Trans-China Automotive ends first day trading at 6.5% above IPO price

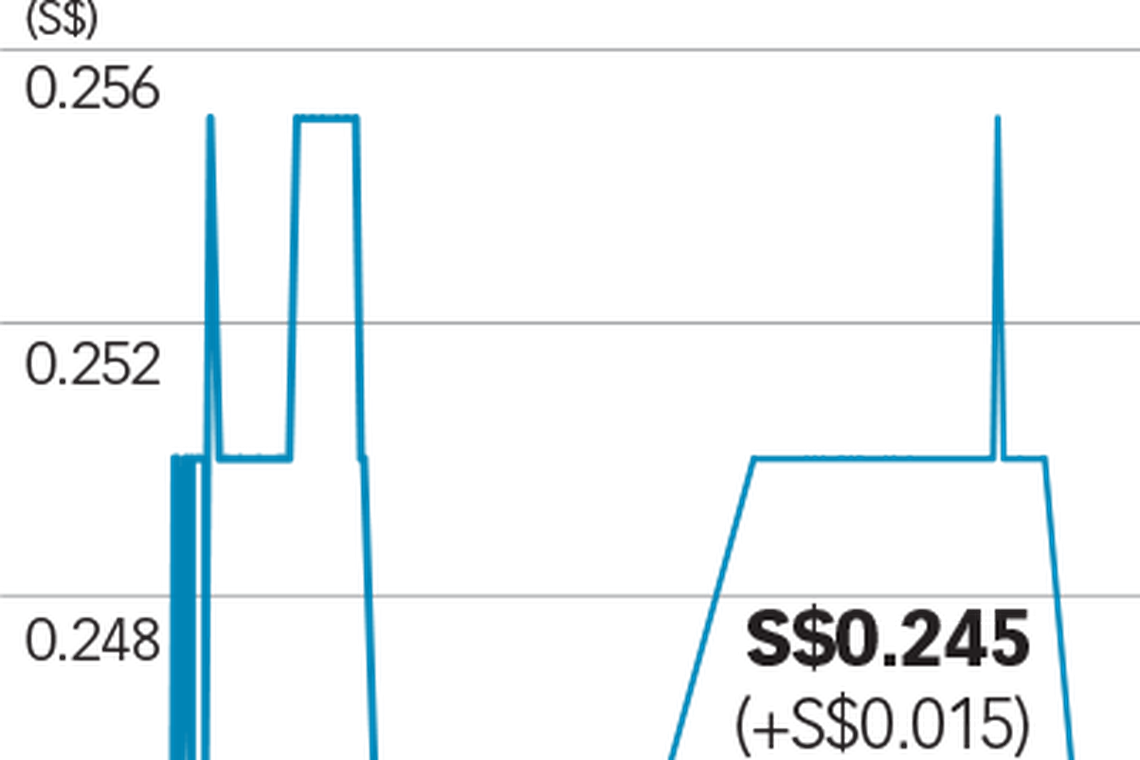

TRANS-CHINA Automotive Holdings (TCA) VI2 : VI2 0% on Thursday (Nov 11) ended its first day trading on the Catalist board at S$0.245, 6.5 per cent or S$0.015 above its initial public offering (IPO) price of S$0.23.

From the start of trading at 9am till market close, the counter traded within a narrow band of S$0.245 to S$0.255. About 10.2 million shares changed hands. The company was also among the most active counters by volume on the Singapore Exchange (SGX) in early trade.

Shares of the car dealership group opened at S$0.245 and its share price reached an intraday high of S$0.255 at around 9.17am. It ended at S$0.245, unchanged from the opening price.

Based on the offer price and the post-offer share capital, TCA's market capitalisation is about S$134.4 million.

TCA's listing brings the total number of Catalist-listed companies to 216, with a combined market capitalisation of about S$12.6 billion.

Within the consumer sector, there are currently 134 companies listed on the SGX, with total market capitalisation of about S$76 billion.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

The IPO of TCA's 85 million shares comprised 2.9 million shares under the Singapore public offer which was 8 times subscribed. Meanwhile all 82.1 million placement shares were validly subscribed for. Overall, the offering had a subscription rate of 1.2 times.

TCA was founded in 2009 by executive chairman and chief executive officer Francis Tjia who has more than 20 years of industry experience. Headquartered in Hong Kong and Shenzhen, TCA specialises in car dealerships in the premium and ultra-premium market segments under the BMW, McLaren and Lotus brands.

Its two main business segments are car sales and provision of after-sale services including repairs and scheduled servicing, maintenance and inspection of cars.

In addition, TCA sells pre-owned cars that come mainly from customer trade-ins, auction companies and other suppliers of used cars. The company also offers automobile agency services such as referrals for insurance and car registration agency services.

TCA plans to use the bulk of the S$16.3 million in net proceeds from the IPO to expand its dealerships, showrooms and service centres in cities where it has existing operations.

Some S$3 million will go towards growing its dealership network to new regions and diversifying its business while another S$2.3 million will be channelled towards general working capital.

Tjia said in a statement that the group is well-positioned to reap the benefits of being in the world's largest market for automobile sales given its focus on premium and ultra-premium car brands and the strategic locations of its dealerships in geographically affluent cities in China.

China's growing affluence as well as robust economic performance also presents "vast opportunities" for TCA to expand its business, said Tjia.

Mohamed Nasser Ismail, global head of equity capital markets at SGX said that the continued economic growth in China has led to an increase in propensity for consumption.

"Paired with an experienced and committed management team and their strong business relationships, TCA is well-geared to tap on the growth opportunities in their industry including the promising prospects for the new energy vehicle market," he said.

READ MORE:

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

DigitalBridge-backed Vantage said to weigh Hong Kong data centres sale

Vietnam delays launch of new stock trading system

Tesla’s plan for affordable cars takes page from Detroit rivals

Meituan to debut in Riyadh as expansion beyond China quickens

Mapletree Industrial Trust to distribute S$13 million of divestment gains over next 4 quarters

K-pop agency Hybe’s internal strife wipes out 1.2 trillion won