US office S-Reits - half empty or half full?

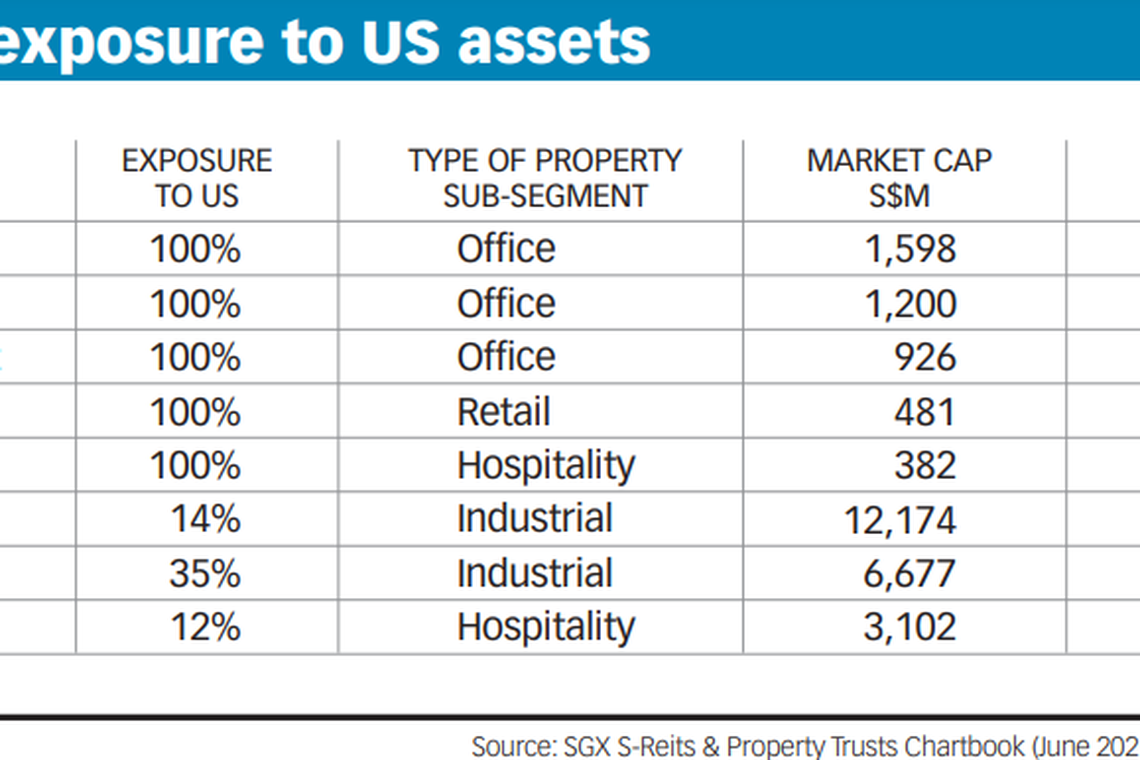

SGX lists eight actively traded S-Reits with properties in the United States (US). Five out of the eight S-Reits have pure exposure to the US and among them are three US office S-Reits.

The US Centres for Disease Control and Prevention (CDC) on May 13 announced that fully vaccinated individuals do not need to wear masks outdoors and can avoid wearing masks indoors in most places, and updated that life can begin to return to normal despite caution issued by the World Health Organization (WHO).

Nonetheless, US Office S-Reits remain sanguine about companies' return-to-office plans and are adapting to agile and "new normal" arrangements as the US continues to push for normalcy and re-opening of sectors and industries.

The three US Office S-Reits trade at an average price-to-book ratio of 0.98 times and average 7.8 per cent in distribution yield. All of the three have average committed occupancy rates of over 90 per cent, above the average Class A US office average of 84 per cent, and have weighted average lease expiry (WALE) that range from 4.3 to 5.3 years.

Manulife US Reit (MUST), which has an occupancy rate of 92 per cent, has observed more tenants gradually returning to the office with May 2021's portfolio physical occupancy at 20.0 per cent, versus 13.3 per cent seen in Jan 2021. The Reit notes that offices continue to remain relevant as companies adopt a hybrid model and the majority of employers do require the same if not more office space post Covid-19, driven by the demand for rising headcount and social distancing needs.

SEE ALSO

A NEWSLETTER FOR YOU

Property Insights

Get an exclusive analysis of real estate and property news in Singapore and beyond.

MUST sees post-Covid-19 themes such as the acceleration of population and company migration to magnet cities, growing tech sector, strong demand for health care, and fast developing knowledge economy to provide uplift for the Reit. MUST has a focus to target magnet cities which are defined as having attributes such as growing tech tenants, population growth, business friendly and lower costs of living.

Prime US Reit (Prime) sees interest in its assets pick up as tenants make longer-term leasing decisions, despite the current low physical occupancy. Its current portfolio occupancy rate is at 91.7 per cent. Some of its tenants which include Goldman Sachs and Wells Fargo have also made plans for employees to return to the office by July 2021.

In securing new leases, Prime notes that its new tenants are largely from diverse established and technology sectors. The Reit observes that the US office transaction market has shown signs of activity in recent weeks and it is actively exploring acquisition opportunities in its target markets.

Keppel Pacific Oak US Reit (KORE) has a 91.6 per cent portfolio committed occupancy rate and believes that the rollout of vaccines and removal of restrictions is raising confidence and optimism. LaSalle Network's Office Re-Entry Index shows that 70 per cent of CEOs, human resources and finance leaders are planning for employees to return to the office by fall 2021.

KORE has a focus in markets with exposure to technology hubs and tech-tenancy. Its recent leasing activities are driven mainly by demand from professional services, finance and insurance, and technology. Over 37 per cent of its current portfolio by net lettable area comprises tenants from technology and medical and healthcare. SGX RESEARCH

For more research and information on Singapore's Reit sector, visit sgx.com/research-education/sectors for the monthly S-Reits & Property Trusts Chartbook.

Source: SGX Research S-Reits & Property Trusts Chartbook.

READ MORE: Should you go for Singapore-listed US office Reits?

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Reits & Property

LMIRT Q1 net property income dips 3.1% to S$30 million on higher expenses

Mapletree Industrial Trust to distribute S$13 million of divestment gains over next 4 quarters

OUE wins tender to lease, develop new ‘zero-energy’ hotel at Changi Airport’s T2

CapitaLand Investment posts total revenue of S$650 million for Q1

Mapletree Industrial Trust Q4 DPU rises 0.9% to S$0.0336

Suntec Reit Q1 DPU down 13% to S$0.01511 in absence of capital distribution