Hard to pick clear winner between two upcoming US hotel Reit listings

Their similarities beg the question why DBS, as issue manager, appears to be launching the IPOs one after the other and risks diluting interest from investors

IT IS a tough one to pick a winner between ARA US Hospitality Trust and Eagle Hospitality Trust (EHT).

The two Reits have many similarities between them - investment mandates, time of launch of their initial public offering (IPO), DBS Bank being their sole issue manager and a common cornerstone investor in veteran property tycoon Gordon Tang.

Both are vying to be the first US pure-play hospitality Reit to be listed on the Singapore Exchange. Based on the timeline, ARA US Hospitality Trust looks likely to be first, after registering its final prospectus with the Monetary Authority of Singapore on Thursday.

One big plus point the trust has is its sponsor - ARA Asset Management and its co-founder John Lim are well-known names in Singapore.

In contrast, EHT is backed by Los Angeles-based property investor and developer Urban Commons, a privately held real estate investment and development firm in the US which has managed most of its initial portfolio hotel assets for the past decade. Urban Commons was co-founded by Howard Wu and Taylor Woods, both of whom are prominent figures in the US lodging industry but less well known in this part of the world.

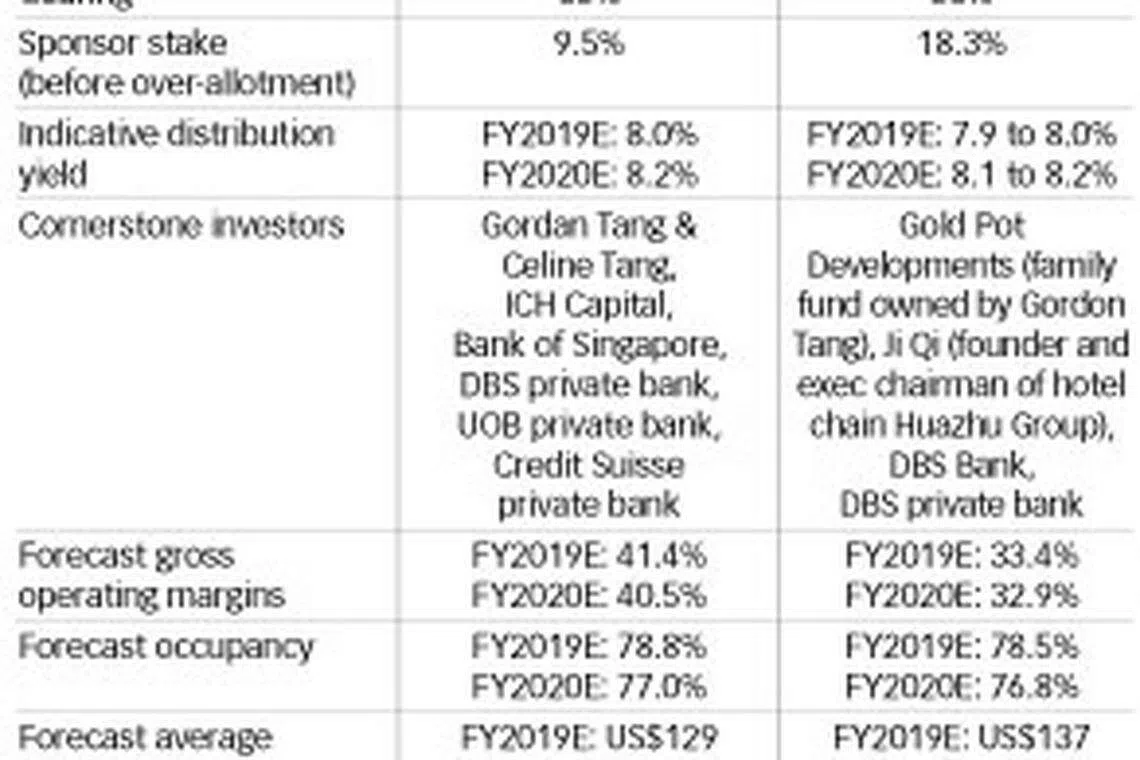

The Reits have other similarities. They have indicated a yield of about 8 per cent for FY2019, and 8.2 per cent for FY2020. Their portfolios comprise mostly freehold assets. Both are banking on rising arrivals of international tourists to grow their business in the next two to three years, capitalising on the weak US dollar. Their management fee structure is also similar: a base fee of 10 per cent of distributable income and an annual performance fee of 25 per cent of growth in distribution per stapled security over the previous year.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Still, there are slight differences between both Reits. Firstly, ARA US Hospitality Trust owns "select service" assets that have higher gross operating margins since they don't include lower-margin businesses such as restaurants and business facilities.

In its prospectus, it said: "Without an extensive array of facilities, services and amenities, select-service hotels maintain lower labour costs which contribute to higher operating efficiency and profitability."

Select-service hotels have higher gross operating profit margins of 42.5 per cent, compared to 39.3 per cent for full-service hotels in 2018.

In terms of geographical spread, there is also a difference. While EHT boasts that most of its initial portfolio is located in the top 30 largest metropolitan statistical areas in the US, ARA US Hospitality Trust, which has assets spread over more states, has its footprint in a number of lower-tier cities.

Secondly, there is a difference in their rental model.

Two-thirds of EHT's rental is fixed, protecting it from downside risks. The remaining variable rent is pegged to gross operating revenue and gross operating profit, which combined together, give the Reit stability and growth. This is, perhaps, more significant to the hotel industry than other sectors, given that "leases" can be as short as one night for hotel dwellers.

ARA US Hospitality Trust, on the other hand, has a largely variable cost structure. One could argue that unitholders get to enjoy the full upside in good times, but the reverse is also true when the market is down.

The third difference has to do with portfolio valuation. While both Reits are purchasing their assets at a discount to appraised valuation from their sponsors, the discount for ARA US Hospitality Trust is about 3 per cent as opposed to EHT's 11 per cent. This suggests the latter obtained better value for money.

Timing the IPOs

At the end of the day, both still remain fairly smallish Reits, evident from the fact that private bank clients make up most of the cornerstone tranche. Institutional participation will probably be limited.

As for retail investors, the 8 per cent yield on offer looks tempting.

But they need to be mindful that hospitality Reits pay higher yields than Reits of other asset classes due to higher volatility and unpredictability of room occupancies.

Also, there is no guarantee that the 8 per cent yield is sustainable, especially if the Reits were to do any dilutive equity fundraising that is not accretive to unitholders. For example, OUE Commercial Reit faced a backlash last year when it did a massively dilutive 83-for-100 rights issue to part-fund the purchase of strata office space in the OUE Downtown building. (see amendment note)

The timing of the IPOs could be due to improved sentiments in Singapore Reits in recent months, including those owning US assets such as Manulife US Reit.

This is not surprising because issuers invariably want to grab hold of a good window to launch when market conditions are favourable. For example, both Frasers Commercial Trust and Ascott Reit launched their offers in March 2006; CapitaLand Retail China Trust and First Reit did theirs in December 2006, while SPH Reit and OUE Hospitality Trust floated in July 2013.

Still, it begs the question why DBS, as manager for both issues, appears to be launching the IPOs one after the other and risks diluting interest from investors torn between two issues.

Amendment note: We earlier reported that it was OUE Hospitality Trust that did a rights issue last year; it is supposed to be OUE Commercial Reit. We are sorry for the error.

Copyright SPH Media. All rights reserved.