Singapore’s shophouse sales dip in Q3 as market sees price resistance

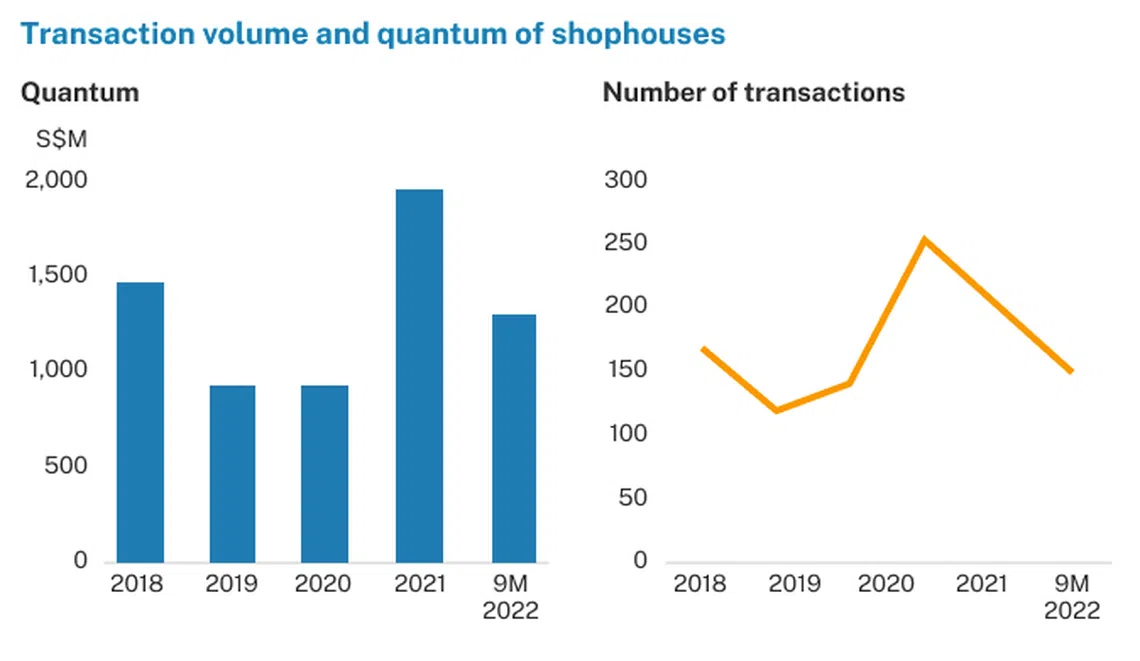

SHOPHOUSE sales in Singapore plunged in Q3 2022, down 49.3 per cent from the previous quarter, Huttons’ latest market update on Thursday (Oct 13) showed.

The total volume of shophouse sales amounted to 34 transactions in Q3, from 67 transactions in Q2 of 2022. This is also a 54 per cent decline in sales year-on-year.

Shophouse sales totalled 153 transactions year-to-date, down from 194 transactions in the same period a year ago.

Freehold shophouses continued to account for the bulk of transactions in Q3, at 73.5 per cent, with leasehold sales volume sinking by more than a third from the previous quarter to nine units.

The average shophouse transaction value swelled by more than 30 per cent, with a total value of S$330.1 million or an average of S$9.7 million per shophouse.

The biggest transaction in this quarter was 161 Lavender Street with a land area of 17,561 square feet (sq ft), acquired by mainboard-listed Hafary Holdings at S$71.3 million. The estimated gains from this transaction amounted to S$15.7 million.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Other top transactions include a block of five adjoining conserved shophouses along Jalan Besar with a land area of 6,584 sq ft for S$40 million; and a shophouse at 11 Bali Lane with a land area of 1,664 sq ft for S$23 million. The latter has since made S$4.2 million in estimated gains.

Huttons noted that investors are shifting their focus to shophouses in areas such as Joo Chiat, Kampong Glam and the Jalan Besar area, to “find more reasonably priced shophouses to enhance the tenant mix and rental return”.

The home-grown property agency added that even though interest in shophouses remained high, supply is limited and existing owners are holding onto their “prized assets” unless a compelling offer is received.

“Family offices are keen to invest in this asset class for wealth preservation (too),” it said.

Likewise, real estate consultancy Knight Frank noted in its Q3 investment sales report that while the shophouse investment market continued to draw interest, the drop in sale this quarter “may suggest that elevated prices have met resistance by prospective buyers”.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.