Digitally transform your business' accounting needs today

Now there is a government grant featuring Xero's accounting software to automate tedious processes

For businesses big and small in Singapore, one constant challenge during tax season is the rush to get all the accounting done, by tallying all the income and expenditure in place.

This annual undertaking has long been accepted as part and parcel of doing business, but many of its manual processes are unnecessary.

Not only are they labour intensive and take away valuable time, they also contribute to added costs for businesses - especially for small- and medium-sized enterprises (SMEs) sensitive to additional overheads.

That is why many businesses are looking to more efficient, cost-effective and automated processes to digitally transform their accounting practices.

This would simplify one's accounting as well as deriving more insights from that process to boost one's business.

Automating daily processes

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Take, for example, the simple tallying of receipts that employees regularly present for expense claims. These could range from costs incurred for taking a taxi to meet a client to a lunch meeting to discuss a potential project.

Instead of manually submitting the receipts at the end of each month, each employee can use a mobile app to scan the receipts into the system, which automatically identifies claimable amounts.

Upon confirmation by the employee, the claim is sent to a supervisor for approval, then automatically added to the company's expenses list.

This cuts down the time taken for the employee to make the claim, and smoothens the process of having the right amount entered into the company's books.

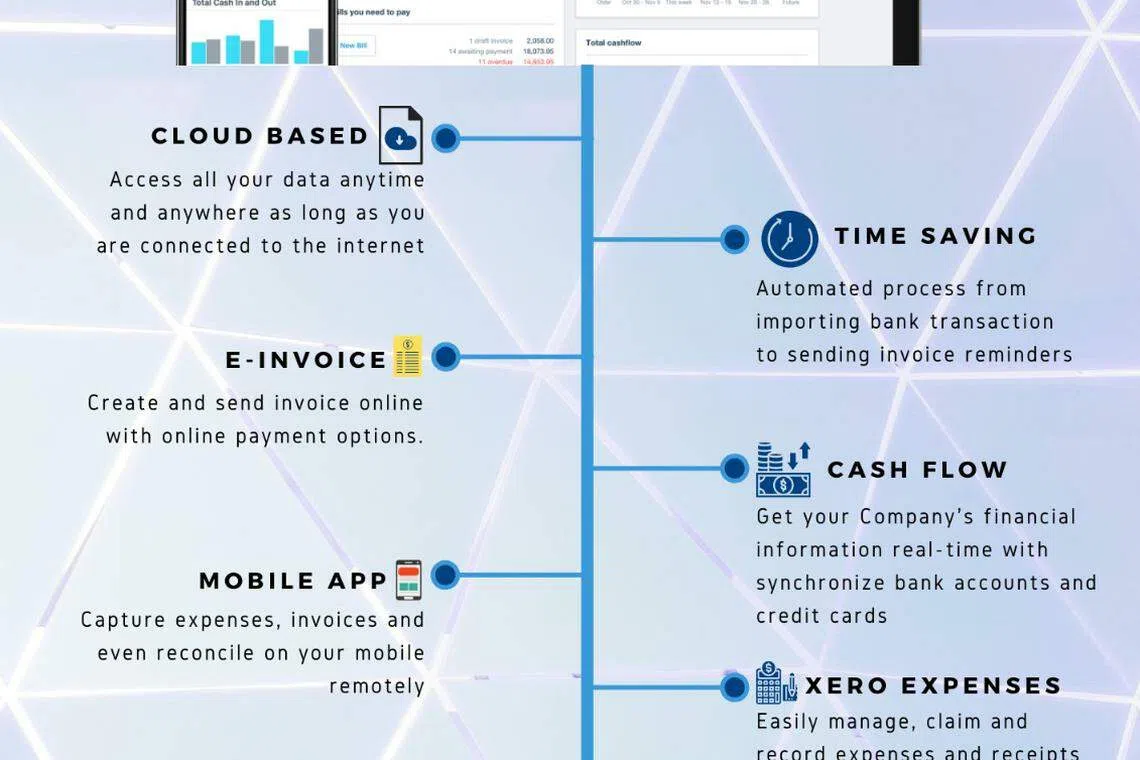

All this is made possible by cloud-based accounting software Xero, which helps digitalise the paper-based and manual processes of business operations.

But more than that, it also brings a lot more visibility to the process, empowering both business owners and employees with intuitive, easy-to-use features.

For example, Xero is able to import and categorise your latest bank transactions, saving valuable time spent trying to reconcile what they mean in an accounting sense.

Just transferred some monies to a supplier? Xero lists it as a payment to the supplier. Received payment from a client for a job? Xero links it to an invoice you had sent earlier. Xero makes accounting simple and easy for SMEs!

Get real-time insights

With such automation and insights, the benefits go beyond beating the rush to submit one's accounts each year. Instead, business owners have a real-time understanding of their cash position, for instance.

They also gain insights on areas they should focus their energies on - for example, which sectors their company is doing well in - without having to wait for the usual quarterly reports to reflect performance.

Plus, with a mobile app that reconciles, sends invoices and creates expense claims and views financial statements, they can also run their business on the go without being physically at a desk.

On top of this, Xero - one of the accredited software solutions accredited by the Inland Revenue Authority of Singapore (IRAS) and compliant with its requirements - offers functions such as inventory management, project management, online payments and e-invoicing.

Get up to speed with a grant

SMEs can tap on a government grant that helps offset the costs of going digital with solutions such as Xero.

The (PSG) Productivity Solutions Grant, introduced by the Infocomm Media Development Authority (IMDA), was enhanced in 2020 to fund up to 80 per cent for IT solutions and equipment to encourage SMEs to digitalise their businesses.

This means a large part of the expense of signing up for Xero is offset by the PSG, so the cost of transforming one's accounting practices is significantly reduced.

To be eligible for PSG, an SME must:

Leave the setting up in good hands

Of course, moving one's accounting to a new platform is not a casual undertaking. For some SMEs, this could mean connecting their existing accountant to the Xero platform as well.

As such, W.L.P Group, a business solutions company and PSG Grant Xero partner, helps consult SMEs for the big move. It works closely with them to enable a smooth transition to the new digital platform for the long term.

Whether your company is a new start-up or well established in your sector, W.L.P. will assist in the initial Xero accounting setup, which involves the linking of bank accounts and initialisation of user rights.

It will also provide the necessary set up, training and software support required to manage Xero.

This frees you up to stay focused on your business, and be ready to reap the benefits of digitalising a core part of your operations.

Click here to find out more about W.L.P.'s Xero accounting services.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Share with us your feedback on BT's products and services