BT Explains: What happens on the detachment dates of SGX SPACs?

INVESTORS have been trading in units of 3 special purpose acquisition companies (SPACs) on the Singapore Exchange (SGX) since January 2022, following the listing of Vertex Technology Acquisition Corporation (VTAC), Pegasus Asia and Novo Tellus Alpha Acquisition.

The units of these SPACs will soon undergo detachment in March, where they will split into shares and fractional warrants of the SPAC.

Pegasus and VTAC units will detach on Mar 7, while Novo Tellus units will do so on Mar 14, making up the first batch of SPAC detachments on SGX. BT explains how the detachment works and what investors will gain when their units detach, as per SGX's FAQ (frequently asked questions) on SPAC detachment released on Tuesday (Mar 1).

What is a SPAC detachment?

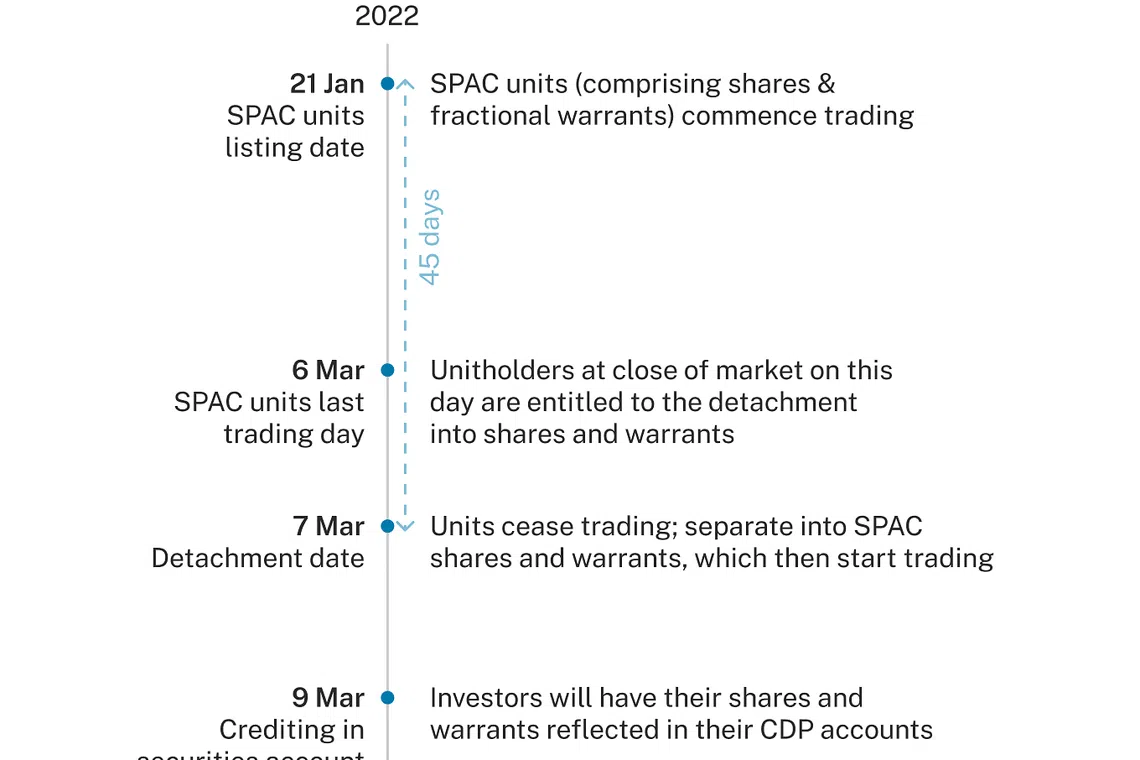

SPAC units, which comprise 1 share and a part of 1 warrant, will separate into individually traded SPAC shares and warrants on the detachment date, which is typically 45 calendar days after the SPAC's listing.

Unitholders' accounts will be credited with the shares and warrants 2 business days after the detachment date.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Stock codes for the SPAC shares and warrants may be different from that of the SPAC unit.

How many shares and warrants will 1 SPAC unit result in after the detachment?

One SPAC unit is made up of 1 share and a part of 1 warrant. The fractional warrant differs depending on the SPAC.

Among the currently listed SPACs, units of both Pegasus and Novo Tellus comprise 1 share and 0.5 of a warrant.

Meanwhile, 1 VTAC unit is made up of 1 share and 0.3 of a warrant. An additional right to 0.2 of a warrant per share will only be issued at a later time to holders of shares which have not been tendered for redemption at or around the completion of the initial business combination.

The initial business combination refers to the process where a SPAC merges with its acquisition target, following a simple majority of shareholders and independent directors voting in favour of the transaction, which will result in the target being listed on the exchange. This is also known as de-SPAC.

De-SPAC has to be completed within 24 months from the date of the SPAC's initial public offering, with an option to extend up to 12 months if there is a binding agreement for the proposed business combination.

Will all SPACs detach into shares and warrants?

All 3 current SPACs will automatically detach on their respective detachment dates into shares and warrants.

However, future SPACs may offer optional detachment, and detachment dates for the different SPACs can vary.

When is the last day to trade SPAC units before detachment?

The last day of trading for SPAC units is 1 business day before the detachment date. Holders who sell their SPAC units on or before that day will not be eligible to receive SPAC shares and warrants.

On and after the detachment date of SPACs with automatic detachment, only SPAC shares and warrants can be traded, as is the case for all 3 current SPACs listed on SGX.

For future SPACs that offer optional detachment, their units can still be traded along with the SPAC shares and warrants.

What is the board lot size for trading of SPAC shares and warrants?

The shares will be traded in board lot size of 100 and warrants will be traded in board lot size of 1.

What happens to fractional warrants that cannot be combined into a whole warrant?

The fractional warrants that cannot be combined to make a whole will be disregarded, as only whole warrants can be traded. Investors have to ensure they hold enough SPAC units to create whole warrants upon detachment of the units.

For example, in the case of Pegasus, investors should hold an even number of units by the detachment date to ensure the 0.5 fractional warrants can be combined into a single warrant.

An investor who has 100 Pegasus units will therefore receive 100 SPAC shares and 50 warrants within 2 business days of the detachment, after the units are debited from the unitholder's securities account.

However, should an investor have an odd number of Pegasus units, the additional fractional warrant will not be included in what they receive - if they have 101 Pegasus units, they will receive 101 shares but only 50 warrants, with the last 0.5 of a warrant disregarded.

When can the whole warrants be exercised?

The whole warrants are typically exercisable within 30 days after de-SPAC is completed, up to its warrant expiry date, which is usually 5 years after the completion of the business combination.

Certain SPACs may also have an exercise period of 30 days after de-SPAC or 12 months from the SPAC's initial public offering date.

The warrant holder can elect to use cash to exercise and convert the warrants into shares, typically at a 1:1 ratio, during the exercise period. During the warrant exercise period, the sponsors may call for warrant redemption.

READ MORE:

- Things to know before diving into Singapore SPACs

- Hong Kong's first SPAC wins exchange approval for IPO, sources say

- Singapore bets on niche SPAC listings to capture tech boom

- Asia's SPAC race is over; the hard work is just beginning

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.