Is technology a disruption or an opportunity for retailers?

SINGAPORE'S retail real estate sector showed continued signs of distress, with softening demand for retail spaces and sliding rental performance. In Q4 2016, Urban Redevelopment Authority's Retail Rental Index for the Central Region fell by 8.3 per cent year-on-year (y-o-y). From its recent peak in Q4 2014, the index has eased 12.1 per cent.

Knight Frank's gross effective average monthly rental value for its prime retail basket also declined 2 per cent y-o-y to S$30.90 per square foot (psf) in Q4 2016. From its recent peak in Q4 2014, the figure is down by 4 per cent. The rents across different areas in Singapore saw varying extents of decline, with Marina Centre, City Hall and Bugis areas facing the greatest downward pressure, followed by City Fringe and Suburban areas.

Notwithstanding the healthy island-wide average annual occupancy rate which ranged between 92 per cent and 94 per cent over the last three years (2014-2016), the estimated 1.4 million sq ft of upcoming net new retail space to be completed in 2017 is likely to put downward pressure on the sector, should demand for space remain subdued. Therefore, understanding of retailer sentiment and their key business considerations are vital, entering 2017.

Retailers brace themselves for another challenging year Knight Frank carried out its annual RetailerSentiment Survey, which has been running since 2015, on 50 Singapore- based retailers in the first two months entering 2017. The survey revealed that about 50 per cent of retailer respondents anticipate positive growth in business profitability in 2017, while 38 per cent expect a cutback. The remaining 12 per cent of retailers predict similar levels of profitability as in 2016.

Among the various trades, retailers from the food and beverage (F&B)service-line (that is, restaurants, cafes, kiosks, bar, pubs, etc) are the most optimistic, with 36 per cent of them envisaging at least a 10 per cent growth margin in business profitability in 2017. With consumers increasingly cost-conscious amid the tough market, low to mid-price range F&B retailers in particular are keen to expand their footprint in the local market. The other key trades of electronics & technology, fashion & accessories, hair, beauty & cosmetics, health, fitness & wellness, and household & furnishing saw a mixed-bag of growth expectations.

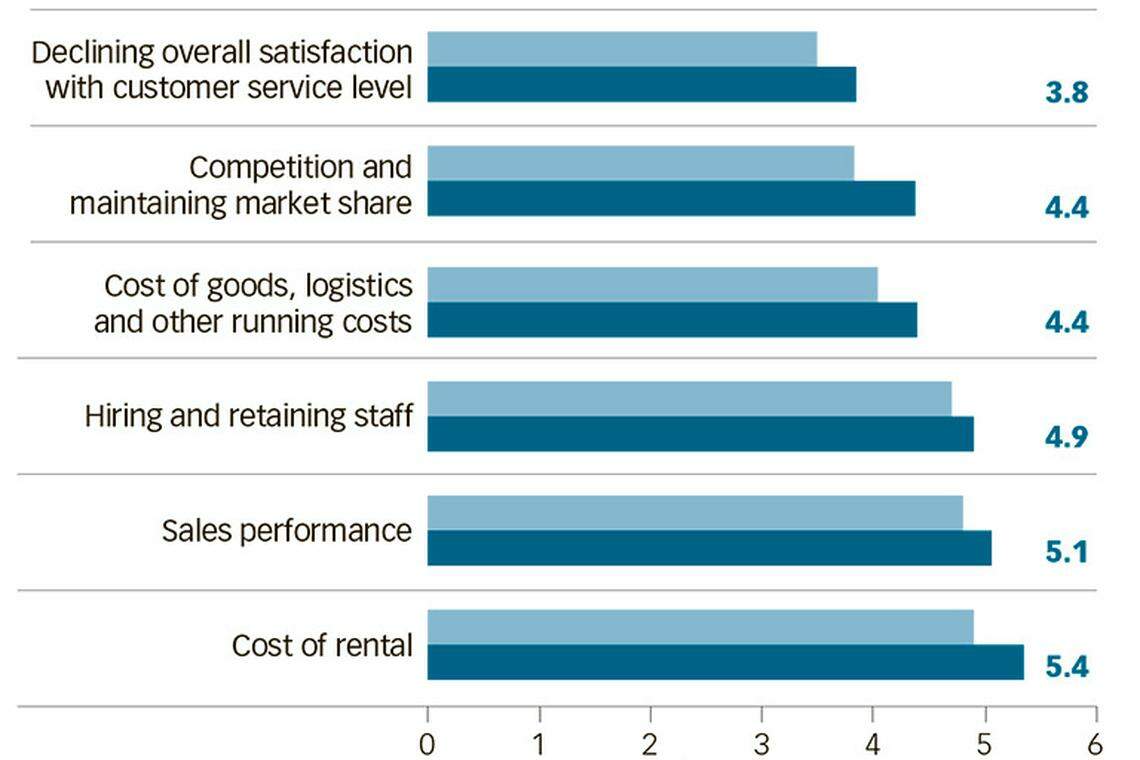

The survey further showed that retailers are bracing themselves for another challenging year in 2017, with business challenges expected to grow in severity compared to 2016. In particular, the cost of rental, sales performance, and hiring and retention of staff were retailers' top three cited business challenges in 2017 (Chart 1).

To navigate the tough business climate, retailers have actively sought to improve their operational capabilities,while seeking innovative solutions to create a conducive and exciting environment for consumers. When surveyed on their top three key business strategies for 2017, 38 per cent of retailers ranked improvement to labour productivity foremost, followed closely by a desire to increase their product and service offerings (36 per cent), and plans to enhance their online presence via websites and social media platforms (36 per cent). With looming uncertainty in manpower supply, improving labour productivity looks set to be a dominant obstacle for retailers in their plans for expansion and growth.

Technology - bridge over troubled waters for retailers

Following the rapid advances of the technology frontier, a new section was introduced to Knight Frank's Retailer Sentiment Survey this year to better understand retailer perceptions in battling and overcoming the waves of technological disruptions that have facilitated online retail and omni-channelling. The physical retail store is no longer the core touch point for consumers in their purchasing journey today, nor the holding monopoly of the retail dollar.

The majority of retailers surveyed demonstrated a very progressive mindset, viewing technology as a partner in crime rather than enemy in waiting. Seventy-four per cent of retailers revealed that the incorporation of technology has improved overall work processes and productivity, and was found to be instrumental to operational efficacy in the face of the prevailing labour crunch. With retailers seeking to reduce their reliance on labour-intensive functions via in-store automation solutions that manage work flows, inventories and business accounts, technological quick-fixes have become the go-to, to tackle labour shortages.

JobsOnDemand, for example, is a location-based job-matching mobile platform created by Aptus Technologies in an exclusive tie-up with Capita- Land Malls. The app enables retailers to leverage its ad-hoc, flexible stream of manpower, notably most useful during peak periods and festive seasons. Additionally, self-order electronic menus and self-checkout devices have assisted in automating traditionally human-dependent functions, such as ordering and payment processes.

While tech-savvy solutions have helped streamline work processes and ease labour stresses, there is room yet for the entry of small and medium enterprises (SMEs) to fill the gap in broadening the awareness and adoption of such technology, to deepen understanding of its benefits in enhancing business productivity. This presents the opportunity for the creation of a one-stop consultancy service to keep retailers abreast of market trends via the provision and transfer of industry knowledge, technological know-how and quick access to related expertise.

Notwithstanding the thrust by retailers to increase online engagement, the in-store experience remains a critical part of the shopper's journey. When surveyed on the top three qualities of the shopping experience that customers value, value-for-money (80 per cent) and quality products (68 per cent) were high on the list alongside good customer service (48 per cent) (Chart 2). If the "human touch" remains an important tenet, it would be imperative that retailers explore innovative and sustainable ways to attract and retain staff, whether via performance incentive schemes, career development and progression plans, or skills upgrading and training programmes. Retailers may also leverage government-led support under the Retail Sectoral Manpower Plan (SMP), an initiative by the SkillsFuture movement to provide training for the development of a quality, productive and deeply skilled retail workforce.

Technology as a staple engagement tool

As the retail landscape gets progressively digitised, physical retailers without an online presence will find themselves stuck in the doldrums with e-tailers hot on their heels. Singapore has a high level of smartphone penetration and with consumers' high reliance on technology and mobile conveniences, the way is certainly paved for the growth of the e-commerce sector.

In a joint study by Temasek Holdings and Google, Singapore came up tops among South-east Asian countries for reporting the highest proportion of e-commerce sales contribution (2.1 per cent) to total retail sales in 2015. The proportion is envisaged to reach 6.7 per cent by 2025, second only to Indonesia (8.0 per cent).

To match consumers' changing and dynamic shopping habits, technology is increasingly regarded as an indispensable engagement tool for brick-and-mortar retailers. As consumers increasingly rely on the Internet in search of the best prices and quality products and services, it is essential that retailers carefully hone their digital presence.

Knight Frank's survey revealed that nearly 62 per cent of retailers employed technology to extend their reach to a wider customer base, via multi-channels such as smartphone apps, emails, websites and social media platforms (eg Facebook, Instagram, Twitter etc). Major retailers Zara, Courts, Giants and Sheng Siong have also established an online presence in Singapore as a critical point of interaction with consumers, providing on demand assistance for enquiries in the areas of product and service information, purchases, delivery modes and to deploy better after-sales service.

Despite prevailing sentiments by 67 per cent of retailers surveyed on the importance of continually adapting to the evolving technological and digital landscape to stay relevant, the challenges in doing so remain for some. SMEs, in particular, trail behind due to the lack of relevant expertise and capital. To support such retailers, the government launched the Second Retail Productivity Plan in September 2015, aimed at assisting them in areas such as omni-channel retailing, branding, technology innovation, productivity improvement, and human resource capability.

Singapore retailers have much to understand and learn about the potential application of technology. In the international arena, the employment of technology on the frontline has transformed into a mode to accelerate sales performance and increase consumer touch-points and engagement. In a novel move, Tommy Hilfiger held a fashion show featuring its Spring collection next to a California beach, and invited 2,000 regular shoppers as audience members. With the use of an app featuring 3-D images of the runway, shoppers were then given the prime opportunity to buy outfits instantly, resulting in more than 15 styles being sold out online, within 24 hours.

However, retailers must remain conscious that technology should not be employed indiscriminately, but strategically and brand-coherently. Luxury brands, for example, may resist including a purchase function on their website to preserve and attract consumers to the luxe, in-store shopping experience, but still retain the essential presence of an e-commerce strategy to feed consumer affinity for the digital. It has been purported that more than 60 per cent of luxury goods purchases, online or in-store, depend on what customers see on the Web.

Impact on the physical mall

As the retail sector restructures, it is inevitable that retailers review their store location strategy and decision- making model, particularly for consumer goods retailers and F&B operators. Consumers expect shorter turnaround delivery times with each click of a button, prompting stores distributed around the island to increasingly function as distribution centres. Although the trend enhances overall productivity and sales generated on the floor space, it could also mean that some stores gradually become less reliant on in-store turnover, and choose to take up smaller footprints.

To combat the potential offset, retail shops will have to differentiate their in-store experience from their online ones, which is set to benefit the shopper experience with a greater focus on customer service. To better engage the consumer in person, product knowledge and service-orientation will be imperative to prevail offline.

Finally, capturing and consolidating consumer data both in-store and online can help paint a more coherent understanding of shoppers' journeys. The insights will be integral in deciphering true consumer needs and wants, resulting in more productive allocation of the marketing dollar and boosting the consumer experience. However, capturing such data will require much innovation and conceptualisation. In 2014, Neiman Marcus rolled out free phone charging lockers and got customers to use their phone numbers as the unlock passcode. The clever idea then enabled the store to send targeted text messages to shoppers within 30 minutes of removing their phones from the stations, proving a worthy strategy for tactical outreach. With greater innovation from retailers collecting Big Data via multiple touchpoints, the combination of such dynamic records are primed to produce superior insights.

Against the headwinds of a lacklustre economy, manpower shortages, technology disruption, and the growing e-commerce sector, retailers and landlords will have to brace themselves for a bumpy ride in 2017. While retailers strive to constantly create and keep up with ever-evolving trends and consumer expectations, the role of landlords is increasingly vital to support the former in the tough market, and be proactive and progressive in providing an immersive environment and refreshed ambience for shoppers. With sound, collaborative effort, retailers and landlords alike will tide through the challenges, and create an exciting and vibrant retail landscape in Singapore.

Wendy Low is head of retail and Graceclia Ching, analyst, consultancy & research at Knight Frank Singapore

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

New Articles

HDB resale prices accelerate, rising 1.8% in Q1 on stronger demand

Digital Core Reit Q1 distributable income slips 2.4% to US$10.6 million

BT subscribers can now share 5 premium articles a month with unlimited number of non-subscribers

First Reit reports 3.2% lower Q1 DPU of S$0.006 amid interest rate, forex headwinds

Vietnam holds first gold auction in 11 years to stabilise market

How Hudson Yards went from ghost town to office success story