Frugality bites for China’s cash-strapped local governments

CHINA’S local governments are gearing up for another tough year and coming to terms with the new normal of frugality, amid growing pressure on fiscal revenue and efforts to tackle their debt burdens.

In his first work report to the annual session of the National People’s Congress – the country’s top legislature – in March, Premier Li Qiang told officials to get used to tightening their belts. This echoed a call in December by top leaders, when they spoke of the growing pressure on budgets at their annual Central Economic Work Conference.

“Prestige and vanity projects and wasteful and excessive spending will be strictly prohibited,” Li said. “Governments at every level must get used to keeping their belts tightened, run on lean budgets, and ensure that fiscal funds are used where they are needed most and to the best effect.”

While all 31 provincial-level regions on the Chinese mainland reported positive growth in fiscal revenue last year, mainly thanks to a weak out-turn in 2022 when the Covid-19 pandemic hit economic activity, many localities are not optimistic about the outlook for 2024.

Growing fiscal strain

Other than the provinces of Jiangxi and Shanxi, all other regions have set their forecasts for this year’s general public budget revenue growth lower than last year’s actual growth.

The general public budget comprises the vast majority of local government revenue and spending, and raises most of its funds from taxation. Most local governments are projecting revenue increases of 3 to 6 per cent, Caixin’s analysis of provincial budget forecasts showed, although five are aiming for growth around or above 7 per cent.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

“The fiscal situation is set to come under greater strain in 2024, and it will become more challenging to strike a balance between revenue and spending,” Han Jie, director of the Beijing Municipal Finance Bureau, told a meeting of the city’s legislature in January, pointing to pressure on last year’s revenue from the sluggish property market and declining profit in the banking sector.

The budget report from the government of Zhejiang province, one of China’s biggest economic hubs, warned that the tax base has yet to resume its normal growth trajectory. It forecast that its general public budget revenue will grow by just 5 per cent this year.

Tepid consumer demand and weakening confidence in the overall economic recovery are also weighing on local authorities’ fiscal revenue growth.

In its budget report, the government of Hunan province warned that “social expectations are weak”, and that households and businesses are increasingly cautious about spending on big-ticket items or investing in production expansion.

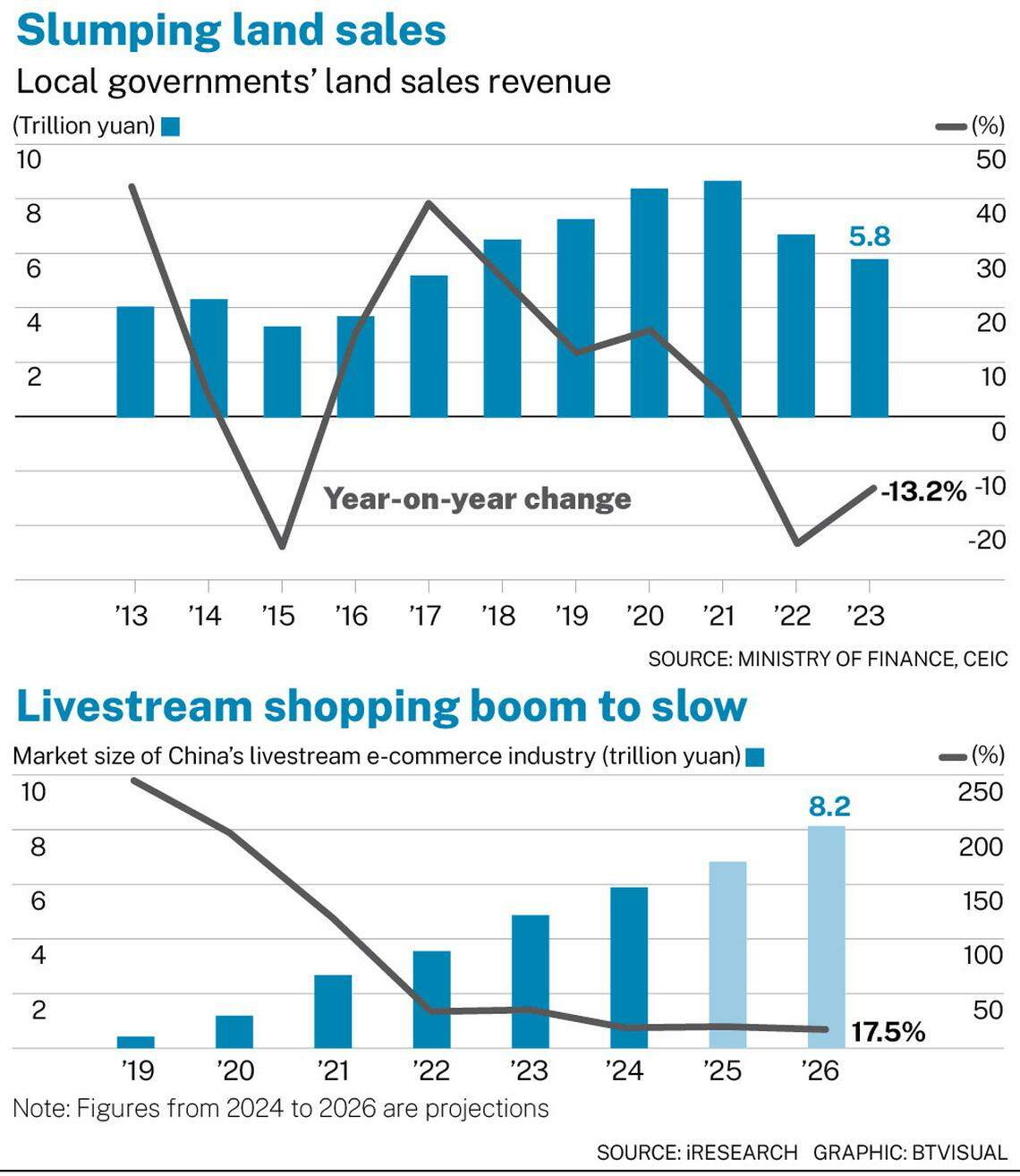

On top of those headwinds, the slump in land sales revenue, previously a major source of fiscal revenue for local governments, has exacerbated the strain on budgets.

Last year, land sales revenue fell 13.2 per cent nationwide to around 5.8 trillion yuan (S$1.1 billion), the second straight annual decline.

Of the 28 provincial-level regions that had disclosed the data as at Feb 23, 2024, 22 reported a drop, with nine logging slumps of more than 20 per cent, said Luo Zhiheng, chief economist at Yuekai Securities.

Tackling local governments’ explicit debt, which exceeded 40.7 trillion yuan at the end of 2023, and their hidden debt, estimated to be as high as 70 trillion yuan by some analysts, is also a top priority. Much of the hidden debt is owed by local government financing vehicles (LGFVs).

Besides bringing the hidden liabilities onto local budgets, the interest burden on the borrowings is growing and a mountain of debt repayment is looming.

LGFVs have 4.65 trillion yuan worth of bonds due this year, according to data compiled by Bloomberg, the highest amount on record, and roughly 13 per cent more than in 2023.

To help ease the pressure on their budgets, local governments have little option but to cut back on general expenditure, which covers things such as meetings, exhibitions and official trips.

This is to ensure they have enough money to spend on what is known as mandatory expenditure, which includes the “three guarantees” – ensuring basic livelihoods, wages, and the authority’s daily operations.

Thirteen provincial-level regions said spending on people’s livelihoods is taking up at least 70 or 80 per cent of their budgets.

To ensure they have enough money, some local governments are scrapping or suspending investment in certain types of projects. Top of the list are unprofitable investments and those aimed at burnishing the political image of local officials, such as exhibition halls, local budget reports show.

Under new guidelines issued by the State Council – China’s cabinet – that took effect on Jan 1, 2024, 12 provincial-level regions identified as high-risk in terms of their debt burdens have been told to suspend new investment in infrastructure projects unrelated to people’s basic livelihoods and review ongoing ones until their debt risks are reduced to moderate or low levels.

A local official from one of those 12 regions told Caixin that the local counterpart of the National Development and Reform Commission has classified government investment projects into three key categories: banned new projects, projects that should be supported, and those that require further review and approval.

The policy is partly aimed at preventing localities from investing in vanity projects that may boost GDP but fail to deliver tangible economic gains.

Some local authorities are exploring new ways to raise money.

Shandong province and the municipalities of Tianjin and Chongqing have said they are studying changes to reform the state-owned capital operations budget, one of four budgets in the fiscal system, and that manages the revenue from and expenditure on state-owned enterprises.

Among the options are increasing the percentage of their annual profits that state-owned enterprises must pay to local governments, and expanding the scope of profits to be handed over.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.