Singapore NODX extends decline in May; posts worst showing in more than 3 years

SINGAPORE'S non-oil domestic exports (NODX) slumped by 15.9 per cent in May, as uncertainty from global trade tensions, the fading of the electronics cycle, and a high base from a year ago continue to bite.

This is the worst performance since March 2016, when NODX fell by 16 per cent.

This followed a 10 per cent drop in April and an 11.8 per cent contraction in March, according to the latest report by Enterprise Singapore. But this was slightly less gloomy compared to economists' earlier prediction of an 18.7 per cent plunge in exports.

The dismal showing in May came on the back of declines in both electronic and non-electronic shipments.

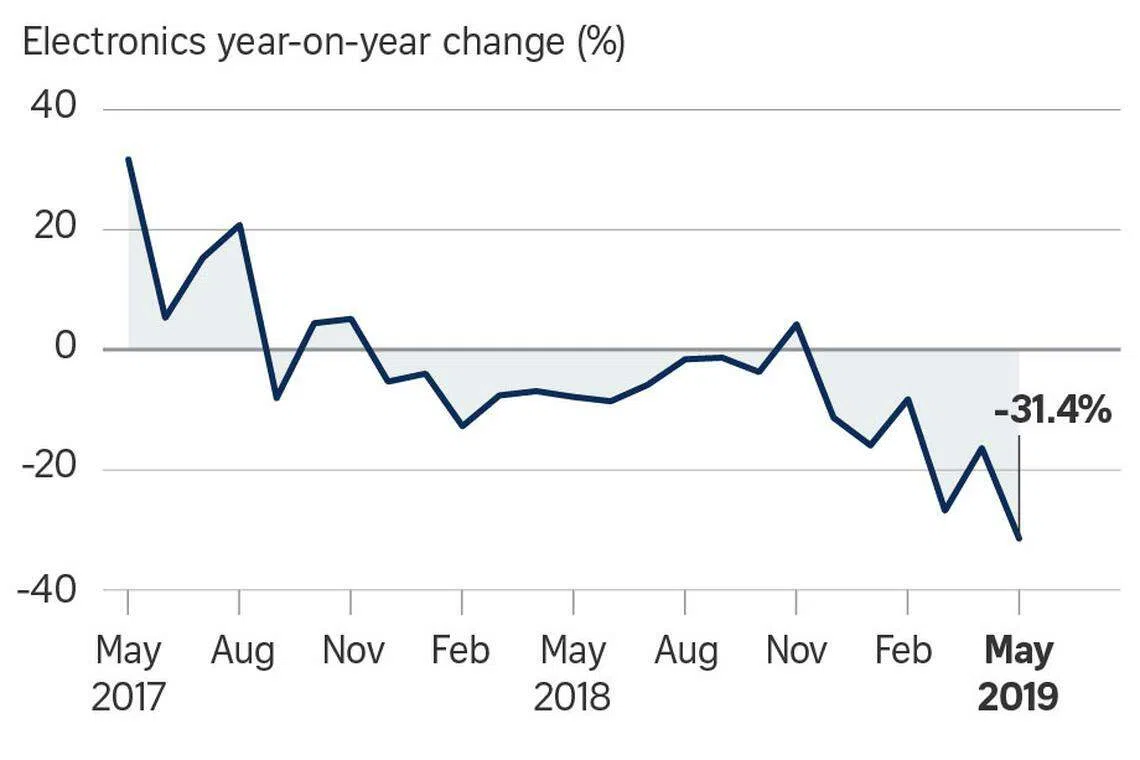

Electronic NODX fell by a sharp 31.4 per cent in May, following the 16.3 per cent decrease in the previous month. Integrated circuits (ICs), disk media products and parts of ICs contributed the most to the drop, contracting by 39.8 per cent, 42.4 per cent and 54.2 per cent respectively.

Non-electronic NODX decreased by 10.8 per cent last month, after the 8 per cent decline in April. Civil engineering equipment parts (-92.4 per cent), non-monetary gold (-72.4 per cent) and petrochemicals (-14.7 per cent) contributed the most to the fall.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Non-oil exports to the majority of Singapore's top markets decreased in May 2019, with the exception of the US. The largest contributors to the NODX decline were China, Taiwan and Hong Kong.

On a month-on-month seasonally adjusted basis, NODX rose by 6.2 per cent in May, after the previous month's 0.7 per cent decrease.

Total trade decreased by 2.1 per cent in May as both imports and exports declined, after the 3.2 per cent growth in the preceding month.

Earlier in May, the official non-oil domestic export growth forecast for this year was trimmed from between zero and 2 per cent growth to between negative 2 and zero per cent growth.

Economists noted that while the lacklustre NODX figures in May are partly due to a high base effect, they are expecting it to remain weak as the global tech downcycle continues and the US-China trade conflict escalates.

Howie Lee, economist, OCBC Bank said: "We do not see a quick turnaround in the fortunes of the electronics sector. The multiple trade barriers by the US is likely to crimp global disposable income, dampening worldwide demand for smartphones and PCs (personal computers) pushing the highly cyclical electronics industry into an even deeper downturn."

He added that the US ban on Huawei is also expected to result in rippling effects across the electronics supply chain, which may "inadvertently pressure the semiconductor and disk media industries that form a substantial portion of Singapore's electronics exports".

In the near future, however, Nomura economist Euben Paracuelles believes there might be "some improvement" in NODX figures in June. This comes as China's front-loaded exports to the US ahead of the tariff increase may temporarily boost NODX, he said.

Copyright SPH Media. All rights reserved.