranche saw strong demand across all classes of bonds, with a combined placement orderbook in excess of US$3.4 billion equivalent from over 189 accounts. High quality institutions accounted for 70 per cent, including insurance companies, endowment funds and foundations. Accredited investors accounted for 30 per cent.

The Azalea group is a subsidiary of Temasek Holdings. Azalea holds more than US$4 billion worth of PE assets.

The public offer opens at 9am and closes at noon on June 18. The minimum subscription for A1 bonds is S$2,000.

Class A-1 bonds have a final maturity of 10 years and a mandatory call at the end of five years. The issuer is required to redeem the Class A-1 bonds on June 20, 2024, if there is sufficient cash set aside to repay Class A-1 bonds and other conditions are met. Otherwise the interest rate for Class A-1 bonds will have a one-time step-up of 1 per cent until the bonds are fully redeemed.

Astrea V is the fifth in a series of PE-backed securities by Azalea since 2006. Last year's launch of Azalea IV was the first time there was a retail tranche, comprising S$121 million and a coupon rate at launch of 4.35 per cent.

Margaret Lui, Azalea chief executive, said: "We are excited to bring the Astrea V Class A-1 PE bonds, another series of investment-grade rated bonds, to retail investors in Singapore as a continued effort to make PE more accessible to retail investors... Looking ahead we will be expanding our product offerings in private equity for a wider investor base.''

Chua En Yaw, Azalea managing director and head of PE funds, said Astrea V's larger portfolio of US$1.3 billion "allows us to offer more PE bonds to Singapore retail investors while retaining a conservative capital structure''.

PE is an asset class typically only accessible to high net worth individuals due to the high minimum investment required and illiquidity. The Astrea series of securities are structured with risk mitigating features, such as safeguards to ensure that coupons and principal are paid as scheduled.

The A-1 bonds are also listed on SGX-ST which gives an avenue for bondholders to trade. Astrea V's A-1 bonds are expected to start trading on the main board on June 21.

OCBC credit analyst Wong Hong Wei said Astrea V offers a higher yield than the yield to estimated maturity of Astrea IV at about 3.4 per cent. "We also note that the coupon on the retail tranche of Astrea V is higher than that of the SIA retail bond (3.03 per cent). (see clarification note)

"If interest rates fall, the new issue may benefit. There are limited retail bonds in the local market so comparison is difficult. Hence, the retail tranche of Astrea V offers an option to diversify, given the lack of choices in the SGD retail bond market.''

DBS Bank executive director for fixed income Tan Chek Soon pointed to some recent Singapore corporate issues such as SIA's 3.03 per cent five-year notes and UOL's S$200 million 3 per cent five-year notes. "Based on Astrea V PE Bonds' coupon of 3.85 per cent, this is attractive comparatively. However, we do not think that retail investors should compare asset-backed securities such as Astrea V PE Bonds with the typical SGD corporate bonds. The more appropriate comparison are the Astrea IV PE Bonds issued in 2018 which have a largely similar structure, and is (as of June 11 ) being quoted at approximately S$1.057 (yield-to-call at 2.835 per cent) on the main board of SGX-ST.''

Class A-1 bonds of Astrea V have a preliminary credit rating of A+(sf) by S&P. Fitch has an expected rating of Asf for A-1 and A-2 bonds, and BBBsf for Class B bonds.

S&P said in a May report that the rating is on the strength of Azalea's substantial PE investing experience, the diversification of the portfolio of funds across managers and fund vintages, among others.

Clarification note: An earlier version of the article said that Astrea V offers a higher yield than the current yield-to-maturity of Astrea IV at about 3.4 per cent. OCBC has clarified that it is the yield to estimated maturity of Astrea IV. The article above has been revised to reflect this.

Copyright SPH Media. All rights reserved.