Thin home supply in Downtown area may stir more interest for Marina View site, triggered at S$1.51b

THE white site at Marina View that was said to be triggered by IOI Properties at S$1.508 billion may be well-received by developers given the limited supply of new homes in the Core Central Region (CCR), analysts said. Given the large financial commitment required for the site, developers are expected to set up joint ventures to parcel out the risk.

The tender was launched for sale by public tender on Monday, and will close at noon on Sep 21, 2021, the Urban Redevelopment Authority (URA) on Monday said.

URA released the white site in Marina View for sale by public tender following a successful application from a developer - not named by URA - that committed to bid at least S$1.508 billion or S$1,379 per square foot per plot ratio (psf ppr) at tender.

The 0.78-hectare (about 84,000 sq ft) site, with 99-year leasehold tenure, can be developed up to 1.09 million square feet (sq ft) of gross floor area (GFA).

The plot can generate some 905 private homes, 540 hotel rooms and 21,528 sq ft GFA of commercial space.

Lee Sze Teck, director of research at Huttons Asia, similarly said the tender will attract "no more than five bidders" made up of consortiums, because of the large quantum and higher risks involved.

SEE ALSO

A NEWSLETTER FOR YOU

Property Insights

Get an exclusive analysis of real estate and property news in Singapore and beyond.

With developers mindful of the increasing labor cost, the expected bidding price could be about S$1,550 psf - S$1,700 per square feet per plot ratio (psf ppr), with an expected selling price of between S$2,500 and S$2,800 psf, said Christine Sun, senior vice president of research and analytics, OrangeTee & Tie.

"The site may be well received as currently some of the new projects like Marina One Residences, The M and Midtown Modern received good sales response in recent months," she added.

According to data from OrangeTee & Tie, the median transacted price of Midtown Modern stood at about S$2,700 psf, that for The M is about S$2,675 psf, while that for Marina One Residences is S$2,450 psf.

"Currently, mixed development sites with residential and commercial components are also popular among buyers especially those with retail shops," said Ms Sun. The comparable site could be the white site in Central Boulevard next to Asia Square Tower 1, which was sold for about S$2.57 billion or land rate of S$1,689 psf ppr, she added.

Supply is also tight in the CCR. Data from PropNex showed that as at end of Q1 2021, there were a total of 1,650 units from four residential projects situated in the Downtown Core area.

Ismail Gafoor, CEO of PropNex, said the Marina View site can become a "trophy project" for a developer in the heart of downtown Singapore.

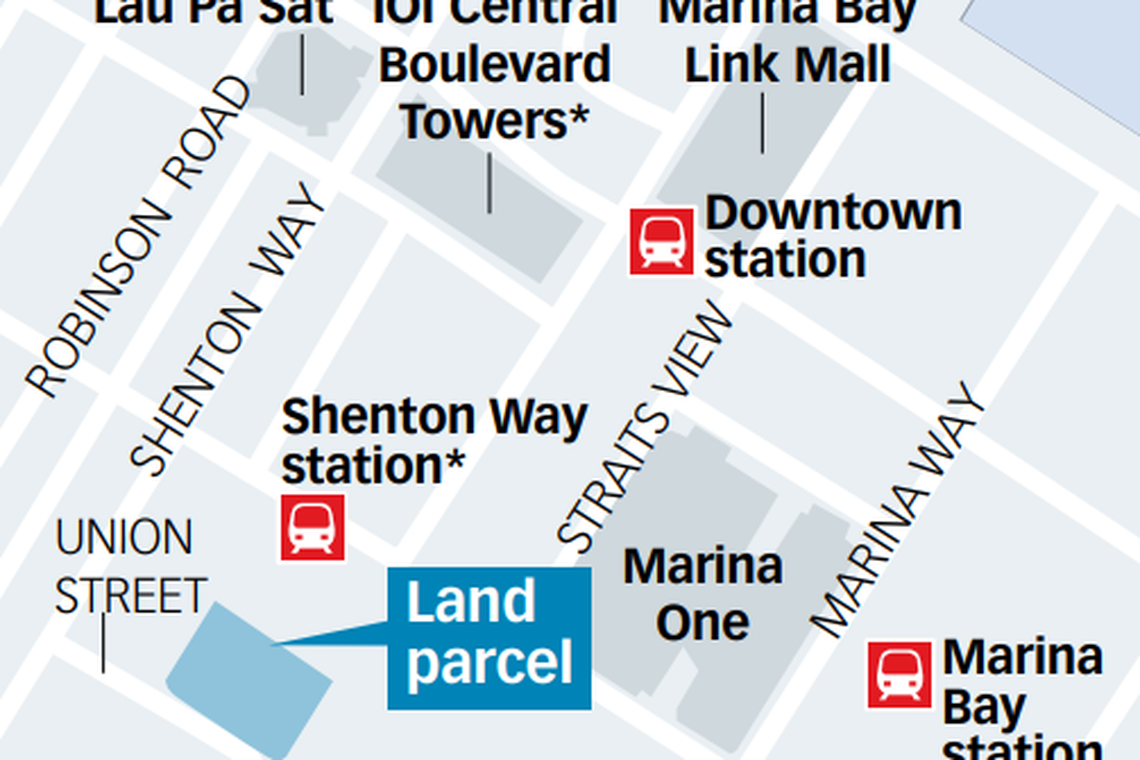

PropNex noted that the site’s location is attractive, being in the Downtown Core, and next to the upcoming Shenton Way MRT station. It is also a stone’s throw from the Marina Bay MRT interchange station, which will be linked up to the future Thomson-East Coast Line.

He said: "We believe the site will help to boost the resident population and inject more vibrancy in the Marina Bay area – in line with the government’s plans to enliven the city centre and to make sure the central business district does not become a ghost town after work-hours."

Developers can take advantage of the flexibility of the commercial-white use to propose innovative uses too, such as co-working office spaces, or entertainment venues - uses that will not only benefit the residents of the development but also the wider Marina Bay precinct, he added.

The land was available for sale on the Reserve List of the first half 2021 Government Land Sales Programme.

A "white" site is a land parcel where a range of uses are allowed, although the government is likely to stipulate a minimum component, or even a maximum component, of a specific use or specific uses to meet its planning intentions.

In this case, the site is intended for a mixed use development with residential, hotel, commercial and/or serviced apartment.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Property

Private home prices ease to 1.4% rise in Q1; rents fall a further 1.9%

Singapore office rents in central region fall 1.7 per cent in Q1 after rising for 9 quarters

Singapore retail rents slip 0.4% in Q1 as vacancy rates creep up

Country Garden plans to present debt revamp plan in H2, sources say

Hong Kong home prices rise for first time in 11 months after curbs scrapped

HDB resale prices accelerate, rising 1.8% in Q1 on stronger demand