Investors to see more useful data in mandatory sustainability reports

Data under current regulatory framework less comparable for investors

Claudia Tan HS

Singapore

THE Singapore Exchange Regulation (SGX RegCo) is looking to make ESG (environmental, social and governance) data in mandatory sustainability reports more useful for investors over the next six months, said SGX RegCo chief executive Tan Boon Gin on Wednesday in his opening speech at the "Sustainability Reporting: Progress and Challenges" event held at SGX.

The event was co-organised by SGX and the Centre for Governance, Institutions and Organisations (CGIO) of the National University of Singapore (NUS) Business School.

Out of 627 listed companies, 496 were required to publish their reports by end-December 2018, and 495 firms met the deadline. It also saw 80 per cent of the companies reporting for the first time, according to the joint review by SGX RegCo and CGIO, which was presented at the event at SGX. The study examined the information disclosed by the 495 companies.

The current regulatory framework allows companies to choose material matters to report on, making data less comparable for investors, said Mr Tan.

This has led to critics to point out that data is not meaningful for investors or may become unreliable when companies use it as a means to promote themselves without tangible action.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Having said that, there are other reporting formats in the market that tend to be "more prescriptive and harmonised in the way ESG data is captured and presented, especially when it comes to industry-specific formats", said Mr Tan. But these formats are voluntary.

To address the gap between the mandatory reporting framework and the voluntary reporting formats, Mr Tan said: "We are going to start by engaging investors who look at ESG investing globally, for their views on how to improve the quality of the reports our listed companies have produced."

This will provide more guidance for companies to disclose ESG data that is useful to investors.

However, in a panel discussion on the findings of the review at the event, Marion O' Donnell, associate director of sustainable investing at Fidelity International, cautioned against too rigid a framework.

"Overall, there can be more guidance and more mandates in certain areas but it shouldn't be too rigid or some companies will need to spend time and money on areas that are irrelevant to them," she said.

On criticism that the current sustainability reporting mandate is merely a tick-box approach, Associate Professor Lawrence Loh of the CGIO at NUS told The Business Times: "In fact, I see this the other way round, companies use the criteria for sustainable reporting as a starting point to practise sustainability. The mandatory sustainability reporting serves as a guided approach so they know the expectations.

"There are specific components to fulfil as sustainability reporting is quite new to many companies," said Prof Loh, who is also one of the project heads that led the study.

The companies that submitted their reports were reviewed under the SGX-CGIO Sustainability Reporting Scorecard that focuses on the general scope of reporting and five primary components - material ESG factors, policies, practices and performance, targets, sustainability reporting framework and board statement.

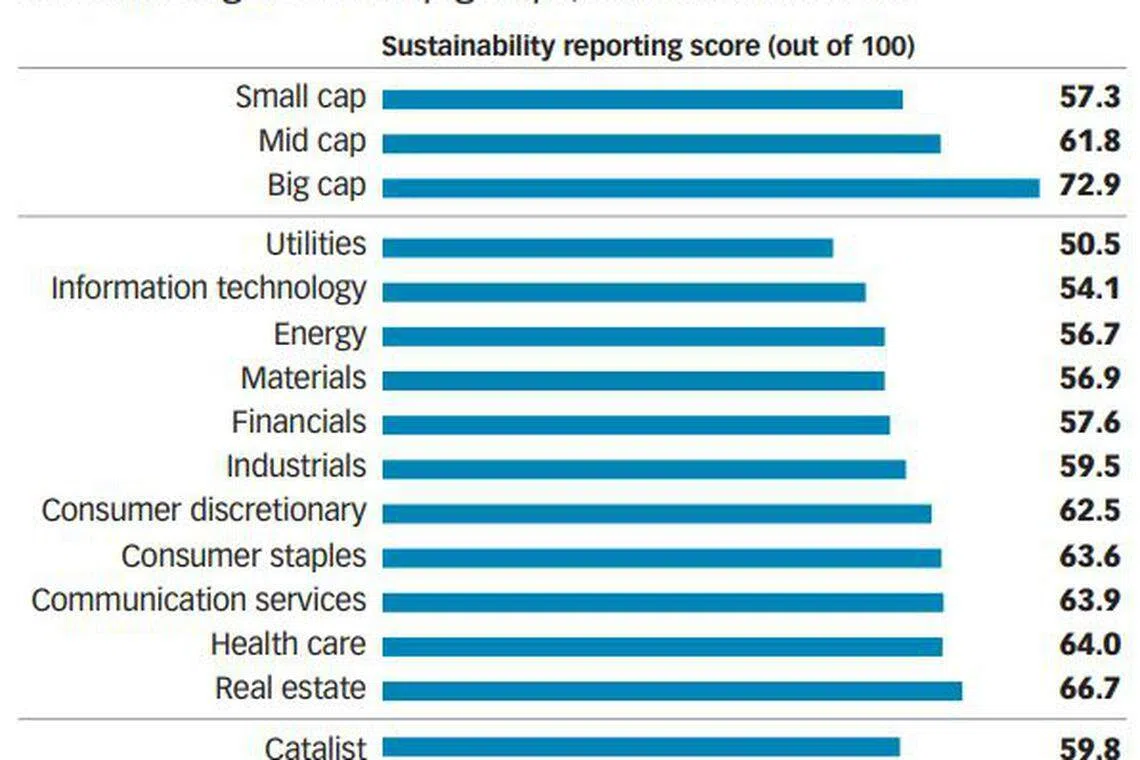

The overall average sustainability reporting score among the 495 listed issuers is 60.6 out of 100, with firms in the real estate, healthcare and communication sectors taking the lead. Large-cap companies also outperformed the small- and mid-caps. However, there were no differences in terms of reporting quality between Mainboard- and Catalist-listed companies.

The review also noted that more can be done on the climate change front given that it has been a hot button issue recently. Currently, a mere 6.5 per cent of companies acknowledged climate change as a material factor.

Listed issuers are not spared from the challenges and impact of climate change, said Masagos Zulkifli, Minister for the Environment and Water Resources in his welcome address at the event.

"As climate change brings disruption to operating environments, we may see more stranded assets. Business models and costs may also be affected by climate-related policy changes," said Mr Masagos.

"Increasingly, consumers, particularly the millennial generation, consider businesses' sustainability profiles when making consumption decisions. Businesses that do not keep pace with these developments will be left behind," he added.

Among the five components, the disclosure rate for policies, practices and performance was the highest at 96 per cent of issuers. Of these companies, some 8 per cent mentioned links between top executive remuneration to sustainability performance.

While some market watchers suggest that this is an indicator of the board's commitment towards sustainability, chief executive officer of e-commerce platform company Arcadier, Dinuke Ranasinghe, thought otherwise. In the panel discussion, Mr Ranasinghe said that tying remuneration to sustainability might lead to greenwashing.

He also noted that looking ahead, sustainability reporting should involve SMEs. "The issue is a global one, we have to take it beyond the listed companies," he added.

Copyright SPH Media. All rights reserved.