Asean startups shine with Asia-Pacific VC deals set to surpass US$152b record

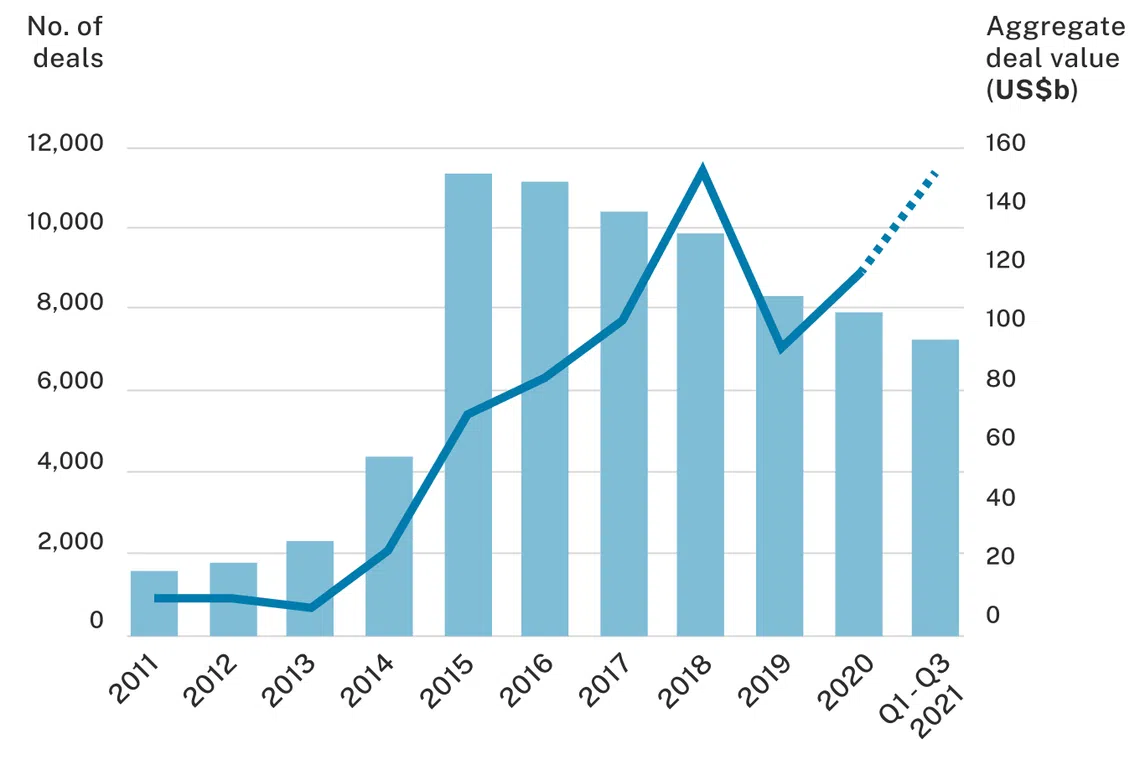

THE maturing South-east Asian startup scene continued to attract strong interest in 2021, amid a record year for venture capital (VC) deals in the broader Asia-Pacific region, a report by market intelligence firm Preqin shows.

"This could be because fund managers grew more risk-averse in the face of macroeconomic headwinds, preferring to inject capital into later-stage companies with a higher likelihood of profitability," the report noted.

The largest deal of the year was Grab's US$40 billion merger with US blank-cheque firm Altimeter Growth Corp. Other notable ones include Flipkart's US$3.6 billion pre-initial public offering (IPO) raise from GIC and Canada's CPP Investment Board.

Against this backdrop, South-east Asia continues to buzz with deals. The growth of 3 "decacorns" - Grab, GoTo Group and Sea - is likely to set off a chain of M&A as they acquire smaller startups, offering them an alternative to an IPO.

Preqin also sees more South-east Asian startups following Grab's lead and pursue SPAC listings, especially in Singapore and Indonesia. The US$1.5 billion listing of Indonesian e-commerce group Bukalapak has also raised investor confidence in the region.

The exits landscape in broader Asia-Pacific is likewise bustling. VC exits in the first 9 months of 2021 totalled US$98 billion, past the previous annual record of US$82 billion in 2020. China alone accounted for 74 per cent of this.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

However, the future of the country's tech regulations hangs in balance. Among private equity fund managers surveyed by Preqin in November, 27 per cent said that they would be targeting China in the next year, a lower proportion than 55 per cent a year ago. If uncertainty persists in China, investors may look more towards India, Indonesia and Vietnam, the report said.

There could be some caution among limited partners as well. Despite the exuberance in dealmaking, Asia-focused capital raised by VCs was lower in 2021, with US$40 billion raised by 286 funds. This marks a cooling from US$51 billion raised in 2020 and the US$103 billion record high in 2018.

Nevertheless, Preqin is optimistic about the continued growth of VC in South-east Asia, India and China, given the compelling themes of fintech, edtech, telehealth and digital payments.

Family offices are also increasingly visible in VC. For instance, Singapore's JL Family Office set up a PEVC (private equity venture capital) division in September 2020, Odyssey Venture Holdings, that invests in Singapore and US early-stage funds. Shanghai-based Gopher Asset Management, the alternatives unit of family office Noah Holdings, backs Series C and later rounds.

"Asia-Pacific's growing wealth and the increased involvement of family offices could be a significant factor in the region's rising VC assets under management," the report said.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.