Contractors' cash flows worsen; small guys hardest hit

Singapore

CONTRACTORS' cash flows continued to deteriorate in the first quarter, with the small guys hurting the most in the economy's worst-performing sector.

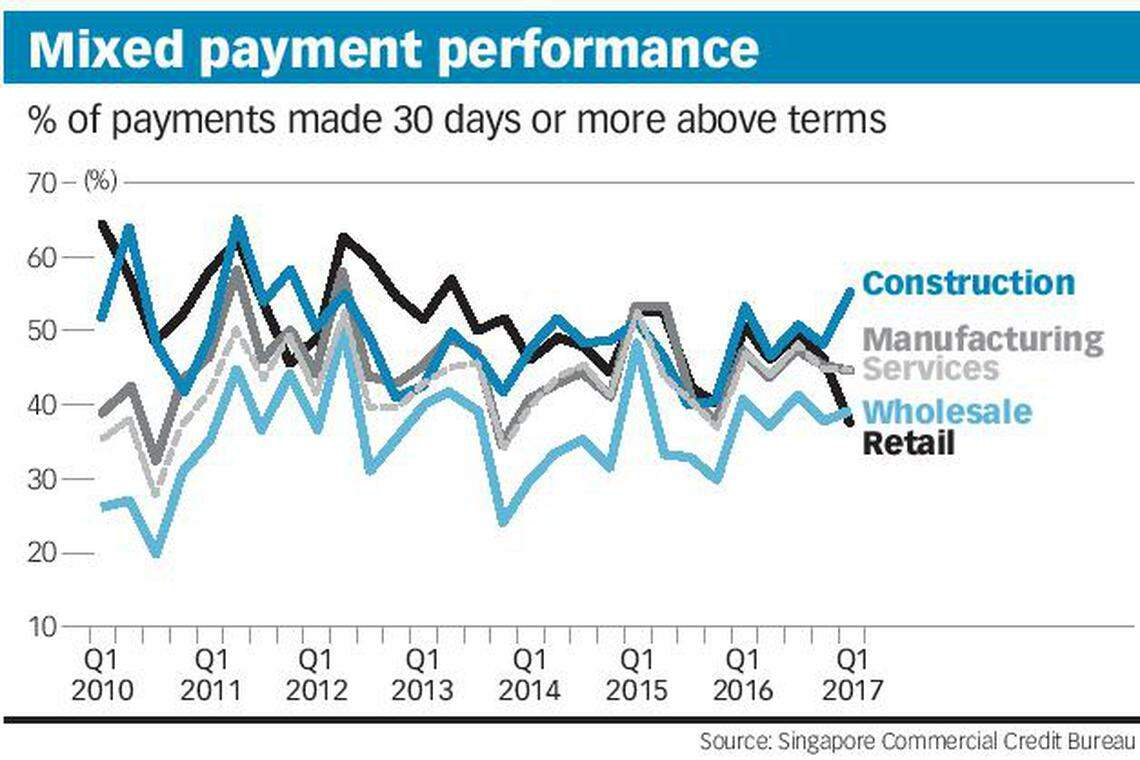

Slow payments by the construction sector in Q1 2017 jumped to 55.22 per cent, up from 47.97 per cent in Q4 2016, said the Singapore Commercial Credit Bureau on Tuesday.

In the economy at large, there was little change by Singapore firms in their payment performance, reflecting the weak economy. Quarter-on-quarter, slow payments slid slightly by 0.47 percentage points - from 43.28 per cent in Q4 2016 to 42.81 per cent in Q1 2017, the Bureau said.

Payments are considered prompt when at least 90 per cent of total bills are paid within the agreed payment terms; payments are classified as slow when more than half the total bills are paid after the period under the agreed credit terms.

As with Q4 2016, the construction sector registered the highest proportion of slow payments since Q4 2011, when such payments accounted for nearly three-fifths of payment delays, at 58.30 per cent.

The sector registered the highest quarter-on-quarter rise in payment delays as a result of a visible deterioration in payment performance by the building construction sub-sector and special-trade contractors.

Main contractors typically outsource work in plumbing, painting, plastering, carpentry, roofing, structural steel erection, glass and glazing to special-trade contractors.

Last month, economists said construction will remain the worst-performing sector in Singapore this year.

The median forecast among economists in the latest quarterly survey by the Monetary Authority of Singapore put the sector's growth at just 0.3 per cent this year - a major downgrade from last December's forecast of 2.4 per cent.

The government has said it will bring forward S$700 million in infrastructure projects to support the construction sector.

The sector shrank by 2.8 per cent in the fourth quarter of 2016, extending the 2.2 per cent contraction recorded in the quarter before.

For the whole of 2016, the sector expanded marginally by 0.2 per cent, moderating from the 3.9 per cent growth in the previous year.

Contracts awarded fell by 29 per cent to S$4.6 billion in Q4 2016, on the back of a fall in both public- and private-sector construction demand.

For the full year, total contracts awarded fell by 3.6 per cent to S$26 billion, as a result of weakness in private-sector construction demand; public-sector construction demand, on the other hand, provided some support.

Audrey Chia, D&B Singapore's chief executive, said: "As the construction industry is highly capital-asset-intensive, firms within the industry are facing a difficult time sloughing off heavy debts incurred from working capital loans, which has in turn negatively impacted their cashflow."

D&B Singapore compiles payment data by monitoring more than 1.6 million payment transactions of firms operating through its Bureau.

Outside the construction sector, payments performance was mixed. Services and wholesale deteriorated mildly; retail made a big improvement, and manufacturing, a moderate one.

Slow payments in the retail sector improved significantly in Q1 2017 on the back of an uptick in retail activities of discretionary goods.

Payment delays fell by 8.61 percentage points from 46.69 per cent in Q4 2016 to 38.08 per cent in Q1 2017.

Retailers of fashion apparel and accessories registered the highest proportion of payment delays, followed by those selling building materials and garden supplies; furnishing stores experienced the third highest proportion of slow payments.

The manufacturing sector's slight improvement in slow payments came from a better performance by the food manufacturing and pharmaceutical segments.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

International

When US diplomats visit China, meal choices are about more than taste buds

China’s first-quarter industrial profits rise at slower pace

Laid-back vibe, stunning beaches, rich cuisine and low cost of living lure more expat retirees to Malaysia

Vietnam tycoon appeals against US$27 billion fraud death sentence

US announces new restrictions on firearm exports

Central banks will probably only cut half as much as they hiked