Funds under CPF Investment Scheme up average of 5.1% in Q1

Singapore

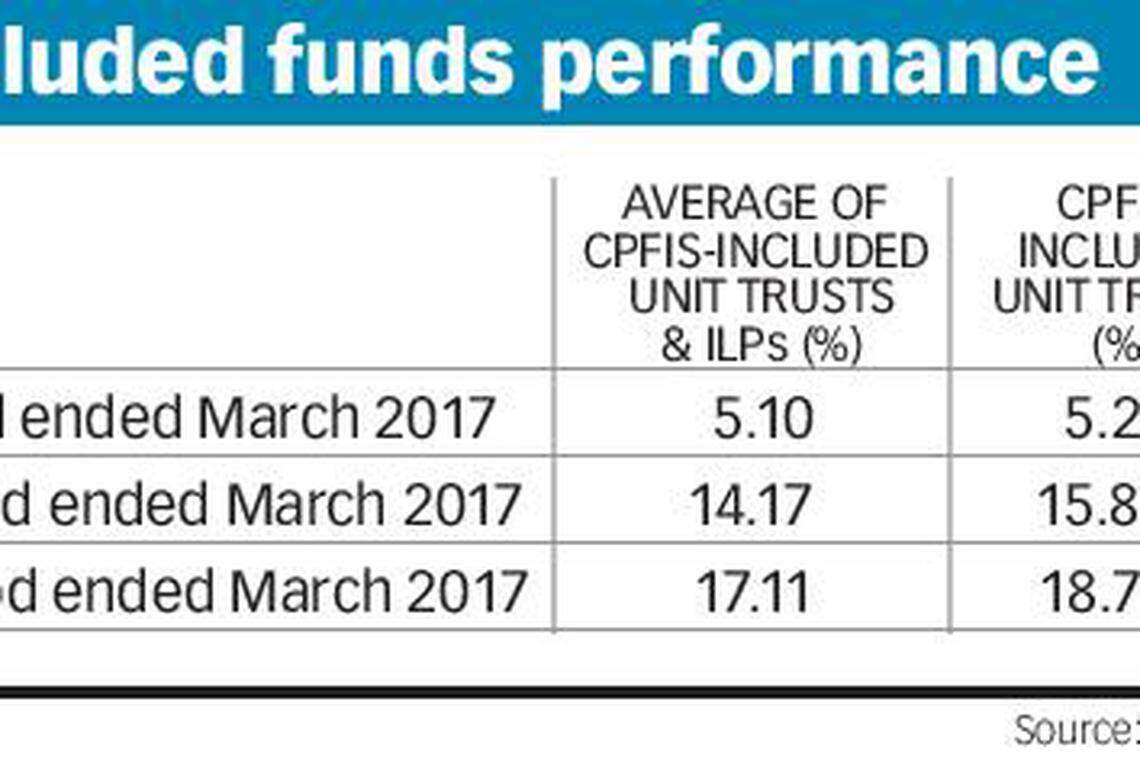

Q1 2017 has seen the overall performance of funds included under the Central Provident Fund Investment Scheme (CPFIS) rise an average of 5.10 per cent. This is according to a Thomson Reuters Lipper assessment on the performance of all unit trusts and investment-linked insurance products (ILPs).

Specifically, CPFIS-included unit trusts increased 5.20 per cent and CPFIS-included ILPs rose 5.04 per cent.

For all CPFIS-included funds, equities posted positive returns of 6.44 per cent; mixed-asset 4.10 per cent; bonds 1.27 per cent; and money market funds 0.19 per cent. During the same period, MSCI AC Asia ex-Japan index rallied 9.68 per cent while Citigroup WGBI TR fell 1.78 per cent.

For the one year since March 2016, the overall performance of CPFIS-included funds posted a positive return of 14.17 per cent on average. CPFIS-included unit trusts rallied 15.80 per cent on the year and CPFIS-included ILPs soared 13.16 per cent.

During the same one-year period, equities (+18.55 per cent) outperformed bonds (+1.16 per cent), mixed-asset (+10.66 per cent) and money market funds (+0.64 per cent) on average. Meanwhile, MSCI AC Asia ex Japan Index soared 22.25 per cent, whereas Citigroup WGBI TR fell 0.03 per cent.

For the three-year period from March 2014 to March 2017, CPFIS-included funds grew by 17.11 per cent on average, accounted for by a gain of 18.71 per cent from CPFIS-included unit trusts and 16.27 per cent from CPFIS-included ILPs.

Equities were the lead gainer with growth of 20.11 per cent, while the money market portfolio posted 1.52 per cent. During this three-year period, MSCI AC Asia ex-Japan Index rallied 28.49 per cent and Citigroup WGBI TR rose 7.16 per cent.

"CPFIS funds delivered strong returns in the first quarter of 2017. On a macro-level, reflation is a key global trend and growth expectations are gradually on the rise, while geopolitical tensions continue to impact financial markets," said Xav Feng, head of Asia Pacific Research, Thomson Reuters Lipper.

"With the US becoming more of a driver of policy uncertainty than a stabiliser, China and emerging markets are gaining significant traction. Looking ahead, investors are advised to sift through copious amounts of data and news to identify solid investment opportunities and to maintain a diversified portfolio." he added.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

Barclays says it’s winning Asia banking business from US firms

China central bank wants to halt bond-buying spree, not join it

Gold holds steady as investors focus on US Fed meeting

Singapore shares open in the red on Tuesday; STI down 0.3%

Huawei’s pivotal role in the US-China tech war, from 5G to chips

CDL Hospitality Trusts reports 6.8% higher Q1 net property income of S$34.9 million