Temporary relief from contract obligations hit by Covid-19 to come

The Covid-19 (Temporary Measures) draft law is to be tabled in Parliament next week; if passed, it will be in effect for six months in the first instance

Singapore

A NEW Bill in Singapore aims to grant temporary relief for six months to those who cannot fulfil contractual obligations such as rent payments or planned events because of the fallout from the Covid-19 outbreak.

The Bill is designed to provide "breathing space" for companies, in that the obligations are only suspended - not removed. So although the Bill will seek, for example, to protect tenants from eviction or deposits from being automatically forfeited, rent, for instance, will still accrue and eventually have to be paid after the temporary period of reprieve is over.

This will be a rare example of retroactive legislation, in that the measures will apply to contracts entered into or renewed before March 25, 2020, and cover contractual obligations to be performed on or after Feb 1, 2020.

The Bill also temporarily raises the monetary thresholds and time limits for bankruptcy and insolvency, making it harder for individuals to be declared bankrupt or for businesses to be declared insolvent.

If there are disputes, parties can apply to a body of assessors, at no cost, with resolution within five days.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The two Budget packages providing Covid-19 support "can be seen as a transfusion of blood", said Law Minister and Minister for Home Affairs K Shanmugam. "So when you have transfusion, you also have to try to stanch the flow of blood."

The Bill covers five categories of contracts:

The Bill seeks to prohibit contracting parties from taking certain legal actions against parties who fail in their obligations, including starting or continuing court or insolvency proceedings.

First mentioned in the Resilience Budget on March 26, these measures are in the Covid-19 (Temporary Measures) Bill, to be introduced in Parliament next week. They will be in place for six months from the Act's commencement and can be extended for another six months.

To receive the relief, the party which cannot perform the obligation due to Covid-19 has to serve a notification of relief to the other contracting party. This could be as simple as tenants writing a letter or e-mail to their landlord, explaining that they cannot pay rent due to lower footfall amid the virus outbreak. The notified party will then be unable to take prohibited actions such as terminating the lease or repossessing the premises. If they do not comply and still take such actions, they will be committing an offence. Details of the penalty will be released in due course.

For construction contracts or supply contracts, where obligations cannot be performed due to Covid-19, the contractor will not be liable for liquidated damages, nor for delays or non-supply of goods.

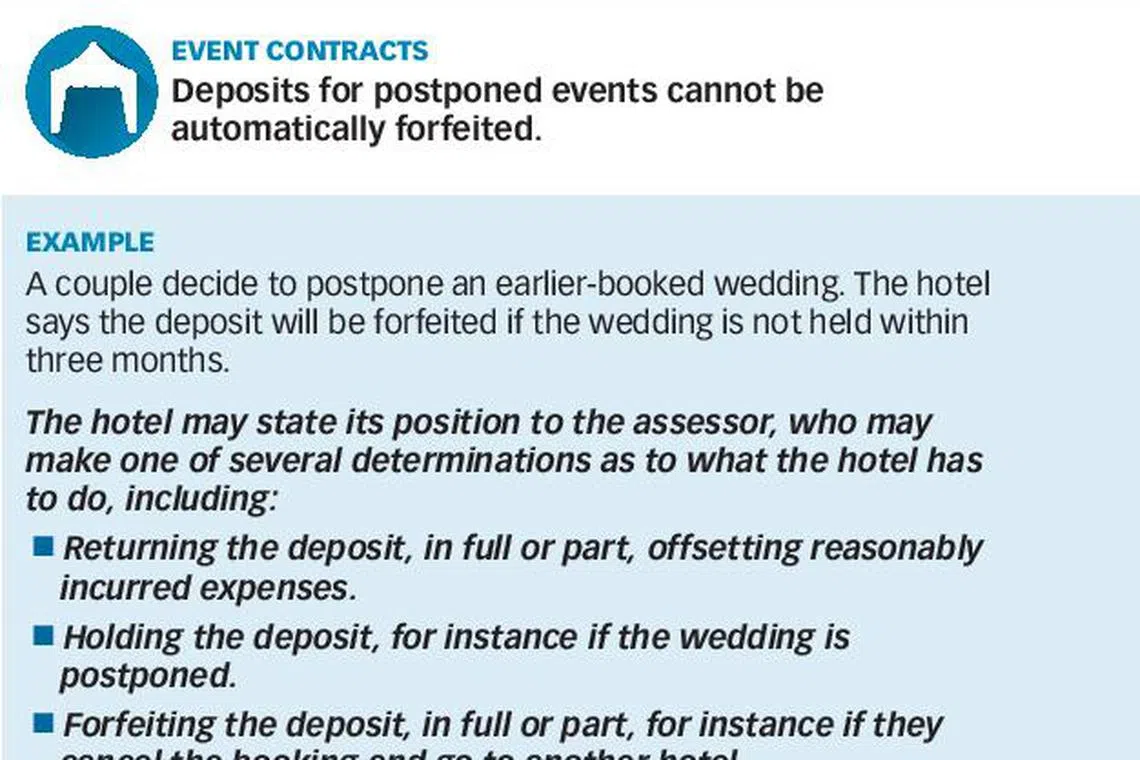

For event contracts where the event is postponed due to Covid-19, paid deposits cannot be automatically forfeited. Similarly, for tourism-related contracts, if travel cannot take place due to Covid-19, sums paid cannot be automatically forfeited.

If there is a dispute, the assessor can decide whether the deposit or paid sums should be fully or partially forfeited, taking into consideration legitimate expenses incurred.

SMEs, defined as those with annual revenue of no more than S$100 million, will be protected against enforcement action in relation to loan facilities secured against real estate, or plant, machinery, or other equipment used for business purposes.

In disputes, assessors will determine if the inability to perform contractual obligations was due to Covid-19, and can grant relief that is "just and equitable" in the circumstances.

There will be no representation by lawyers and no appeals. Details of this will be released in due course.

About 100 assessors from sectors such as law, accountancy and industry will be appointed. They are carrying out policy, not serving a judicial function, noted Mr Shanmugam.

Most contracting parties should not need to come to the assessors, unless there is a dispute, he said. A tenant should be able to go to his landlord, explain that he cannot pay rent due to Covid-19, and come to an agreement. A detailed explanation, with examples, will be put online.

The Bill will also temporarily raise the monetary threshold for bankruptcy to S$60,000 from S$15,000 usually, and raise that for insolvency to S$100,000 from S$10,000 usually. The statutory period to respond to demands from creditors will be temporarily lengthened to six months, from 21 days usually. Directors will be temporarily relieved from the obligation to prevent their companies from trading while insolvent, if debts are incurred in the ordinary course of business.

Mr Shanmugam said the Bill was put together "in a matter of days, as we saw the situation deteriorating", with the involvement of various ministries and government agencies, and consultation with private-sector representatives.

In response to media queries, the Monetary Authority of Singapore (MAS) said the Bill is "carefully scoped to avoid impairing the interests of banks and Singapore's role in international financial transactions".

Under the relief measures announced by MAS on March 31, banks have already undertaken to defer principal payments on secured loans to SMEs until the end of the year, subject to assessment of the quality of the security. "The proposed Bill provides legal protection for the specific security and hence complements banks' relief measures for SMEs," said MAS.

It added that the contractual rights of banks are not affected, other than the right to start legal action for a default on a relevant loan, which is suspended for the six-month period.

Banks' contractual right to charge fees and interest for non-payment or late payment of loan obligations due is unaffected.

READ MORE:

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.