Greener pastures abroad, wealth fees drive profits for Singapore banks

Worst of oil-and-gas woes believed to be over, bad loans have been provided for by the banks, though debt restructuring continues

Singapore

SINGAPORE banks are chalking up growth from beyond their home turf, where growth is slowing and banks have been working through exposure to the embattled oil-and-gas segment.

The first-quarter results of the three lenders beat analysts' expectations, fuelled as well by a surge in the wealth management business that rode on the positive market sentiment so far, although DBS chief Piyush Gupta - known for his usually upbeat outlook - had cautioned that some "animal spirits" may be at play.

The share prices of the Singapore banks have surged, with OCBC up 16 cents to S$10.46 on Tuesday, DBS up 20 cents to S$20.50, and UOB 11 cents to S$23.55.

"The confluence of factors driving the sector may be at its most positive now - earnings beat, worst of asset quality just over, margin expansion potential from higher rates, prospect of loans recovery. It's hard to get a quarter when all the stars are so aligned, and the rally reflects that," said Kum Soek Ching, head of Southeast Asia research, private banking research, Credit Suisse.

She added that the banks should meet their full-year mid-single digit loan growth guidance comfortably, if the cyclical recovery in Singapore and the region is sustained.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

"More overseas expansion by Singapore companies and Chinese companies' One-Belt-One-Road expansion would also drive loan growth opportunities for the Singapore banks."

Looking at numbers out of Singapore, OCBC's chief Samuel Tsien told reporters that loans to food and beverage and retailing here have been "stable".

There was, by comparison, stronger growth from trade finance as well as lending to Singapore conglomerates and individuals investing overseas in properties and hotels in London, Australia and the United States, and Japan more recently.

The Singapore performance reflects Mr Tsien's cautious outlook. At the bank's latest annual general meeting, he noted signs of recovery in certain sectors in the Singapore economy, but warned against hopes of strong broad-based growth.

"We will not be able to say at this time that we will see strong growth in Singapore this year," said Mr Tsien then.

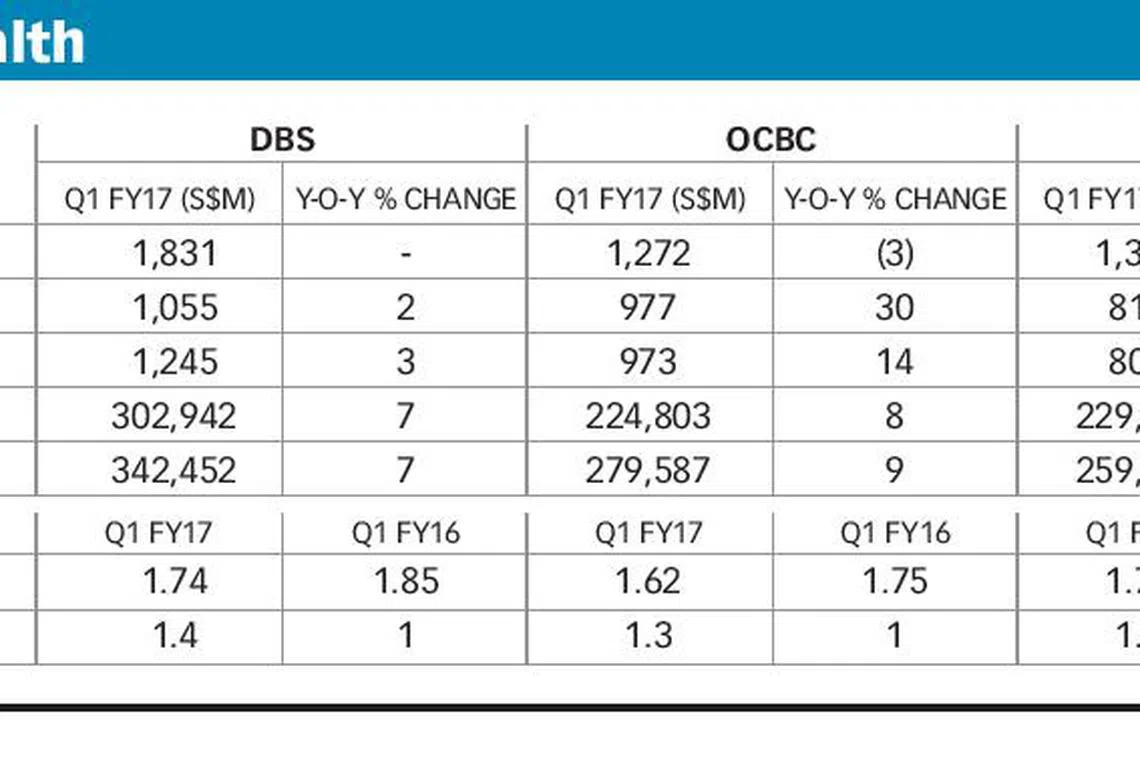

That being said, OCBC closed off the earnings season for the three banks with a 14 per cent jump in net profit to S$973 million for the three months ended March 31, 2017.

This came amid a 70 per cent rise in wealth management fee income, bumped up by the acquisition of Barclays' private banking business in Singapore and Hong Kong last November.

Wealth management income now makes up about 30 per cent of the group's total income, compared to 23 per cent a year ago. Based on estimates, wealth management income makes up 15-20 per cent of total income for DBS and UOB. But to be clear, OCBC's wealth management numbers include insurance, asset management, and stockbroking.

DBS's net profit was boosted by wealth management, which rose 26 per cent in fees to a quarterly high of S$222 million from stronger sales of unit trusts and other investment products.

CEO Gupta did warn, however, that he wasn't sure if wealth management's "standout" performance could be maintained as there were some "animal spirits" in the first quarter.

He noted that the results showed improvement across the markets of Greater China, South and South-east Asia, as well as the rest of the world, "reflecting some degree of turnaround in the global economy".

Mr Gupta added that DBS's net interest margin improvement from a quarter ago reflected a larger current and savings account deposit base out of Hong Kong - this now makes up 60 per cent of DBS Hong Kong's deposit base.

DBS's regional earnings - which strip out profit from its operations in Singapore and Hong Kong - also more than doubled from a year ago. By contrast, in Singapore alone, net profit fell 9 per cent to S$850 million from a year ago, hurt by higher allowances.

Mr Gupta told analysts that it was safe to assume that "the worst is behind us" in terms of non-performing loans (NPL) formation, which has mainly come from the oil-and-gas segment.

But he was also clear that it's getting "extremely hard" to get a good assessment of collateral values for vessels because there are not many transactions. Amid this uncertainty, DBS has kept a S$200 million buffer for possible provisions later.

UOB reported a net profit of S$807 million for the quarter, up 5.4 per cent from a year ago, again on higher fund management and wealth management income. Its wealth management segment has been driven by organic growth, with assets under management and client base growing by more than two times since 2010.

READ MORE: OCBC beats expectations with 14% rise in Q1 profit to S$973m

Copyright SPH Media. All rights reserved.