Bungalow market down but not out

Sales of Good Class Bungalow Area houses fall to a historic low in 2023, but buyers are waiting on the side for sellers to drop price

It IS often said that most Singaporeans aspire to own a landed home because the property is tied to much prestige and status, as well as long-term legacy planning.

The scarcity of such large homes on sizeable plots of land confers much value to this housing type in land-starved Singapore. Only 5 per cent of Singapore residents live in landed properties, compared to the 17 per cent who live in apartments or condominiums and 78 per cent residing in public housing.

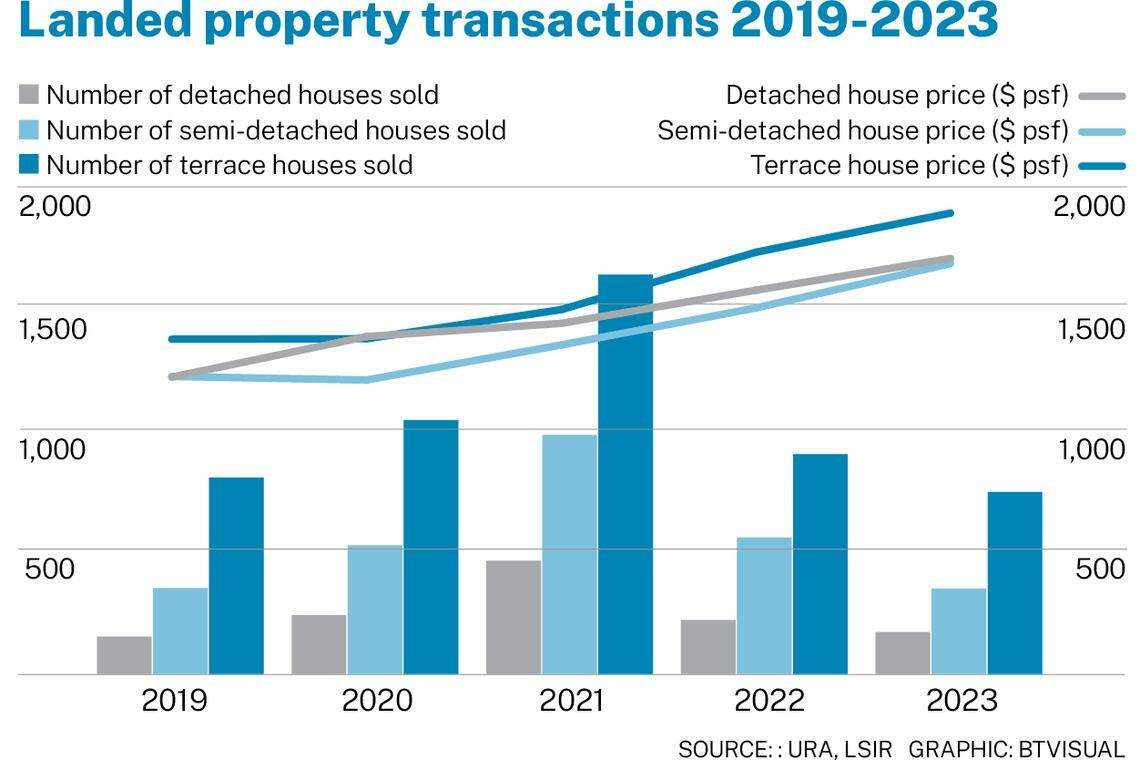

Transaction data provided by the Urban Redevelopment Authority (URA) over the past five years (2019 to 2023) showed that between 1,300 and 1,800 landed homes changed hands every year.

However, 2021 was an exception – sales volume was an outstanding 3,080 units. The Covid-19 pandemic led people to realise the need for bigger living space, to contain bigger households that were working and learning from home.

2023 turned out to be the year with the lowest sales volume.

2023 was the year in which the Singapore residential market was hit by several headwinds, ranging from macroeconomic and geopolitical conditions around the world to property cooling measures, and a high-profile money laundering bust on home ground. The year saw only 1,268 landed homes transacted, down from 1,681 in 2022.

A NEWSLETTER FOR YOU

Property Insights

Get an exclusive analysis of real estate and property news in Singapore and beyond.

Despite the lower sales, landed home prices – on a per-square-foot (psf) basis – continued to trend upwards. Year on year, detached house prices rose 8.4 per cent to S$1,699 psf, semi-detached prices gained 12.4 per cent to S$1,678 psf, and terrace house prices rose 9.4 per cent to S$1,888 psf.

GCB deals slowed as price surged

At the apex of the landed homes market are detached houses in Good Class Bungalow (GCB) Areas. GCBs are detached houses with large land plots and are guarded by strict planning restrictions to preserve their exclusivity and low-rise character. There are 39 GCB Areas gazetted by the URA, examples of which include Nassim Road, Whitehouse Park and Chatsworth Park. There are around 2,700 detached houses in these GCB Areas and this is expected to stay the same in the long term.

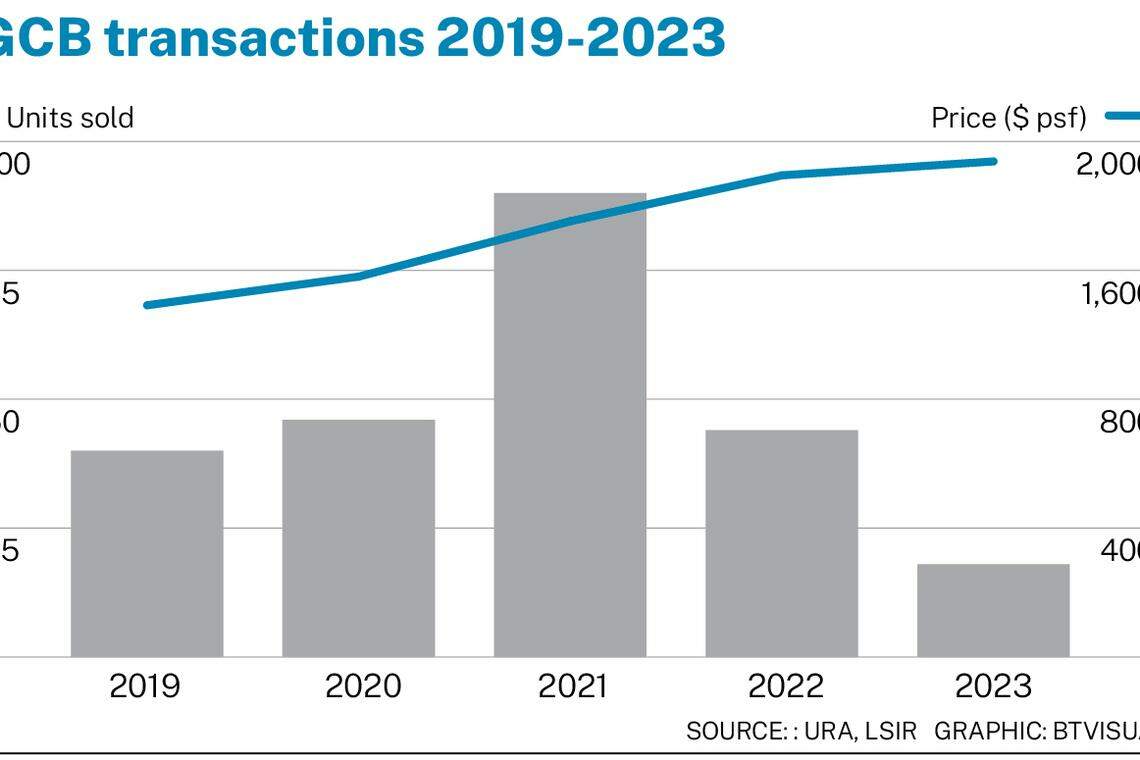

The 18 GCB deals in 2023 marked the lowest sales volume in a year since 1996 when the statistics were first made available by the URA.

The luxury market was hit by eroding sentiment which stemmed from ongoing uncertainties in global economies, rising interest rates, property cooling measures in April and the anti-money laundering raids in August.

Buyers also held back because they felt that asking prices were too high. They were not prepared to pay a premium unless the property ticked all the boxes with respect to site attributes, design and finishes of the house, and/or rarity, for example, large plots of above 30,000 square feet (sq ft).

In the four years from 2020 to 2023, the average price of GCBs climbed 30 per cent from S$1,477 psf to S$1,924 psf.

Crazy rich deals and rents

The 18 GCB deals that showed up in caveats data last year did not include four significant GCB deals at Nassim Road, reported by the media, that were completed in the March-April period of 2023. No caveats were lodged for these deals.

A portfolio of three GCBs was sold by Cuscaden Peak Investments to members of the Fangiono family behind Singapore-listed palm oil producer First Resources, for a total sum of S$206.7 million (S$4,500 psf). Before this, a member of the Fangiono family also bought a GCB further up the road for S$88 million (S$3,917 psf). If these deals had been included, they would have pushed the average price (psf) even higher.

One interesting phenomenon in the GCB market in recent years has been the evolution of exuberant rents. Some bungalows were leased at above S$100,000 per month, with some tenants reportedly paying three years or more rental in advance. Statistics showed that there were three bungalows leased out at above S$100,000 a month in 2021 and 2022, while 2023 registered four such cases.

However, the “party” more or less ended following the high-profile money-laundering bust in August 2023, with several of these “wealthy tenants” either being arrested by the police or leaving the country.

As a result, several bungalows fell vacant and are now available for rent. Even at more realistic rents, owners of such properties are now taking a longer time to find replacement tenants due to the stigma associated with former occupiers. By the fourth quarter of 2023, asking rents for GCBs had declined by 30 per cent or more.

Where is the bungalow market headed?

The outlook for the bungalow market in 2024 is still somewhat clouded. For one, due to the increases in Additional Buyer’s Stamp Duty (in December 2021 and April 2023), we have observed that most of the GCB buyers in 2022 and 2023 were Singapore citizens and newly naturalised citizens who were buying their first property for owner-occupation. Most of them were professionals and businessmen in their late 30s or early 40s.

With the current uncertainties and the repercussions of the war in Ukraine and the Israel-Hamas conflict, it remains to be seen how many more new multimillionaires will support this segment.

Secondly, owners of high-end properties will be paying higher property taxes. For owner-occupied properties, property tax rates have been raised from 4 to 23 per cent in 2023, to 4 to 32 per cent in 2024.

For properties that are rented out, rates have been increased from 11 to 27 per cent in 2023 to 12 to 36 per cent in 2024.

The higher tax burden might lead some owners to sell their bungalow on one hand. On the other, any potential buyer whose original intention was to acquire a GCB to enjoy high rental income might decide that it is no longer attractive to do so.

With all these factors at play, we can expect the first half of 2024 to see slow sales, with room for some moderation in prices.

That said, we are aware that there are ready buyers who are waiting on the side for sellers to drop prices. When that happens, sales momentum would improve, bringing more stability to prices.

Han Huan Mei is research director at List Sotheby’s International Realty

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Property

Luxury private home rents jump in Q1 amid wider market slump: Huttons Asia

Evictions surge in Arizona with housing shortage and rising prices

China property shares firm after Politburo highlights clearing inventory

Dubai billionaire’s children plan to revive troubled world islands

UK commercial real estate lending plunges to lowest in a decade

Hybrid, flexible working set to curb Singapore office usage and rents