Analysts predict upside for wastewater-treatment firms

The sector has flown under investors' radar lately, but its players have quietly been bagging contracts; business from China is expected to take off

Singapore

WASTEWATER treatment firms on the Singapore Exchange (SGX) have scored a flurry of contract wins lately, but with the sector currently out of favour among investors, these have barely moved their share prices.

Still, analysts say the fundamentals of the sector remain strong, and that it is only a matter of time before their stock prices catch up.

Citic Envirotech, the largest pure-water play on the SGX, has announced three contract wins in the last quarter alone:

Meanwhile, China Everbright Water has also bagged new contracts. Previously known as HanKore before China Everbright International injected all its water assets into it, the company announced last week that it has secured a 161 million yuan BOT Phase Three wastewater-treatment project in Jiangsu.

This came on the heels of another project win announced a few days before - a 120 million yuan BOT wastewater-treatment project in the Huashan district in Shandong.

Analysts, noting that these contracts have not made much of a splash on the stock market, say investor interest in the sector has been weak, given the lack of news flow on the Chinese water sector amid the implementation of government policies.

UOB Kay Hian analyst Edison Chen said: "The whole sector is downbeat. It's at the trough of the whole cycle."

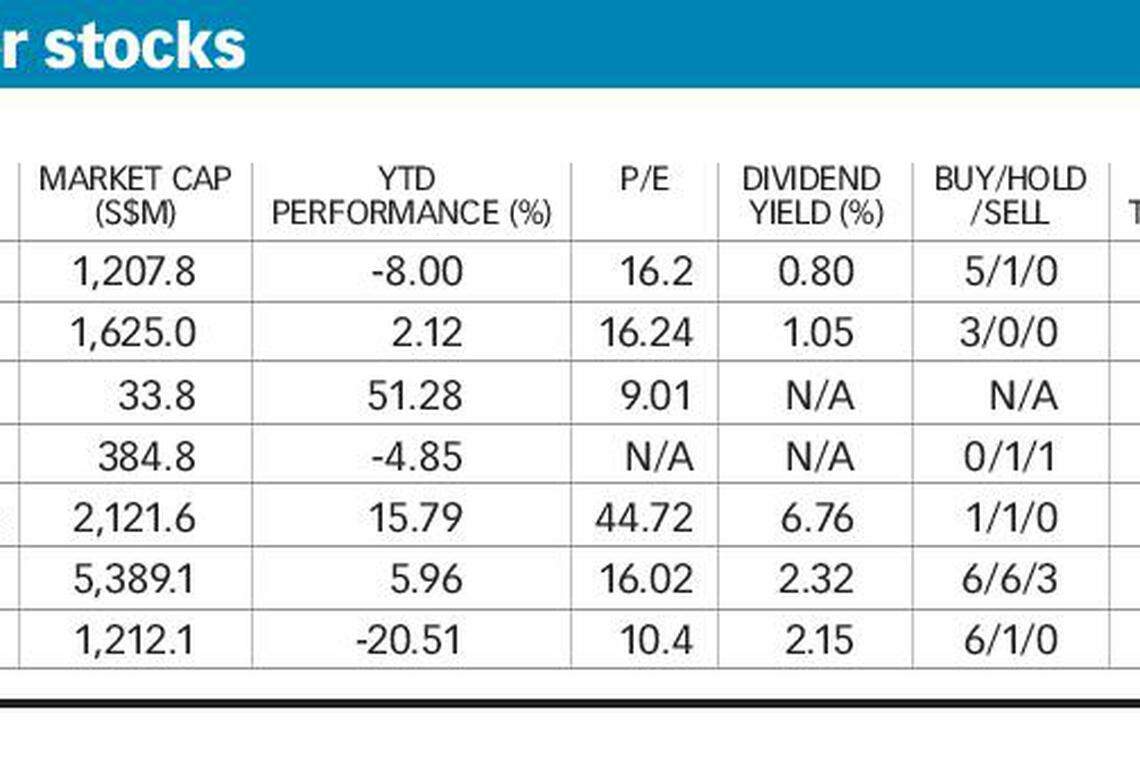

As a result, the sector is now trading at a price-earnings ratio of 15 to 18 times, compared to 26 to 30 times during their peak, noted CIMB analyst Ngoh Yi Sin.

Phillip Securities analyst Chen Guangzhi said: "Investors are not fond of the water business at the moment because the market sentiment is focused more on sectors with higher yield and growth."

Generally, only projects involving substantial capital spending or which contribute large amounts of revenue or profit attract market attention, he added.

Concurring, CIMB's Ms Ngoh said share prices tend to react more to sizeable project wins and substantial earnings improvement.

There has been a steady stream of project wins by Singapore-listed water treatment firms, but these have, increasingly, been of a different nature - such as river-restoration projects. These firms have also won projects outside China, she noted.

"The returns on such projects are unknown and may not be higher than the typical leveraged internal return rates (IRR) of between eight and 12 per cent for municipal, and between 12 and 15 per cent for industrial projects."

Nevertheless, the outlook for the sector continues to be strong, given the vast demand for water treatment in China.

China's annual water shortage has hit 50 billion cu m; two-thirds of its cities experience varying degrees of shortage, said the National Development and Reform Commission.

A study by the Ministry of Water Resources last year found that more than 80 per cent of the country's underground water, drawn from relatively shallow wells, is polluted and thus unsafe for drinking.

The government has therefore made tackling water pollution - as well as air and soil pollution - a priority in its 13th Five Year Plan running till 2020.

UOB Kay Hian's Mr Chen said: "The outlook (for the water-treatment sector) is very, very good. The contract wins have been strong. Nothing has changed in the water-treatment space; it's just the news flow and the market sentiment." He said he expects the Chinese government to announce new water-related policies after the leadership reshuffle at the upcoming 19th National Congress of the Chinese Communist Party.

Market sentiment towards the sector should then improve correspondingly. Investors should thus buy the stocks now, before their prices pick up, he advised.

Other factors are also driving the potential upside in the sector. Ms Ngoh said that tariff hikes timed with the upgrading of certain wastewater-treatment plants will help support treatment margins.

And new forms of of financing are emerging as well, she added. For example, Panda bonds - renminbi-denominated bonds from a non-Chinese issuer - were issued last month by China Everbright Water.

"The wastewater treatment industry is a capex-intensive one, hence return-on-equity improvement for each company hinges on its ability to raise financing at low costs," she said.

But downside risks are also lurking, analysts caution. The companies are now reporting earnings growth, but these are mainly driven by construction earnings, which are lumpy, said Ms Ngoh. The expansion of operating capacity, which delivers more stable revenue, will take some time.

Furthermore, given that water-treatment projects are capital-intensive - making for high debt levels for all such companies - an interest rate hike will be a potential downside risk, said DBS analyst Patricia Yeung.

She advises investors to look for companies with financial muscle, or those with access to various financing channels to fund projects, as they will be able to grab a larger share of the market and thus have higher potential for earnings growth.

Citic Envirotech and China Everbright Water are the most favoured by analysts covering the sector.

DBS Vickers has a "buy" call on both companies on account of their strong deal flows last year; these are expected to lead to stronger earnings growth this year.

Ms Yeung said: "They also achieved breakthrough in new areas."

China Everbright recently won its first project in urban-rural integration for water supply, and also an underground wastewater-treatment project; Citic Envirotech has made breakthroughs in its river-restoration project. "The water sector has underperformed the market so far this year, but we believe strong growth in the upcoming interim results will attract investors' attention again," she said, ahead of the release of second-quarter earnings by the companies.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

HCA beats first-quarter profit estimates on higher patient admissions

F&B operator YKGI to exclusively operate Chicha San Chen in Macau for next eight years

LMIRT Q1 net property income dips 3.1% to S$30 million on higher expenses

Exxon misses on Q1 profit despite big gains in Guyana

US FDA approves Pfizer’s gene therapy for rare bleeding disorder

Chevron's quarterly profit beats estimates