Demand, rents for life-sciences real estate hold up against slowdown in revenues, funding

DEMAND and rents for real estate occupied by life-sciences companies in the Asia-Pacific have remained resilient despite a slowdown in revenues and venture capital funding, a CBRE report said on Friday (Mar 24).

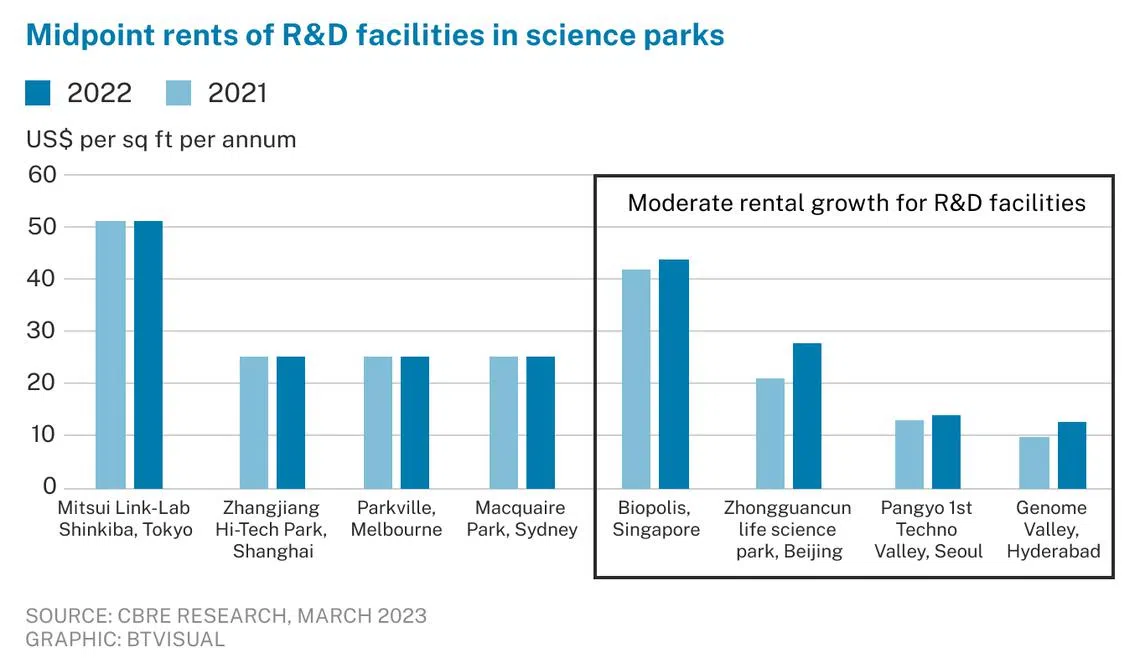

The industry’s continued focus on research and development (R&D), as well as the need to support such activities, have kept occupancy tight, with rents rising between 5 per cent and 30 per cent in the R&D clusters of China, Singapore and India.

But even though total gross leasing activity has risen, new leasing volumes are falling. This comes as life-sciences companies’ growth normalises post-pandemic, and as they look to save on costs.

In 2022, total leasable area in the Asia-Pacific for the industry grew to over 100 million square feet (sq ft). This followed the substantial expansion of life-sciences clusters in recent years to support the R&D operations of local and multinational companies.

Singapore alone has a leasable area of about 3.7 million sq ft for life-sciences parks in Biopolis, with rents ranging between US$43 and US$45 per sq ft (psf) as at the third quarter of 2022.

The largest life-sciences clusters are in Shanghai, with about 36 million sq ft, including space used by industries other than life sciences, being leased at between US$17 and US$34 psf. Sydney has about 10 million sq ft being leased at between US$23 and US$27 psf, while Seoul has about seven million sq ft of land being leased at between US$13 and US$15 psf as at the third quarter of last year.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Another 58.8 million sq ft of land in new life-sciences parks will be on stream in Singapore by 2025. A new redevelopment by CapitaLand Development and CapitaLand Ascendas Reit will cover about 1.3 million sq ft with an asking rent of US$60 psf, which is significantly higher than the current rent at Biopolis.

This comes even as revenue and funding for the industry have cooled. During the earlier stages of the Covid-19 pandemic, there was a surge in demand for the development and sale of Covid-19 vaccines, as well as an influx of venture capital which supported the sector’s growth. Fundraising for the industry in the US and China has weakened year on year, by 36 per cent and 53 per cent respectively.

The industry is forecast to grow by about 1 per cent to 2 per cent year on year in 2023, compared to an estimated 7 per cent in 2022, CBRE said.

“Given the current economic conditions, venture capital funding for the life sciences industry is likely to remain muted in 2023,” the real estate services company added.

Despite the slowdown, life sciences’ long-term growth in the Asia-Pacific is expected to be driven by an ageing and more health-conscious population, as well as government policy support.

CBRE said expenditure on R&D in the industry is also forecast to “remain solid”, with growth set to normalise around 4 per cent over the next three years following the pandemic surge. It also noted that companies are continuing to look for longer-term leases for specialised and high-quality R&D spaces.

R&D is one of the biggest expenses for life-sciences companies, accounting for an average of 15 per cent to 20 per cent of industry revenue in 2022. The focus on R&D has led to continued robust demand from life-sciences companies for laboratory space to support such activities. Singapore, in particular, has emerged as a hot spot for new manufacturing plants.

“Life-sciences companies in the Asia-Pacific have robust appetite for laboratory space to support R&D activity,” said Ada Choi, CBRE’s Asia-Pacific head of occupier research.

“As R&D capabilities expand, we expect to see the proliferation of new manufacturing plants with enhanced productivity and operational efficiency, facilitating the production of new blockbuster drugs.”

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.