Will golden age for construction firms return?

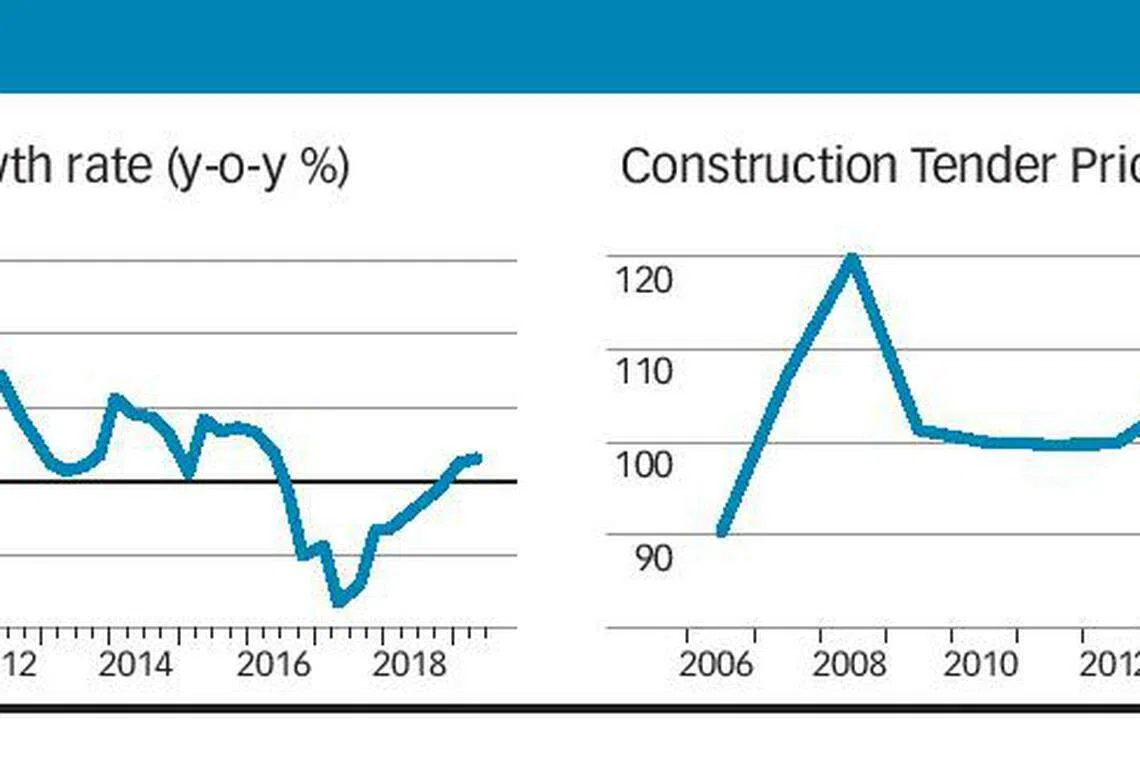

SINGAPORE'S construction sector swung back into growth mode in 2019, after two-and-a-half years of contraction. But that doesn't tell the full story.

Despite this and other promising signposts of a sustainable sectoral turnaround, shares of general building and civil engineering firms have largely disappointed this year.

Soilbuild Construction, Chip Eng Seng, KSH, Keong Hong, Koh Brothers and Tiong Seng shares are in the red so far this year.

Analysts point to keen competition for projects and a shrinking foreign labour pool that have kept industry margins slim. The construction tender price index, compiled by the Building & Construction Authority (BCA), has remained stubbornly flat.

In fact, tender prices in the second quarter fell by 0.4 per cent from the first quarter this year.

"Since this is despite the rising construction cost trend over the last few quarters, we can only infer that contractors' tender margin is now very thin and may be inadequate to buffer project risk," Silas Loh, joint managing partner of property consulting firm Rider Levett Bucknall in Singapore, told The Business Times.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The tender market could improve next year if mega projects like Changi Airport Terminal 5 proceed as planned.

The clock is also ticking down on the two integrated resorts to roll out their S$9 billion expansions.

But don't expect the recovery to be a re-run of the last golden age, circa 2006 to 2008, for construction firms.

The conditions that created that last rally in construction stocks (which died out before 2008, since the market concerns itself mainly with forward earnings) are different today.

Back in 2006, total construction demand was S$16.8 billion, an increase of approximately 46 per cent compared to 2005, noted Khoo Sze Boon, managing director of construction and project management firm Turner & Townsend in Singapore.

The same strong growth momentum of roughly 46 per cent per annum continued in 2007 and 2008 (total construction demand of S$24.5 billion and S$35.7 billion respectively).

In contrast, the BCA forecasts construction demand (in terms of the value of contracts awarded) to reach S$27-32 billion in 2019, and S$27-34 billion in 2020 and 2021.

"Generally speaking, construction demand for the past three to four years has been maintained at a relatively comparable and sustainable level," said Mr Khoo, and the government probably intends to keep it that way.

Mr Loh added: "The tender price index spiked in 2007 and 2008 when market resources were not ready to meet the construction demand led by the two integrated resorts after having declined over a prolonged downturn in thenoughties due to 911 terror attacks and SARS episode."

Marina Bay Sands, which opened in 2010, was also a "rushed job", recalled Terence Wong, chief executive of Azure Capital. Las Vegas Sands was less concerned about how much its contractors earned than it was on revenue forgone each day the casino's opening was delayed. As a result, contractors got away with margins that were "unheard of", Mr Wong said.

In comparison, the recent downturn hasn't driven as much consolidation or capacity reduction across the industry, and foreign competition is here to stay.

Mr Wong added: "In 2017, there was this enbloc craze. Many contracts were given out but margins were not exactly good."

Construction is not immune from a global economic slowdown and the residential space remains weak.

Notably, the common factor among stocks in the construction value chain that have found a following this year is that they tend to be suppliers of building materials and machinery, rather than builders themselves.

For instance, shares of Tiong Woon, the heavy lift specialist that also supports the oil and gas sector, are up 28 per cent so far this year as profits grew. In the same period, shares of Yongmao, which makes and sells tower cranes in China and overseas, have tripled after it swung into the black in the March quarter. Yongmao is part-owned by crane supplier Tat Hong, which was privatised last year.

Shares of Pan-United, Singapore's biggest producer of ready-mix concrete with a 40 per cent market share, are up 27 per cent on stronger sales and higher prices for ready-mix concrete.

Shares of BRC Asia, the largest steel reinforcement supplier in Singapore, are up 4.7 per cent so far this year after acquiring steel fabricator Lee Metal Group last year.

Shares of Boustead Projects, a general builder that also owns a leasehold portfolio for which it is mulling an initial public offering, are up 13 per cent so far this year.

Indeed, the instinct for building firms has always been to diversify their fortunes from purely construction. Chip Eng Seng and Sim Lian Group were among the first to expand into property development in response to changing market conditions in the late 1990s and early noughties.

Not only do property developers and landlords make better margins, they do one better by owning land, which Singapore investors always like.

In recent years, one trend has been for builders to co-develop sites with property developers in deals where they take a "bite-sized" stake, observed Mr Wong. Lian Beng and KSH tend to partner Oxley for landbanking, while Wee Hur is developing Parc Botannia in a 30:70 joint venture with Sing Holdings.

It will be interesting to see how the construction sector continues to morph as challenges persist.

Copyright SPH Media. All rights reserved.