Travel curbs likely to crimp hospitality Reits' distributions

Singapore

DISTRIBUTIONS to investors from hospitality real estate investment trusts (Reits) could be cut by up to double digits, analysts say, after the Singapore government's latest entry ban on travellers with recent history of visiting China.

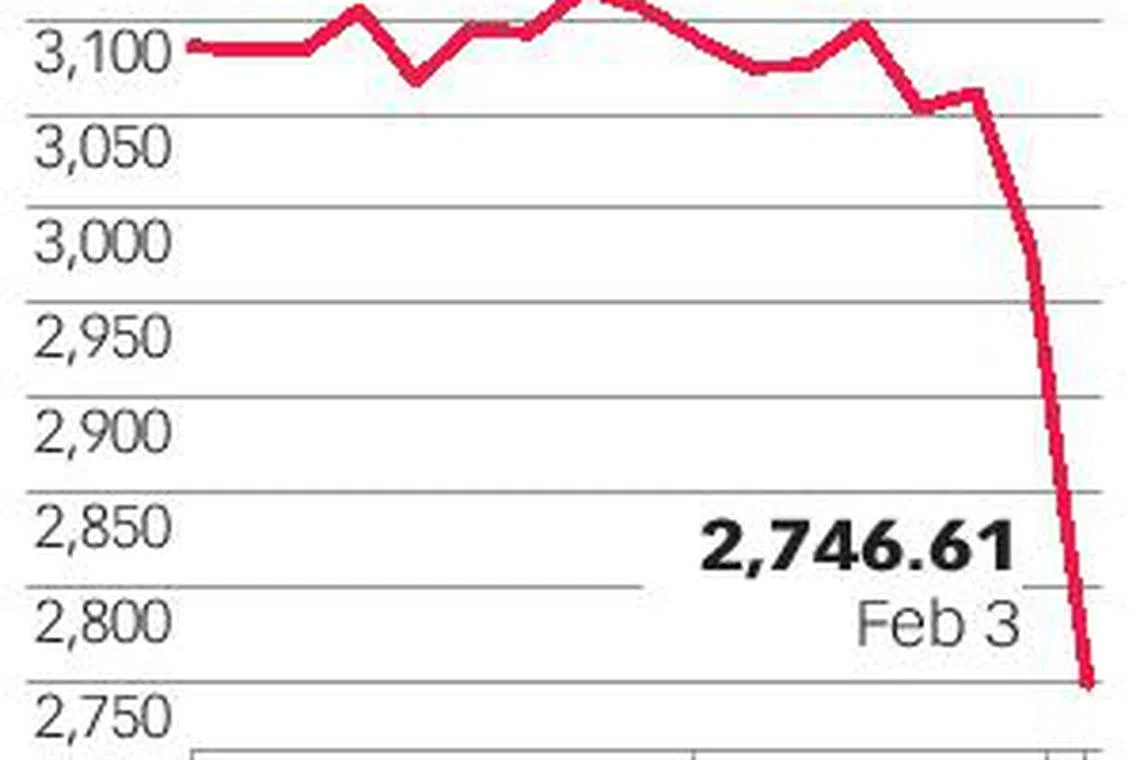

This negative prognosis, accompanied by stock downgrades, caused hospitality Reits to slump on Monday. They have already fallen more than 7 per cent since alarm was raised some two weeks ago over the novel coronavirus outbreak spreading from Wuhan in China, surpassing the benchmark Straits Times Index's (STI) slide of about 5 per cent over the same period.

Units of CDL Hospitality Trusts (CDLHT) hit a one-year trough of S$1.54, down two cents from a day ago. Frasers Hospitality Trust ended at S$0.685, having hit its 52-week low last Tuesday, while units of Ascott Residence Trust continued their descent, falling four cents or 3.2 per cent to S$1.22. Far East Hospitality Trust (FEHT) lost 1.5 cent to S$0.665.

DBS Group Research on Monday said it expects at least a 4 to 8 per cent occupancy drop in the near term, assuming a three- to six-month travel ban. "We believe a further risk of a snowball effect on other travellers (for business or leisure) who may delay their travel is high, compounded by the World Health Organization's health emergency warning."

Hospitality Reits have already seen at least three downgrades. DBS analyst Derek Tan downgraded FEHT to "hold" from "buy", and revised its price target to S$0.69 from S$0.80, citing the trust's 100-per-cent exposure to the Singapore market and 70 per cent exposure to hotels by gross revenue.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Hotels face potentially higher cancellation risks compared to serviced residences due to occupiers' shorter length of stay and higher proportion of leisure travellers.

Mr Tan said: "About 58 per cent of income from the hotel and serviced residence components are fixed within a master lease structure. The remaining 19 per cent and 23 per cent are derived from commercial premises with longer lease tenures and variable rents from hotels and service residences.

"While the master lease structure incorporates elements of stability, variable rents from hotels and service residences may be shaved off, which will hit FY20 distribution per unit (DPU)."

FEHT on Monday said China guests constitute about 9 to 10 per cent of revenue, and there is no one country that makes up more than a tenth of turnover. Additionally, its serviced residences are "not really affected" and still see healthy occupancies because of their focus on corporate guests with long-stay contracts.

However, analysts still find other Reits with more regionally diversified portfolios in better stead to tide through this crisis. OCBC Investment Research on Monday also downgraded its "buy" call on CDLHT to "hold", and lowered its fair value estimate on the counter to S$1.62, from S$1.69 previously.

"Singapore is CDLHT's key and best-performing market, making up about 62 per cent of FY19 net property income, whereby Chinese tourists contributed about 10 per cent of CDLHT's Singapore business. Should the situation in Singapore escalate further, CDLHT's performance could be badly hit," it said.

CDLHT's management has said booking cancellations so far have not materially impacted its business, and its Singapore revenue per available room, or RevPAR, rose about 4 per cent year-on-year for the first 28 days of January 2020, but analysts believe this momentum is unlikely to continue if the situation in Singapore escalates.

Last Friday, RHB also downgraded CDLHT to "neutral" from "buy", and lowered its target price from S$1.78 to S$1.62. Analyst Vijay Natarajan said CDLHT's Maldives resorts is also expected to be impacted from the sharp slowdown in China leisure travellers, with breakeven likely expected only in 2021.

CGS-CIMB analyst Lock Mun Yee said the actual impact is difficult to quantify for now, but booking cancellations experienced by hospitality Reits indicate weak sentiment, which is likely to weigh on share price.

"In terms of potential impact sensitivity, based on our estimates, the Singapore hotel industry occupancy declined by about 10 percentage points year on year during the 2003 Sars period, to 65 per cent.

"Taking our cue from this, assuming an average 65 per cent annual occupancy for Singapore hotels, compared to their latest reported occupancy levels of 83.5 to 87.5 per cent, CDLHT's and FEHT's FY20 DPU forecasts could decline by 7.5 per cent and 21 per cent, respectively. Cutting Ascott Residence Trust's overall management contract's annual revenue per available unit by 10 per cent could reduce our FY20 DPU forecast by 6.5 per cent."

Copyright SPH Media. All rights reserved.