Singapore industrial real estate: Going strong

The uptrend in occupancy and rents is expected to be sustained, underpinned by healthy demand on the back of strong manufacturing output.

AGAINST a challenging economic backdrop over the past year, industrial rents have bucked the trend and seen significant improvement in recent quarters.

The JTC All Industrial Rental Index rose for the third straight quarter. Meanwhile, ground-floor factory and warehouse rents tracked by CBRE Research also registered increases in Q2 2021.

The uptrend in occupancy and rents is expected to be sustained, underpinned by healthy demand on the back of strong manufacturing output.

In particular, demand for industrial space is likely to stem from an increase in activity in these hotspots: semiconductor manufacturing, the pharmaceutical and biomedical industry, and the rising trend of e-commerce and online grocery shopping.

SEMICONDUCTORS

The ongoing global chip shortage has been exacerbated by stronger demand for semiconductors from cloud services and the 5G market, along with supply-chain disruptions.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The shortage could benefit industrial players in the electronics sectors, as Singapore accounts for 5 per cent of global wafer fabrication capacity and 19 per cent of the global semiconductor equipment market share.

Semiconductor manufacturers have been committing to higher capital expenditure to add more capacity for higher production volumes, which could lead to an increase in space requirements for both factories and warehouses. US semiconductor maker GlobalFoundries announced in June that it would invest S$5 billion in Singapore to expand its wafer plant.

In addition, we are seeing an uptick in renewals and expansion activity among smaller semiconductor companies. Many are located in well-known electronics clusters in the north and north-east region, such as Yishun, Ang Mo Kio and Woodlands.

Other firms in the downstream segments of the value chain are also eyeing high-tech space in these areas, as the proximity to the point of production and suppliers could help reduce overall costs.

PHARMACEUTICALS, BIOMEDICAL

Over the past few quarters, trade has been strong in Covid-19 beneficiary sectors, particularly the pharmaceutical and biomedical segments.

According to the Singapore Economic Development Board, eight of the top 10 pharmaceutical companies have facilities in the city-state, manufacturing four of the top 10 drugs by global revenue. For their real estate needs, the build-to-suit model has enabled businesses to construct facilities suited to their needs with lower upfront capital. For example, French pharmaceutical giant Sanofi is set to build its vaccine production site at the Tuas Biomedical Park, which provides manufacturing and laboratory space.

Meanwhile, multi-user developments, such as JTC Space @ Tuas Biomedical Park, can cater to multinational corporations as well as small and medium-sized enterprises with smaller space requirements. This will, in turn, create a clustering effect and enhance the biomedical manufacturing ecosystem of research and development centres and technology partners, building factories of the future.

E-COMMERCE, ONLINE GROCERY

Changing consumer patterns stemming from the pandemic have accelerated e-commerce adoption.

According to Euromonitor International, Singapore's online sales volume in 2021 is set to increase by as much as 80 per cent from pre-Covid-19 levels, and is expected to increase by a 13 per cent compound annual growth rate (CAGR) from 2021 to 2025. This will inevitably lead to higher demand for warehouse space.

Take-up of new or upcoming warehouse facilities have been strong in recent quarters, with commitment rates averaging 50 to 70 per cent.

The majority of warehouses are located in the western part of Singapore, which includes Tuas and Pioneer. This region is set to gain further prominence, as about 91 per cent of future warehouse supply will be located there.

CBRE Research shows that the volume of cold-storage space leased in selected major Asian markets in the first half of 2021 were triple that of H1 2019.

Leasing activity was led by grocery retailers backed by e-commerce platforms, traditional grocers going omnichannel, and specialist cold-storage service providers. With today's consumers demanding groceries of higher quality and wider variety, along with the rapid expansion of the pharmaceutical industry, requirements for cold-chain logistics are expected to grow.

Given the current undersupply of specialised cold storage against the potential growth, we are seeing more developers considering building up specifications to tap on this demand.

To ensure greater flexibility, developers could allow for enough power provision for occupiers that require temperature-controlled spaces to retrofit according to their needs.

OPTIMISTIC OUTLOOK

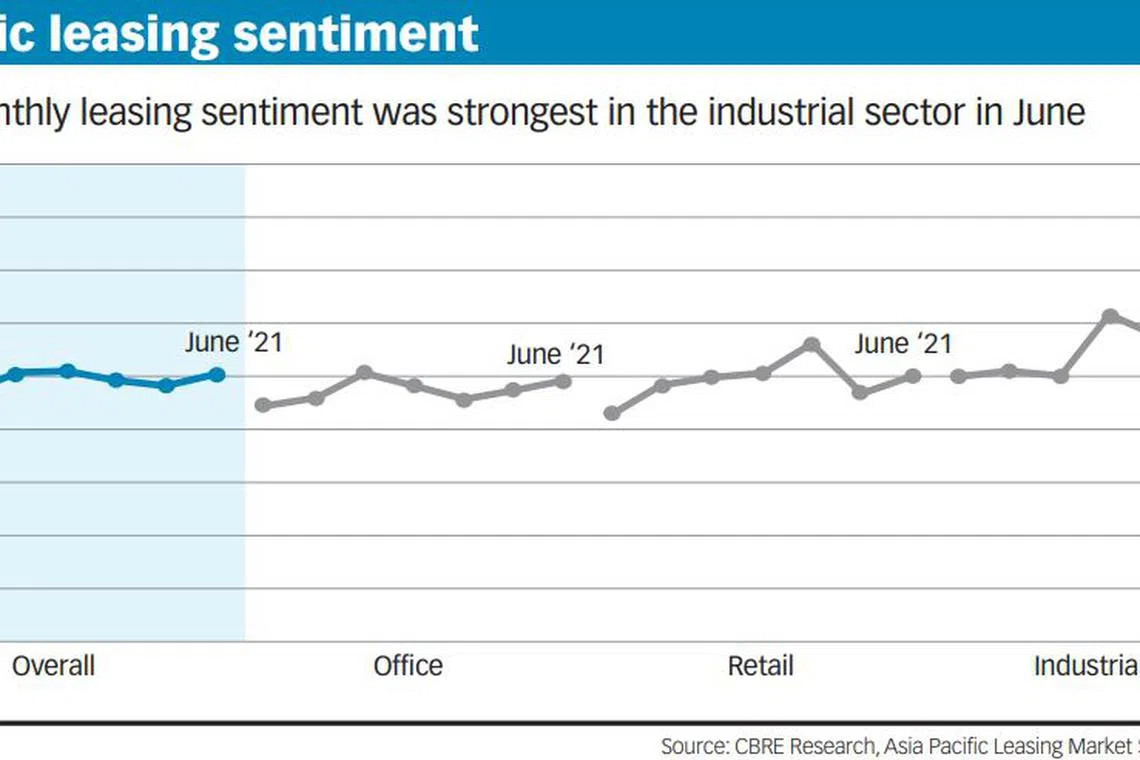

In the near to mid term, CBRE Research expects sentiment among Asia-Pacific occupiers to improve on the back of economic recovery. According to CBRE Research's survey findings released in July, leasing sentiment among Asia-Pacific industrial occupiers were the most optimistic, ahead of the office and retail sectors.

That said, occupiers are concerned about cost escalation from fuel, transport and labour, amid economic disruptions from Covid-19. According to an analysis by CBRE Supply Chain Advisory, transport cost makes up 45 to 70 per cent of total logistics costs for occupiers.

Hence, choosing the right location for logistics facilities is crucial, as it determines the proximity to the entire value chain - customers, labour, suppliers and logistics partners.

Developments that are of modern build (ramp-up warehouse developments) and of high specifications in ceiling height and floor loading will help facilitate operations.

However, vacancies among such buildings remain extremely low. According to CBRE Research, prime logistics buildings in Singapore registered 99.6 per cent occupancy as at the second quarter of 2021. Furthermore, the warehouse supply pipeline remains subdued, with an average future supply of 2.24 million square feet (sq ft) per annum, below the 10-year historical average of 3.86 million sq ft per annum.

Thus, choices for occupiers looking for prime logistics space will remain extremely limited.

Occupiers should plan and commit to space requirements early, while owners should consider upgrading older assets to higher specifications in line with Industry 4.0 standards. With supply-chain disruption set to continue, companies will need to enhance their supply-chain resilience, leading to long-term demand for warehouses. Against a backdrop of tight prime logistics vacancy, strong rental reversions are expected to continue within the prime logistics or high-spec assets segment.

CBRE Research forecasts rents of prime logistics to grow 5 to 6 per cent in 2021. This should drive more investments as investors seek growth and diversification.

Demand for industrial assets has been rising since the second half of 2020, boosted by the manufacturing and logistics sectors' resilience during the pandemic and their projected growth.

According to CBRE Research, between July 2020 to June 2021, investment sales volumes in Singapore's industrial sector overtook the office sector to be the second highest at S$3.9 billion, after the residential sector. Significant deals included Blackstone's S$176 million acquisition of The Sandcrawler, AEW Fund's purchase of high-spec Business-1 facility Admirax for S$142 million, and ESR-Reit's S$112 million acquisition of warehouse facility Global Trade Logistics Centre. These investment deals demonstrated strong institutional interest in the sector.

We are confident industrial real estate will sustain a strong growth momentum, as one of the most active real estate sectors to watch.

- Rimon Ambarchi is CBRE's head of industrial and logistics for South-east Asia, while Goh Jia Ling is senior manager of research for South-east Asia.

READ MORE:

- Singapore property investment sales could return to pre-Covid levels

- Cold storage facilities a long-term play in alternative property investment: M&G

- Blackstone confirms Sandcrawler purchase in Singapore

- Globalfoundries breaks ground on new S$5b fab in Singapore

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.