Selling insurance units could help Asia-Pacific lenders stay resilient: S&P

Michelle Zhu

WITH insurance businesses becoming more costly for banks due to tighter regulations and lower-than-expected benefits of cross-selling banking and insurance products, more lenders in the Asia-Pacific region are expected to shed their insurance units to focus on their core.

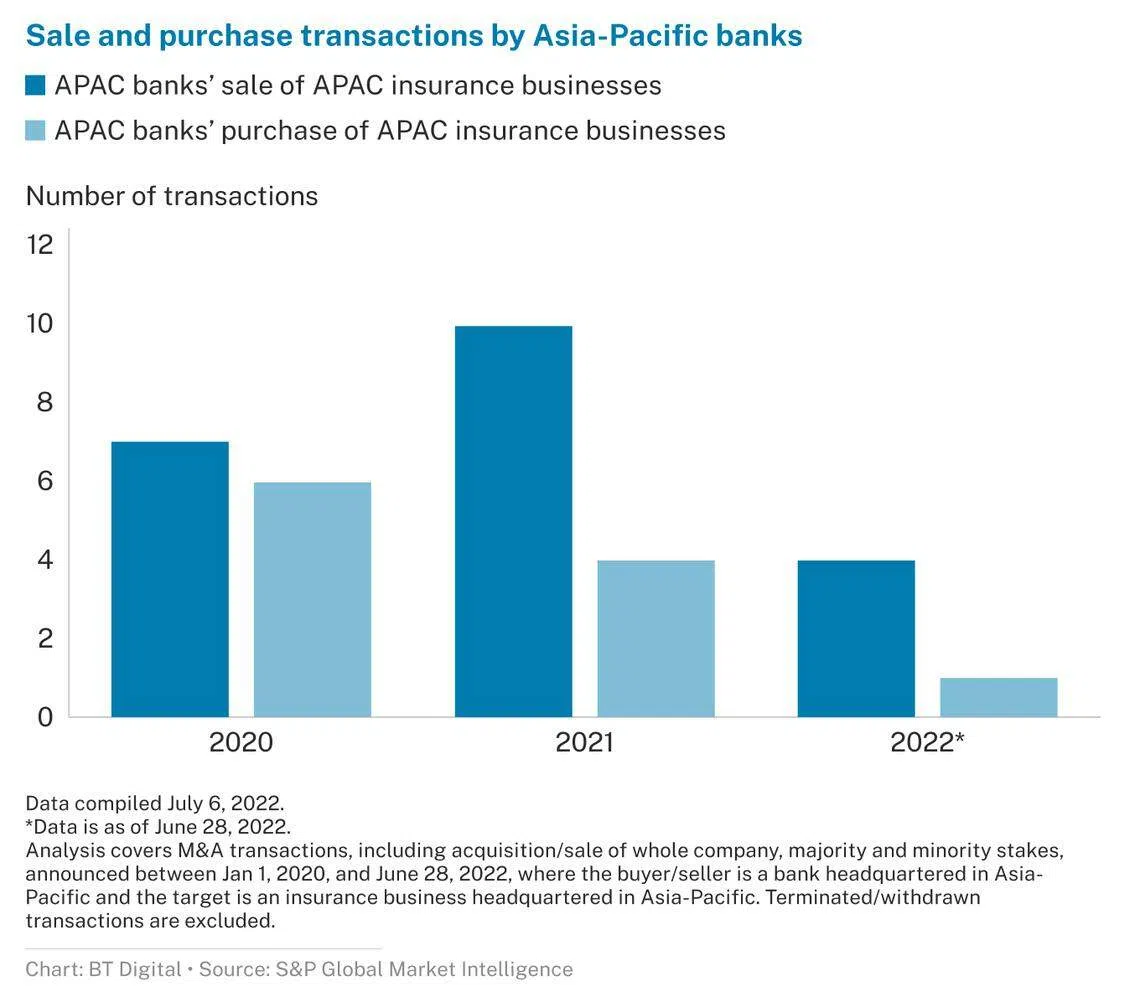

This is according to new analysis from S&P Global Market Intelligence, which found that the region’s banks have been selling their insurance units at a faster rate than acquiring them.

Ten such transactions took place in Asia-Pacific over 2021 compared with just 7 in the prior year.

S&P noted that buyers were largely insurance-focused firms, such as AIA Group, which in September 2021 purchased the Bank of East Asia’s portfolio of life insurance policies underwritten. It is also in the midst of buying the same bank’s subsidiary, Blue Cross Insurance.

According to Ashish Sharma, partner, financial services and the lead on insurance and wealth management in Australia at consulting firm Oliver Wyman, acquirers of banks’ insurance portfolios are “often established insurance players looking to grow their scale or penetrate new market segments”.

“We expect this trend of vertical disintegration to continue into 2022 and beyond as insurance portfolios face rising claims frequencies and inflation, supply chain issues posing customer satisfaction challenges as well as customer affordability,” he added.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

S&P also believes shedding capital-heavy businesses could help Asia-Pacific lenders stay resilient in the current market, where all 20 of the region’s largest banks have recorded declines in market capitalisation in Q2 this year amid fears of a looming recession.

“Typically, banks will maintain long-term distribution agreements with the buyers of their insurance units, allowing them to continue offering insurance services to their customers without having to take on the cost of such products,” observed the company.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.