Singapore's headline, core inflation both ease in October

Janice Heng

SINGAPORE'S headline and core inflation both eased in October, contrary to economist expectations that they would hold steady.

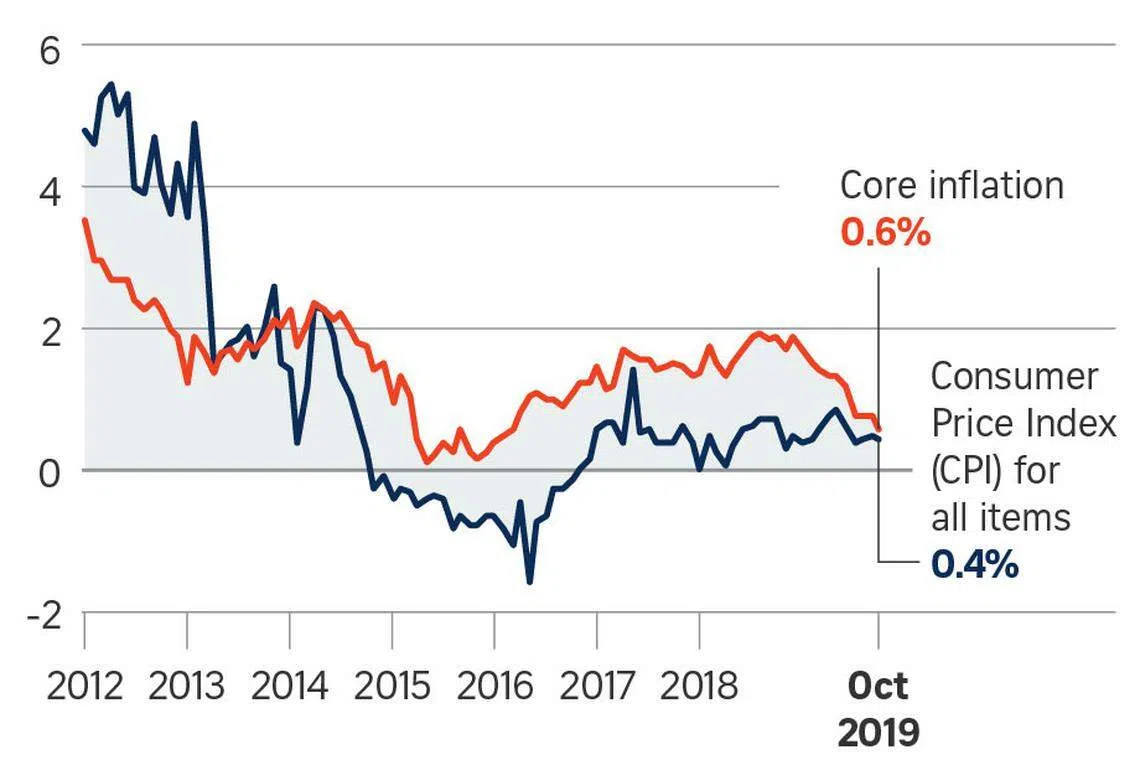

Headline inflation was 0.4 per cent in October, down from 0.5 per cent the month before, according to Department of Statistics consumer price index (CPI) figures on Monday.

Core inflation, which excludes accommodation and private road transport costs, was 0.6 per cent, down from 0.7 per cent the month before and marking the slowest rate since March 2016.

"The downside surprise relative to our forecast came from clothing and footwear prices, which fell by a larger-than-expected 1.8 per cent year-on-year, compared to the 0.9 per cent drop in September," said Barclays economist Brian Tan, whose forecast had been in line with the consensus.

But the outlook for the quarters ahead has not changed. In their joint statement on the latest inflation figures, the Monetary Authority of Singapore (MAS) and the Ministry of Trade and Industry (MTI) kept the same wording as the previous month.

For now, economists broadly expect the MAS to hold steady at its next meeting in April. "While today's data surprised negatively versus market expectations, it was broadly in line with MAS's more dovish forecasts," noted Citi economists Kit Wei Zheng and Ang Kai Wei.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

October's easing in headline inflation was due to a steeper decline in the cost of electricity and gas, as well as lower services inflation.

Electricity and gas costs fell 12.5 per cent year on year in October, steepening from September's 8.3 per cent fall, due to lower electricity tariffs and the Open Electricity Market's continued dampening effect on electricity prices.

Services inflation was 1.2 per cent, down from 1.4 per cent in September, with a slower pace of increase for holiday expenses, education services, and medical and dental treatment fees.

The cost of retail goods fell 0.8 per cent, the same pace of decline as the previous month. Food inflation edged up to 1.7 per cent, from 1.6 per cent in September.

Private road transport inflation was 1 per cent, up from 0.5 per cent the previous month. Accommodation costs declined 0.4 per cent, less steep than September's 0.5 per cent decline.

The MAS and MTI said that external sources of inflation are likely to stay benign in the quarters ahead, though oil prices could be volatile in the near term.

Domestic labour market conditions are softening slightly, which would lower wage growth in 2019 and 2020. "At the same time, non-labour costs such as retail rents should stay subdued, and any cost pass-through to consumers would be constrained by the weaker economic environment," they added.

They expect full-year core inflation to come in at the lower end of the 1 to 2 per cent official forecast range, and headline inflation to be around 0.5 per cent. In 2020, both core and headline inflation are expected to average 0.5 to 1.5 per cent.

"We expect inflationary pressures to stay muted in 2020 as growth recovers at a sluggish pace and wage growth moderates," said Maybank Kim Eng economists Chua Hak Bin and Lee Ju Ye, who expect headline inflation at 0.9 per cent and core inflation at 1.2 per cent for 2020.

They noted that the cost of education, which forms 6.2 per cent of the total CPI basket and has risen faster than other categories in previous years, will likely moderate in 2020 due to higher government bursaries announced at this year's National Day Rally.

UOB has downgraded its full-year headline inflation call to 0.5 per cent, from 0.6 per cent previously, though keeping its 1.2 per cent forecast for core inflation. "Economic growth is likely to stay subdued at 0.5 per cent for 2019, although we are cautiously optimistic there is likely some bottoming of manufacturing and export contraction momentum," said UOB economist Barnabas Gan.

Nonetheless, he notes three upside risks to inflation pressures into 2020. First, as falling electricity prices were led by the progressive roll-out of the Open Electricity Market from April 2018 to May 2019, low base effects will likely be seen into May 2020.

Second, tighter foreign labour quotas for the service sector from Jan 1 may raise operating costs for affected firms. Third, the drag on headline inflation from imputed rentals is expected to dissipate in 2020. UOB thus sees headline and core inflation rising to 1 per cent and 1.2 per cent respectively next year.

The Citi economists see core inflation averaging 1 per cent in 2019 and 1.1 per cent in 2020, taking into account Monday's figures, adjustments in electricity and gas tariffs, higher medical subsidies under the Merdeka Generation Package from November, and higher public transport fares from Dec 28.

Barclays is maintaining its 2019 forecast for core inflation at 1.1 per cent, expecting it to hold steady into 2020. "While our base case is for the MAS to leave its foreign exchange policy settings unchanged in April 2020, we view the risks as being tilted in favour of a 50 basis points slope reduction to zero per cent," said Mr Tan.

On the April MAS decision, OCBC Bank head of treasury research and strategy Selena Ling said: "At this juncture, the domestic inflation picture remains dovish while the growth outlook still remains somewhat tepid in the near-term, which will likely keep MAS in stasis for now." OCBC forecasts headline and core inflation at 0.6 per cent and 1.1 per cent respectively in 2019, rising just above 1 per cent in 2020.

Copyright SPH Media. All rights reserved.