DBS housing loans business takes harder hit from cooling measures

Mortgage growth was under S$2b for 2018; less than original estimate of S$4b and revised estimate of S$2.5b

Singapore

DBS Bank's housing loans business was hit by cooling measures as mortgage growth came in shy of S$2 billion for 2018, even less than what the bank had expected after two rounds of shaving its forecasts earlier on.

Now, the bank expects about S$1.5 billion to S$2 billion in mortgage growth for 2019.

At a results briefing on Monday, DBS chief executive officer Piyush Gupta acknowledged the impact of the cooling measures introduced last July on the bank's housing loans segment in 2018.

DBS' mortgage book grew S$500 million for the fourth quarter ended Dec 31 and just under S$2 billion for the whole year.

Mr Gupta said: "Mortgage business continues to be slow. Actually, our mortgage growth last year didn't even come in at S$2 billion."

He had guided for a S$2.5 billion growth at the third-quarter results briefing last November. That was a further cut from the original estimate of S$4 billion for 2018.

"Bookings have been particularly slow. Overall, our new bookings are coming in at least 30 to 40 per cent lower than they were before the cooling measures."

He noted that there will be about 65 new projects in Singapore this year and estimated a mortgage growth of S$1.5 billion to S$2 billion for 2019.

DBS' share of Singapore housing loans remains at 31 per cent.

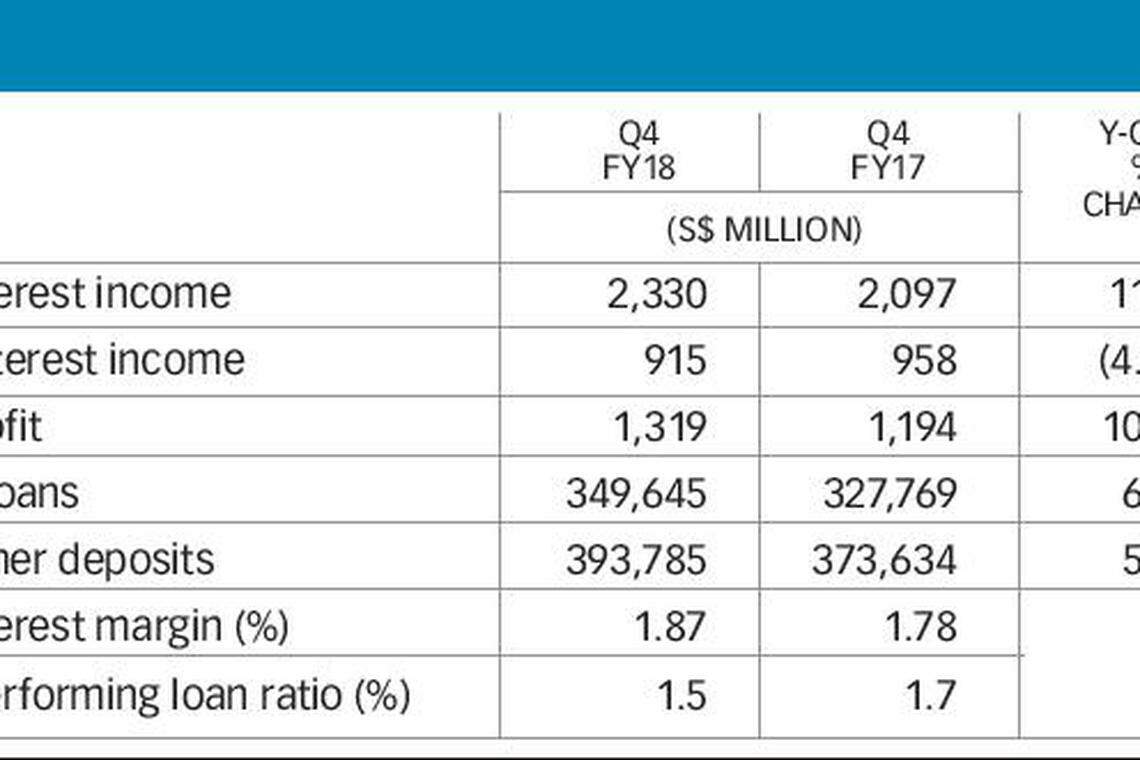

In spite of the muted housing loans growth, DBS saw its net profit improve 10.5 per cent year on year from S$1.194 billion to S$1.319 billion in the fourth quarter, buoyed by loan and net interest margin (NIM) growth.

The bottom line missed market expectations of about S$1.35 billion, though.

The fourth quarter was described as challenging by Mr Gupta, as capital markets were hit by a "perfect storm", and "almost every asset class got hammered".

DBS' treasury markets income halved to S$92 million in those three months.

However, net interest income was up 11 per cent to S$2.33 billion while NIM - boosted by higher interest rates in Singapore and Hong Kong - climbed nine basis points (bps) to 1.87 per cent.

Loans for the fourth quarter grew 6.7 per cent year on year to S$349.65 billion.

Non-interest income was 4.5 per cent lower year on year at S$915 million. Fee income at S$635 million was flat as increases in card, transaction service and loan-related fees were offset by declines in investment banking, wealth management and brokerage fees.

Other non-interest income also dropped to S$280 million, or 13 per cent lower, as net income from investment securities fell 71 per cent to S$31 million.

Expenses stood at S$1.5 billion, up 11 per cent, six percentage points of which were contributed by ANZ as DBS completed the acquisition in 2018.

Specific allowances of S$229 million were little changed from a year ago while total allowances declined 8.9 per cent year on year to S$205 million.

Annualised earnings per share was S$2.01, up from S$1.85 a year ago, while net book value per share rose from S$17.85 to S$18.12.

A final dividend of 60 Singapore cents has been proposed, bringing the total dividend to S$1.20 - an amount the bank has said it will pay in annual dividends beginning from 2018.

The total dividend for 2017 of S$1.43 included a special dividend of 50 Singapore cents.

DBS had a banner year in 2018, with both income and net profit hitting record high.

Mr Gupta said: "We achieved financial results befitting our 50th anniversary, a year when we were also recognised as the world's best bank and best digital bank."

Its bottom line crossed the S$5 billion-mark for the first time after jumping 28 per cent as it took in S$5.63 billion.

Still, this was a notch below Bloomberg's estimate of S$5.7 billion.

Total income increased 11 per cent to S$13.18 billion, boosted by improvements in loan and fee income as well as net interest margin.

But weaker treasury markets income partially offset the good showing.

And the pace of total income growth slowed over the course of the year, mainly due to weakness in non-interest income.

Full-year net interest income was up 15 per cent to S$8.96 billion as NIM climbed 10 bps to 1.85 per cent, thanks to higher interest rates in Singapore and Hong Kong.

Consumer loans rose 3 per cent with the segment softer in the second half as a result of cooling measures in Singapore and financial markets turning volatile.

Unattractive pricing prompted the bank to let some trade loans run off and this resulted in the segment contracting 6 per cent.

For the full year, total allowances of S$710 million were half the previous year's, when provisions were made for weak oil and gas support service exposures.

Return on equity rose from 9.7 per cent to 12.1 per cent, the highest since 2007.

Mr Gupta highlighted the bank's structural shifts to segments with higher returns, and the changes have borne favourable results.

Wealth management and cash management rose from 8 per cent and 3 per cent of total income in 2009 to 20 per cent and 13 per cent respectively in 2018.

North Asia markets also contributed three to four times more to net profit, compared to 2009.

Mr Gupta said the structural shift has helped the bank to be resilient when the markets turned turbulent.

Looking ahead, he sees choppy markets and gentle global economic slowdown. Despite these, DBS is expecting high single-digit income growth for 2019, with mid single-digit loan growth and a higher NIM.

If the Federal Reserve pauses its rate hikes, Mr Gupta forecast DBS' NIM to rise four to five bps. Should there be rate hikes, NIM is expected to up five to six bps.

However, he guided that Q1 2019 will not be as strong, year on year, as 2018 was a "gangbuster".

DBS was the first among the three local banks to release results. Its shares were up 41 Singapore cents or 1.65 per cent to S$25.20 at market close on Monday, after results were announced.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

China’s top airlines improve balance sheet in Q1; outlook positive for May Day

Stablecoin issuer Tether invests US$200 million in brain-computer interface company

Yahoo to lay off staff in Singapore as it shifts to content curation

US: Wall St opens higher on megacap strength, Fed verdict awaited

IReit Global occupancy rate grows to 91.5% in Q1

Yen surges against US dollar on suspected intervention