Invest in AI? GIC CIO says it ‘pays not to put in too much, too broadly, too early’

Singapore’s sovereign wealth fund sees ‘comfort to invest earlier and larger’ in infrastructure instead

Wong Pei Ting

GIC sees great potential in generative artificial intelligence’s (AI) power to transform and disrupt industries, but past technology waves have taught that it “pays to not put too much in too broadly, too early”, said its group chief investment officer Jeffrey Jaensubhakij.

Speaking as the Singapore sovereign wealth fund released its annual report on Wednesday (Jul 26), Dr Jaensubhakij said it is still early days, with a new AI company being set up every week, and dozens attacking the same problem.

“Out of 50 companies that attack the same problem, which will really dominate isn’t very clear,” he said. “What we found in a lot of these technology waves is that it pays to not put too much in too broadly, too early, because it’s actually very hard to identify the winners.”

Still, from use cases already known, GIC is analysing AI’s impact on its investment universe, where there are bound to be losers, its chief executive Lim Chow Kiat noted.

While declining to go into specifics of investments that GIC is making or divesting from as he reiterated that it is “somewhat early in the transformation”, Lim said advanced chip production and full stack, full service developments are becoming “interesting investing subsectors”.

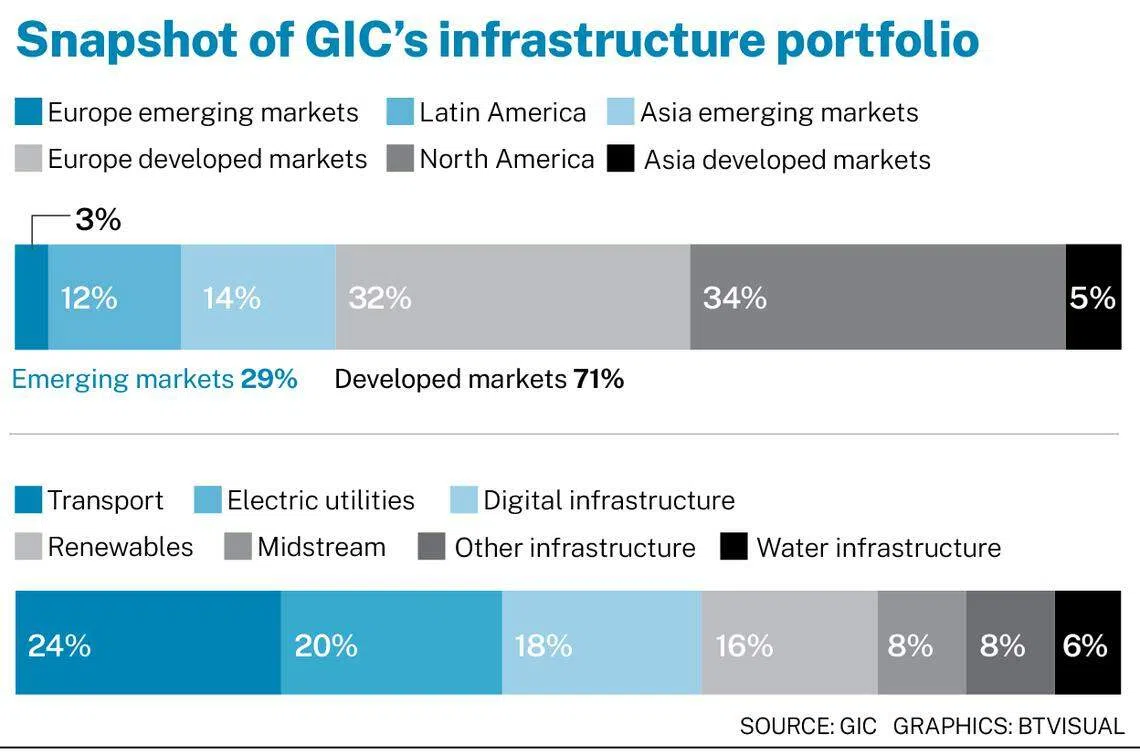

The tone is markedly different for infrastructure. Referencing GIC’s deployment pace of US$10 billion to US$20 billion in new commitments a year in this space, Dr Jaensubhakij said “we’ve got the comfort to invest earlier and larger” in this arena. GIC’s portfolio for infrastructure has already grown by five times since it became a standalone active strategy in 2016.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Backing this appetite, which Dr Jaensubhakij noted is likely to be sustained “at least for the next few years”, is GIC’s early work on sustainability that had guided its investments in the asset class for more than a decade now, he said.

While it is unsurprising that infrastructure has become a popular asset class for large institutional investors and fund managers, Dr Jaensubhakij said: “If you’re new to infrastructure, you probably wouldn’t want to be putting in very large investments at this point in time.”

He cited GIC’s partnership with Canadian investment management company Brookfield for the takeover bid of Australia-based integrated power generator and retailer Origin Energy, which is currently pending regulatory approval. The transaction values Origin at A$18.7 billion (S$16.8 billion). Origin had been engaged in a “brown-to-green conversion” of its coal-fired electricity generation systems, Dr Jaensubhakij noted.

He added that the infrastructure team has a good view of the technologies that are likely to develop well. This has translated to three or four green hydrogen and green ammonia related investments in the past year, he pointed out. “If our forecast is right, these are things that’ll be part of the solution for a cleaner world.”

GIC’s head of infrastructure for Asia ex-China Nicole Goh named Greenko Energy as a rewarding bet. GIC invested in the renewable power producer with a 280-megawatt operating capability in 2013, and it is now at five gigawatts, with more acquisitions in the pipeline. Learnings from Greenko are also informing GIC’s future investments into the sustainability sector in India, she said, citing the recent acquisition of smart metering platform Genus Power & Infrastructures as one.

Chief investment officer for infrastructure Ang Eng Seng, meanwhile, said GIC defines infrastructure as investments with a combination of stable and predictable cash flows, ability to pass through inflation, and low risk of obsolescence.

This means that GIC would not count a merchant power plant that sells power to the spot market without certainty of volume and price as “infrastructure”, while one with long-term offtake contracts providing visibility on price and volume would be, he pointed out.

Asked how GIC squares the emphasis on infrastructure against the expectation for rates to remain high for longer, Ang said while high interest rates indeed present a risk to margins, the asset class’ top line could grow at a rate as fast, if not faster than, the rising costs.

“In assets where there is strong, close to 100 per cent pass-through, ironically, in a higher inflationary environment, your nominal return actually can go higher. It’s somewhat offset by a higher discount factor, because of the higher equity premium and all the costs,” Ang said.

“But in the more ideal case of a good pass-through of inflation, it actually improves. So in real return terms, it’s more or less stable.”

Giving a sense of the range of infrastructure returns GIC is looking at, Ang said it has been moving down from “low to high teens” in the early days, to “high single-digit to low teens” in recent years. It is, however, “moving up a little bit” now, he stated.

Meanwhile, GIC announced the creation of focused teams within asset classes to take more steps to capture sustainability-related investment opportunities. They include:

- Climate Change Opportunities Portfolio in public equities, which looks to deploy more capital towards climate mitigation and adaptation;

- Sustainability Solutions Group in private equity, keen to raise investments in early-stage energy transition opportunities; and

- Transition and Sustainable Finance Group in fixed income and multi asset, to invest in opportunities such as funding decarbonisation and the grey-to-green transition from the bottom up.

In its report, GIC noted that the revenues attributable to green solutions have grown at 17.5 per cent annually, although these companies represent less than 7 per cent of the broader market by market capitalisation today.

Is GIC skewing towards placing bigger bets on climate adaptation with infrastructure, given that its recent contemplation that a “too little, too late” climate scenario has become more plausible?

Responding to this question, Ang said infrastructure happens to find itself in the thick of the climate transition, cutting across the value chain of what needs to be done to decarbonise, from renewable power generation to storage, to carbon capture, and the emerging hydrogen economy.

What he sees is that while they all present themselves as potentially interesting opportunities, renewable power is the only one that has taken off at a scale needed for the world to see that decline in per unit costs to attain affordability.

“The world needs to get through that hump of paying more first, getting through the issues, and then seeing the benefits of that sacrifice, by looking forward to a future that is green and cheaper in terms of power.”

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.