Singapore condo resale prices rise 0.2% in June; volumes down 25.5%: SRX Property

RESALE prices of non-landed homes in June crept up just 0.2 per cent from the previous month as volumes plunged 25.5 per cent, according to latest flash estimates by real estate portal SRX Property.

Compared to May, the Core Central region (CCR) and Outside Central Region (OCR) recorded a price increase of 0.1 per cent and 0.4 per cent respectively, while Rest of Central Region (RCR) prices remained unchanged.

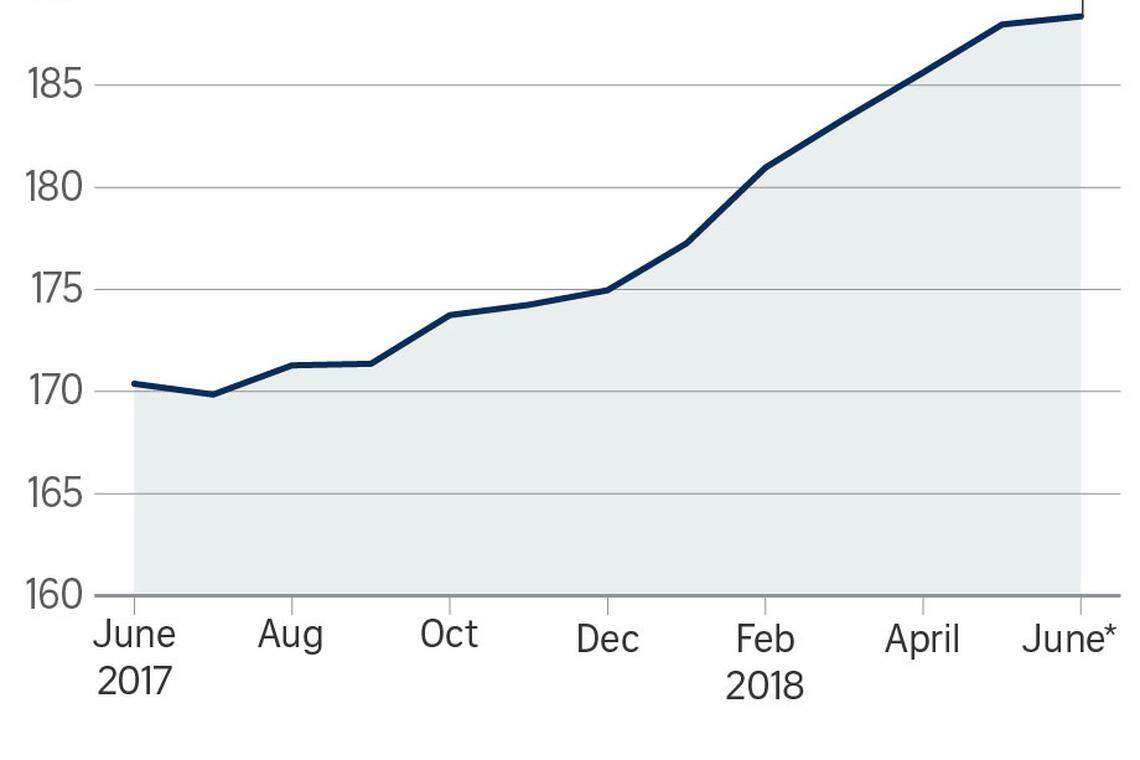

Year-on-year, prices in June 2018 increased by 10.6 per cent from June 2017.

CCR, RCR and OCR recorded a year-on-year price increase of 10.9 per cent, 11.6 per cent, and 9.4 per cent respectively from the previous year.

Based on an index average of three months in the second quarter of 2018 and that of the preceding quarter, prices have risen 3.8 per cent from Q1 2018.

SRX also revised its monthly price change figure for May up slightly to 1.3 per cent from 1.2 per cent.

June's resale volume declined 25.5 per cent to 1,128 units from May's 1,514 units. Year-on-year, the number of units resold rose 4.6 per cent from June 2017, but resale volume was down by 45.0 per cent compared to its peak of 2,050 units in April 2010. Overall median Transaction Over X-Value (TOX) was positive S$17,000 in June 2018, a decrease of S$1,000 compared to positive S$18,000 TOX for May.

TOX measures how much a buyer is overpaying or underpaying on a property based on SRX Property's computer-generated market value.

District 21's Upper Bukit Timah and Ulu Pandan posted the highest TOX among districts with more than 10 resale transactions, of positive S$70,000.

This suggests that a majority of the buyers in that district purchased units above the computer-generated market value.

District 26's Upper Thomson and Springleaf posted the most negative median TOX at S$12,000 among relatively active districts.

This suggests that a majority of the buyers in that district purchased units below the computer-generated market value.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Property

Singapore office rents in central region fall 1.7 per cent in Q1 after rising for 9 quarters

Singapore retail rents slip 0.4% in Q1 as vacancy rates creep up

Country Garden plans to present debt revamp plan in H2, sources say

Hong Kong home prices rise for first time in 11 months after curbs scrapped

HDB resale prices accelerate, rising 1.8% in Q1 on stronger demand

Private home prices ease to 1.4% rise in Q1; rents fall a further 1.9%