Low rates posing a challenge for long-term portfolios

Silver lining is low expected inflation, which means retirees may spend more without draining portfolios

Singapore

EXPECTATIONS of lower interest rates in the US and Europe are proving a boon for risk assets this year, but ever-lower yields in the fixed income market pose challenges for long-term savings portfolios.

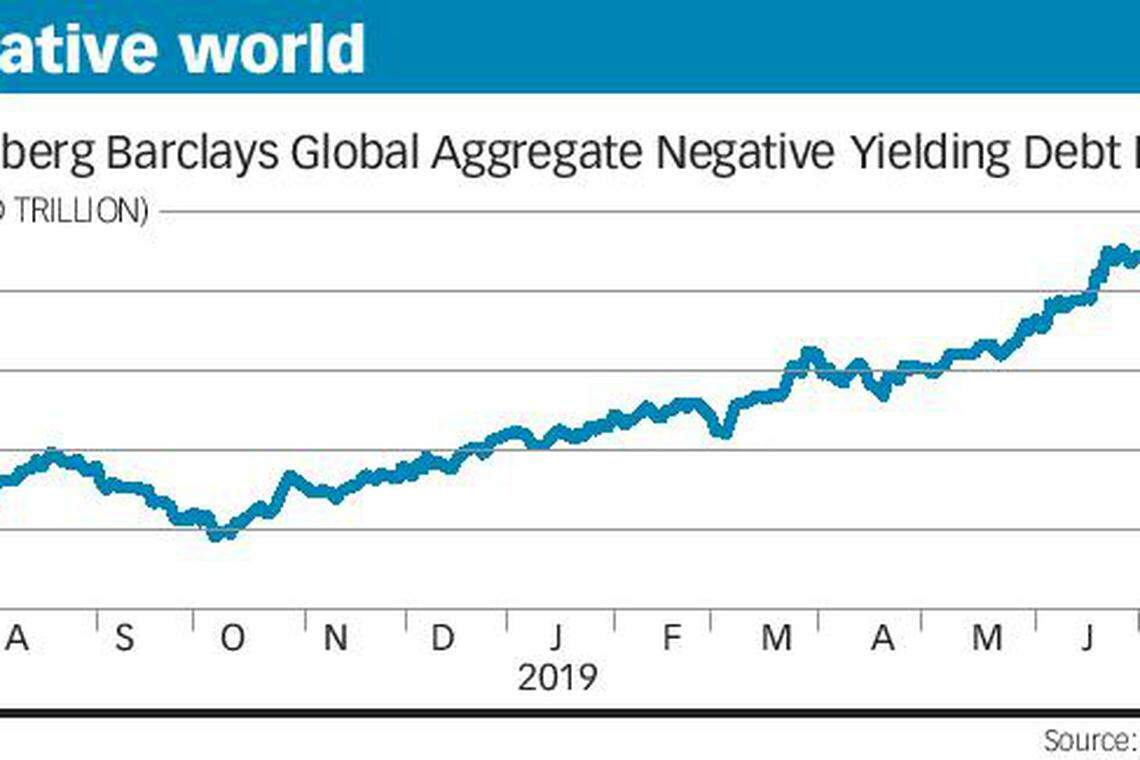

As at end-July, an estimated US$14 trillion of global debt is in negative yield territory. This means that investors who hold the bonds to maturity lose money because they pay a premium over the interest and principal that the bond would pay them.

It suggests, among a number of reasons, that investors have a rather bleak outlook - that is, they are willing to overpay for the perceived safety of government and higher quality debt. Or, they fear deflation.

Based on Bloomberg data, Japan accounted for a large chunk of negative yielding debt, and Europe's share was nearly half. Negative yielding debt accounted for roughly a quarter of the Bloomberg Barclays Global Aggregate Bond Index.

Investment-grade credits are not spared. As at mid-July there were over US$700 billion in negative yielding corporate debt.

Equity markets on the other hand have generated high single- to double-digit gains this year, buoyed by the expectation of looser monetary policy.

As expected, the Federal Reserve cut interest rates last week by 25 basis points, the first cut since 2008. A second rate cut in September is widely expected.

The European Central Bank last month signalled that it is prepared to cut short-term interest rates and re-start a bond buying programme.

Advisers typically advocate a sizeable allocation to fixed income as a stabiliser in portfolios. Fixed income is also a preferred asset class among the high net worth who seek capital preservation.

But the very low yields - and the expectation that interest rates will stay lower for longer - have ignited a chase for higher yields in higher risk assets.

This is evident among Singapore real estate investment trusts, which posted an average capital appreciation of 18 per cent as at mid-July and the average yield exceeded 5 per cent.

Year-to-date, the S&P 500 has returned nearly 17 per cent, a strong showing even as the index last week posted its worst week this year as trade tensions escalated.

US equities remain a favoured asset class despite its extended bull market. One reason, says Julius Baer's chief investment officer for Asia, Bhaskar Laxminarayan, is that the S&P 500's dividend yields at 1.9 per cent are attractive relative to the US 10-year Treasuries' yield. The yield fell from just over 2 per cent last Wednesday to 1.84 per cent.

In fixed income, Schroders' investment director for global fixed income, Sriram Reddy, says the environment is "still conducive" for credit, but "we're probably closer to the end of the business cycle". He added: "We do think that focus on drawdown mitigation techniques and a more diversified portfolio makes sense." (see amendment note)

One silver lining to low yields is low expected inflation, as it means that retirees may be able to maintain spending rates or even spend more without depleting their portfolios too quickly.

Advice from strategists and retirement experts remains evergreen: Decide on a strategic asset allocation, stick with it and be diversified.

Savers, including pre- and post-retirees, still need both fixed income and equities in their portfolios, particularly as life expectancy lengthens.

Said Wina Appleton, JP Morgan Asset Management's Asia-Pacific retirement strategist: "It is important that even in retirement our assets grow as we can easily have 30 years of expenses, and this is compounded by inflation. We need to be conservative to mitigate sequence-of-return risk and to protect wealth. But on the other hand, we also need to have a meaningful but prudent exposure to risk assets."

Sequence-of-return risk refers to the impact of the timing of a sharp or prolonged downturn to portfolios. A downturn that occurs just before retirement or early in retirement can severely impact withdrawal rates and cause funds to drain faster than expected.

BlackRock Investment Institute chief APAC strategist Ben Powell says investors should seek "multiple return pathways'.

"Portfolio resilience is particularly crucial at a time of elevated macro uncertainty . . . Government bonds can play a key role in building portfolio resilience both tactically and strategically."

Willis Towers Watson's head of investments, Jayne Bok said: "It is a difficult time to be an adviser because there is so much uncertainty and complexity ... The only thing you can do is to make sure your portfolio has integrity. And the only way to get that integrity is to diversify as much risk as possible.

"Patience is a virtue and this is where retail investors struggle. In a retail portfolio, diversity often isn't there. Often there is a big chunk in bonds, and a whole chunk of highly risky, very correlated assets."

Marc Lansonneur, DBS head of managed solutions, balance sheet products and investment governance, sounds a caution over long-term expected return rates.

He points out that global long-term interest rates have fallen by 2-3 percentage points compared to the pre-2008 crisis levels.

The Bloomberg Barclays Global Aggregate Index currently yields 1.45 per cent for a seven-year duration, compared to 3.35 per cent for a five-year duration 10 years ago.

"Risk-free rates at current levels are probably not going to generate sufficient returns over the longer term," he said.

"Over the same period, we think a similar ballpark magnitude reduction in the discount rate has been factored into today's valuations for equities, real estate and other risky assets. One can expect lower returns from a composite or balanced investment portfolio over the next 10 to 20 years."

A lower expected rate of return means savers will likely need to save larger amounts or work longer to reach their financial goals.

Neil Dwane, Allianz Global Investors global strategist, said: "My concern for the future is that many parts of the global bond markets offer no return. Multi-asset funds may have a lower return on fixed income, and arguably a lower return on equities. Savers end up saving money for a 3-4 per cent return, but they need 8 per cent. They will need to save more or take more risk."

He added: "We may have reached a point where equity makets become range-bound and bounce around, and the way to add return is to try to time markets when they rally and sell when they become risk-off . . . Indexing may not deliver returns because beta is volatility with no actual positive return. That leads you to become a stockpicker and more active."

Kelvin Goh, OCBC's head of investments and wealth advisory, says a lower inflation outlook allows for cash payouts from CPF Life or other passive income to stretch further.

"Pre-retirees should plan as early as possible what kind of lifestyle they look to have in retirement and be realistic on their spending assumptions... The chasing of yields should be tempered with caution. It should not be an absolute chase, but a focus on the sustainability of yields and the quality of the underlying assets."

Standard Chartered Bank's Sumeet Bhambri, regional head of wealth management (Singapore, Asean and South Asia), says Singapore bonds can be expected to deliver 2.5 per cent annualised returns with 4 per cent annualised volatility over the next seven years.

Asia ex-Japan bonds are expected to generate 2.6 to 3.5 per cent returns with 4 to 8 per cent volatility depending on the currency of issuance and whether returns are hedged.

"History shows that low yields typically occur alongside low inflation . . . An extension of today's low inflation rates over the next few years would mean that net-of-inflation yields would actually continue to look quite similar to the past two decades on average," said Mr Bhambri.

He likes emerging market US dollar government bonds where absolute yields remain "reasonably attractive", and Asia US dollar bonds which have shown "remarkable stability for the yields on offer".

Amendment note: Schroders' investment director for global fixed income is Sriram Reddy. The article above has been revised to reflect this.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Capital Markets & Currencies

Mixed trading in Asia as investors watch for further macro data; STI down 0.2%

Vietnam delays launch of new stock trading system

Hong Kong bourse regains favour on hopes of a market revival

Asia: Markets rise as strong US tech earnings offset poor data

Singapore shares open lower on Friday; STI down 0.1%

Stocks to watch: CLI, Great Eastern, MIT, Sheng Siong, iFast, OUE, Far East Orchard