Gloves demand masks rubber industry woes

Rubber gloves enjoy boom amid Covid-19 but demand for other products like tyres badly hit

Singapore

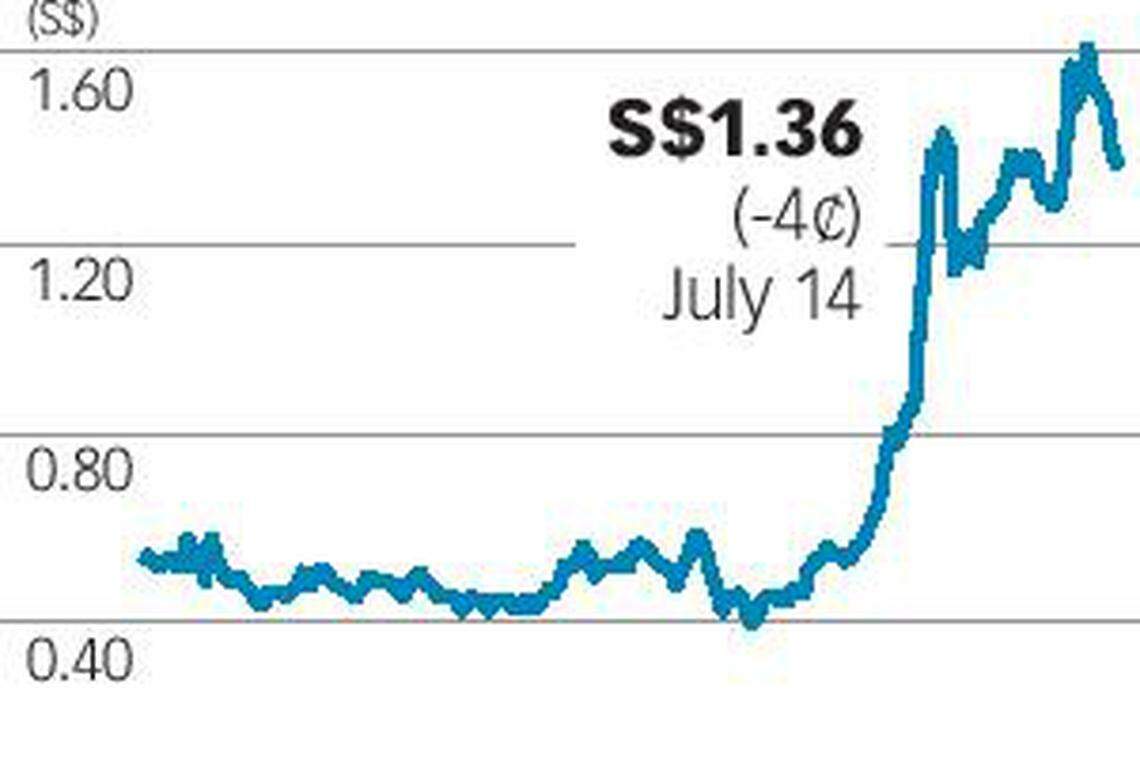

SHARES of rubber-product makers have been on a tear this year, with the Covid-19 pandemic drawing immediate attention to the expected demand for this type of medical equipment.

But such euphoria has overshadowed the overall pain for the global billion-dollar rubber industry, analysts said. It ignores the sharp fall in demand for tyres used on airplanes that have been grounded amid lockdown measures to prevent the virus from spreading across borders.

The global rubber products market is now due to contract by some 3 per cent from a year ago to US$359 billion this year, down from US$370 billion in 2019, a report by ResearchAndMarkets.com showed.

Demand for rubber gloves has surged, allowing Singapore-listed rubber supplier Sri Trang Agro-Industry to price the initial public offering (IPO) of its rubber gloves unit Sri Trang Gloves Thailand (STGT) at the top end of its marketed range.

STGT raised 14.9 billion baht (S$660 million) during the subscription period from June 23 to June 25 in Thailand's biggest IPO thus far. The company sold 438.78 million IPO shares worth 34 baht per share, accounting for some 30.7 per cent of total issued common shares. Since its trading debut on July 2, the stock has gained 23 per cent.

A NEWSLETTER FOR YOU

SGSME

Get updates on Singapore's SME community, along with profiles, news and tips.

Maybank Investment Bank Research said that glove stocks in Malaysia are now "too cheap to ignore" as rubber gloves are replacing "poison plastic" gloves.

Meanwhile, rubber glove makers listed in Singapore such as Top Glove, UG Healthcare, and Riverstone Holdings are barely keeping up with breathless demand. Shares of these three counters have surged several-fold since the start of this year, though to be sure, in recent days, investors have taken profit on some of these counters. CGS-CIMB analyst Ong Khang Chuen told The Business Times that the "stars are aligned" for glove manufacturers this year. He is expecting them to record stronger sales volume, as well as higher average selling prices and margins.

But investors may want to temper their optimism for all and sundry in the rubber manufacturing trade, as the surge in demand for rubber may just be limited to a few segments of the industry. General rubber product uses, including medical and health-related products, as well as automotive and mechanical parts, make up 30 per cent of the total consumption of natural rubber in 2018, data from IHS Markit showed.

But while rubber gloves are highly sought-after now, demand from the largest consumers of rubber, such as tyres and tubes, has been badly hit and is unlikely to recover soon.

Tyres and tyre products accounted for the larger 70 per cent of all consumption of natural rubber two years ago, said IHS Markit.

A large chunk of these tyres are used by the aviation industry, as airplane tyres must be replaced after 300 to 400 take-offs and landings.

"With the number of flights being substantially reduced because of Covid-19, demand for both synthetic and natural rubbers will decrease as well," said IHS Markit analysts.

Since the start of this year, the price of SGX-listed Sicom TSR 20 (technically specified rubber 20), has fallen by some 20 per cent. TSR is liquid latex that hardens naturally into blocks used in tyre manufacturing.

Adding to the woes is that as Covid-19 cases continue to climb, countries could take longer time to lift or ease travel restrictions. The world's largest airplane maker Airbus has said that it would cut some 15,000 jobs; its peer Boeing said that it would slash more than 12,000 jobs.

In the first half of the year, industry heavyweights such as England-based Dunlop Aircraft Tyres and Apollo Tyres announced plans to shave 200 and 750 jobs, respectively.

There has also been limited activity in the auto manufacturing segment, with many car launches put on hold as dealers found themselves faced with mounting inventory in storage.

Japan's Bridgestone, the world's biggest tyre maker, said that it would suspend operations at 11 out of its 15 domestic plants, including eight tyre factories, from late April to early May to cope with dwindling demand.

This bifurcation in the outlook for the rubber industry can be seen in Sri Trang Agro-Industry.

In a management outlook note in May, it said that demand for TSR and ribbed smoked sheet (RSS) rubber has been affected by many tyre manufacturers temporarily closing their factories in Europe, the US and in some other countries to comply with the lockdown measures. This is mitigated by the pick-up in demand from Chinese tyre manufacturers, as the virus outbreak has subsided there.

The significant increase in demand for concentrated latex, which has been growing alongside the demand for gloves, would just "partially offset" the global drop in demand from tyre manufacturers, it said.

Sri Trang Agro-Industry also cited estimates from the International Rubber Study Group that said natural-rubber demand from industries other than the tyre industry will grow by just 4.3 per cent.

In its first-quarter financial results, it swung back into the black with a net profit of 854 million baht, against a net loss of 628 million baht a year earlier, driven by effective raw material costs management and stronger profitability of its glove business, the company said.

Revenue from gloves accounted for just over 20 per cent of total revenue, with sales from TSR making up two-thirds of total revenue.

CGS-CIMB's Mr Ong said demand for STGT's shares has been "overwhelmingly strong", and that this has revitalised interest in the glove sector over the past week.

But it is possible that the group's revenue might not enjoy quite the same boost as its gloves unit has. (see amendment note)

Amendment note: In an earlier version of this story, it was reported that CGS-CIMB commented directly on the financial performance of Sri Trang Agro-Industry. BT has clarified that he was commenting only on the investor demand for STGT.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

UBS weighs synthetic risk transfer amid capital boost proposals

Oil settles higher on supply concerns in the Mid-East, economic woes subdue gains

S-Reits falter as investors weigh possibility of zero rate cuts in 2024

CapitaLand Investment posts total revenue of S$650 million for Q1

Europe: Stoxx 600 logs best day in three months as banks shine

US: Stocks rally after strong tech results