Orchard Road, Zion Road sites among 8 state land plots to be offered in H2 for private housing

EIGHT new sites will be on offer under the Government Land Sales (GLS) programme for private residential housing in the second half of 2023, including two parcels in the prime central areas of Orchard and River Valley.

The Orchard Boulevard plot is the first GLS site released in the Orchard area since May 2018, noted Knight Frank head of research Leonard Tay. The last one was at Cuscaden Road, where 99-year leasehold condo Cuscaden Reserve is now being developed by SC Global Developments and two Hong Kong-listed players, New World Development and Far East Consortium.

Prices at the 192-unit Cuscaden Reserve recently crossed S$3,800 per square foot (psf). The project was launched in 2019 at prices in the range of S$3,300 to S$3,500 psf.

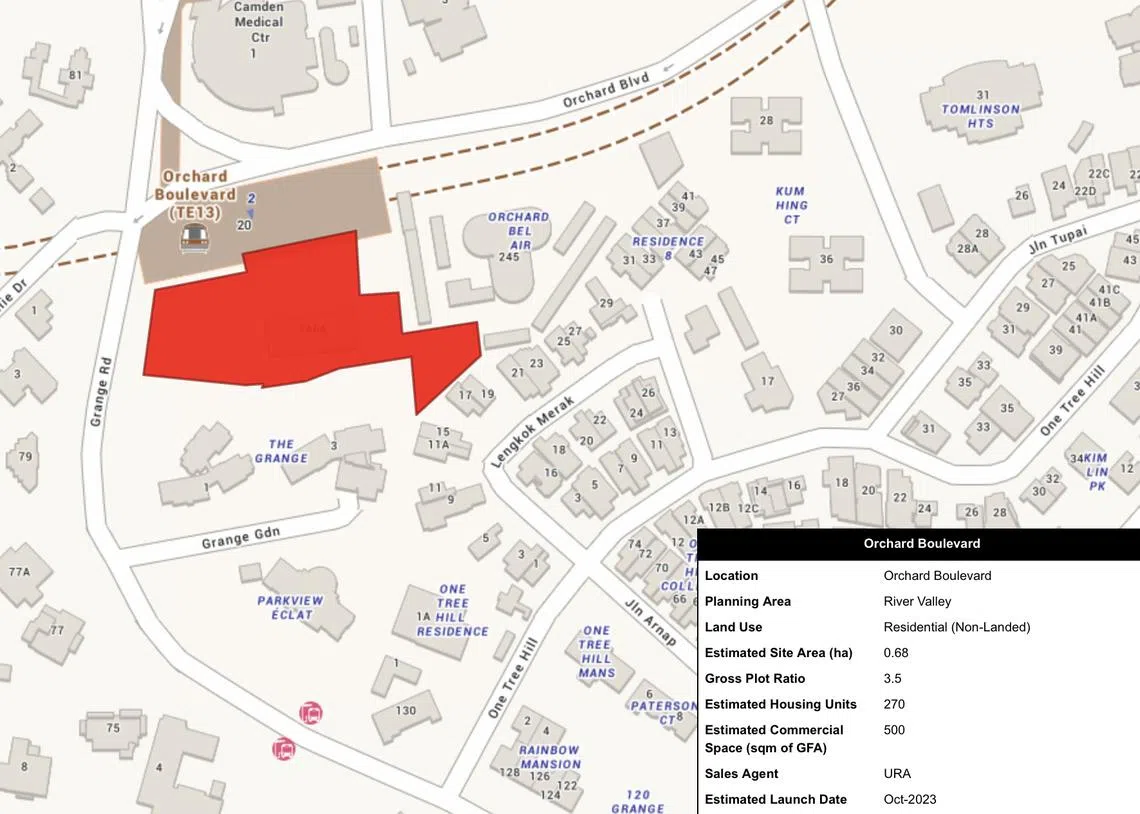

The Orchard site on the H2 2023 confirmed list is a modest 0.68 hectare (ha) piece of land just beside the Orchard Boulevard MRT station on the recently-opened Thomson-East Coast Line (TEL).

The site can yield some 270 homes and 500 sq m gross floor area (GFA) of commercial space. It is expected to launch in October 2023.

JLL head of residential research, research and consultancy Chia Siew Chuin expects bids to be “palatable, ranging from SS$530 million to S$570 million or S$2,069 psf to S$2,225 psf per plot ratio (ppr)“.

Since the latest property cooling measures have crimped foreign demand, the unit mix, size and the selling price of the units on the site may have to “cater more towards the local market”, said Lee Sze Teck, Huttons’ senior research director.

Back in 2018, the Cuscaden Reserve site attracted nine bidders, with a winning bid of S$410 million or S$2,377 psf ppr.

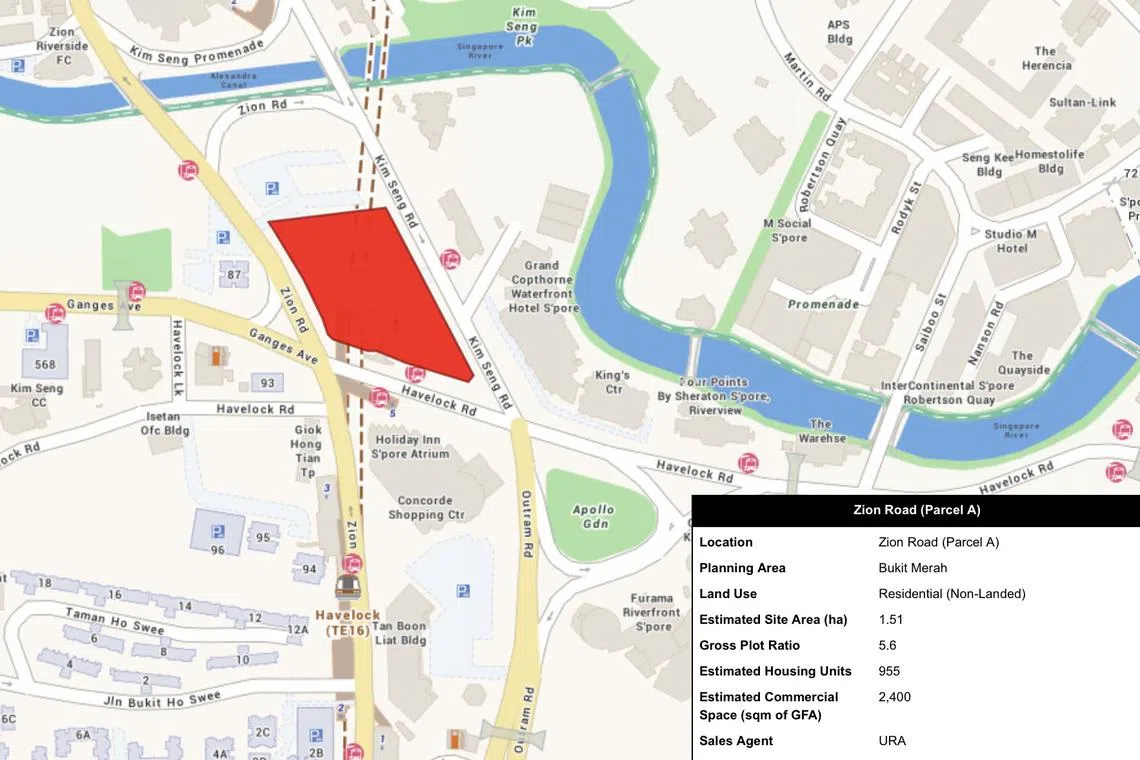

Analysts also anticipate strong interest in the 1.51 ha site along Zion Road, near the Great World City shopping mall in the River Valley area. The site can take 955 units and 2,400 sq m of commercial space, as well as a minimum 600 sq m GFA for childcare centre services and serviced apartments.

JLL’s Chia Siew Chuin predicts that capital outlay for the Zion Road (Parcel A) plot will be “substantial”, with an estimated land cost of around S$1.52 billion or S$1,670 psf ppr. Joint ventures are expected.

Just across from it, in Jiak Kim Street, is the luxury project Riviere, which was built on state land sold under the GLS programme in 2018, noted Christine Sun, senior vice-president of research and analytics at OrangeTee & Tie. The site had garnered 10 bids when it launched in December 2017, with a winning bid of S$955.4 million or S$1,733 psf ppr. Frasers Property started selling Riviere in May 2019, with prices starting at S$2,580 psf. The 455-unit project is now fully sold.

Another GLS site in the area is at Irwell Bank Road, where luxury condo Irwell Hill Residences now stands, said Sun. The land parcel saw seven bidders when it launched in January 2020, with a winning bid of nearly S$583.9 million or S$1,515.10 psf ppr from City Developments Ltd (CDL). Irwell Hill Residences launched in 2021 at an average of S$2,700 psf. As of May 2023, the project was over 90 per cent sold.

Not only is the Zion Road (Parcel A) plot a “choice location”, it is also a stone’s throw from Great World City MRT station on the TEL, as well as Tiong Bahru Food Centre and a “quaint and hip” neighbourhood of cafes, said Lam Chern Woon, Edmund Tie’s head of research and consulting.

The plot’s commercial space will also support the “growing population in the area, with new public housing coming up at the Havelock Hillside Built-To-Order project nearby”, said PropNex head of research and content Wong Siew Ying.

The eight sites in the H2 2023 programme comprise four releases on the confirmed list and four on the reserve list. Confirmed list sites are launched for sale according to schedule, regardless of demand; reserve list sites are put up for sale only if a developer’s indicated minimum price is acceptable to the government.

The confirmed list includes two fairly large residential plots in the Upper Thomson area.

The Upper Thomson Road (Parcel A) site, which spans 2.44 ha, can yield about 595 homes and 2,000 sq m GFA of commercial space. It has a 2,000 sq m cap on retail space and a minimum GFA of 1,000 sq m for childcare centre services. Serviced apartments are allowed.

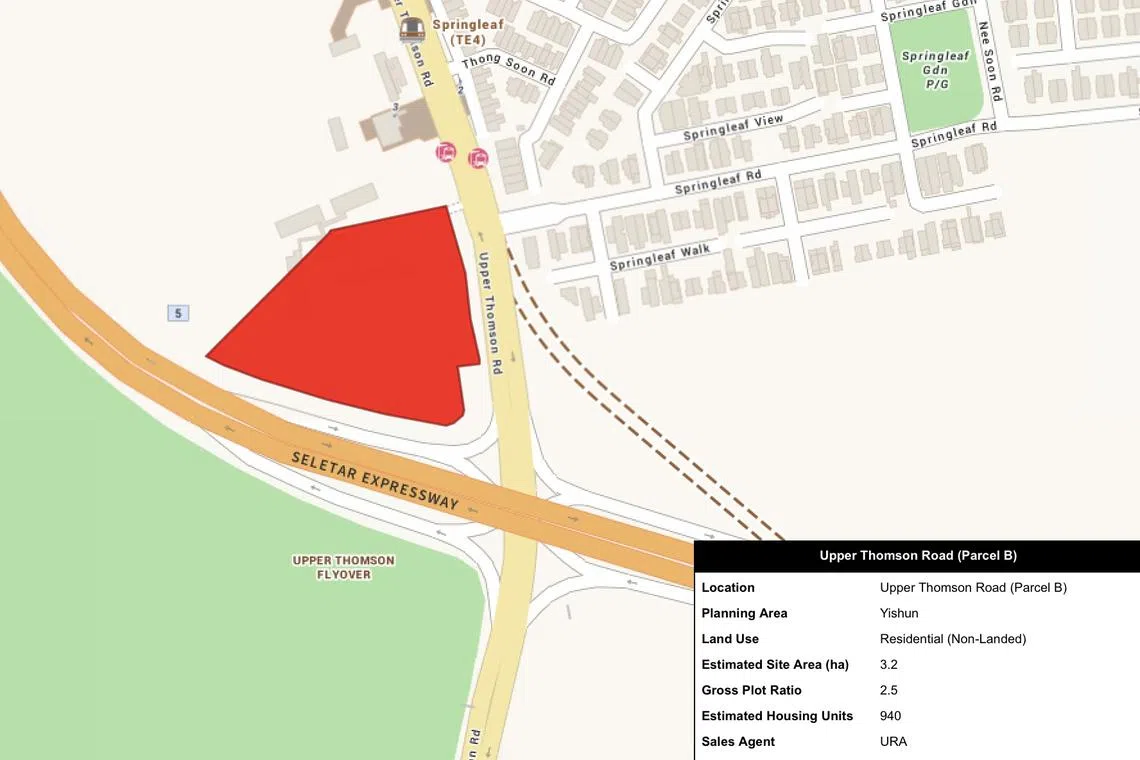

Upper Thomson Road (Parcel B) spans 3.2 ha and will yield 940 units.

Both plots, expected to launch in December 2023, have direct access to the Springleaf MRT station. The sites are also just one train stop from the Lentor area, where more than 3,500 units will be built in the next five years, said Tricia Song, CBRE head of research for South-east Asia.

JLL’s Chia expects the two Upper Thomson Road plots to be “closely evaluated” by developers.

“Parcel A could fetch a land price of between S$595 million (S$1,030 psf ppr) and S$656 million (S$1,135 psf ppr). The land price for Parcel B is estimated to land between S$740 million (S$859 psf ppr) and S$858 million (S$996 psf ppr),” she said.

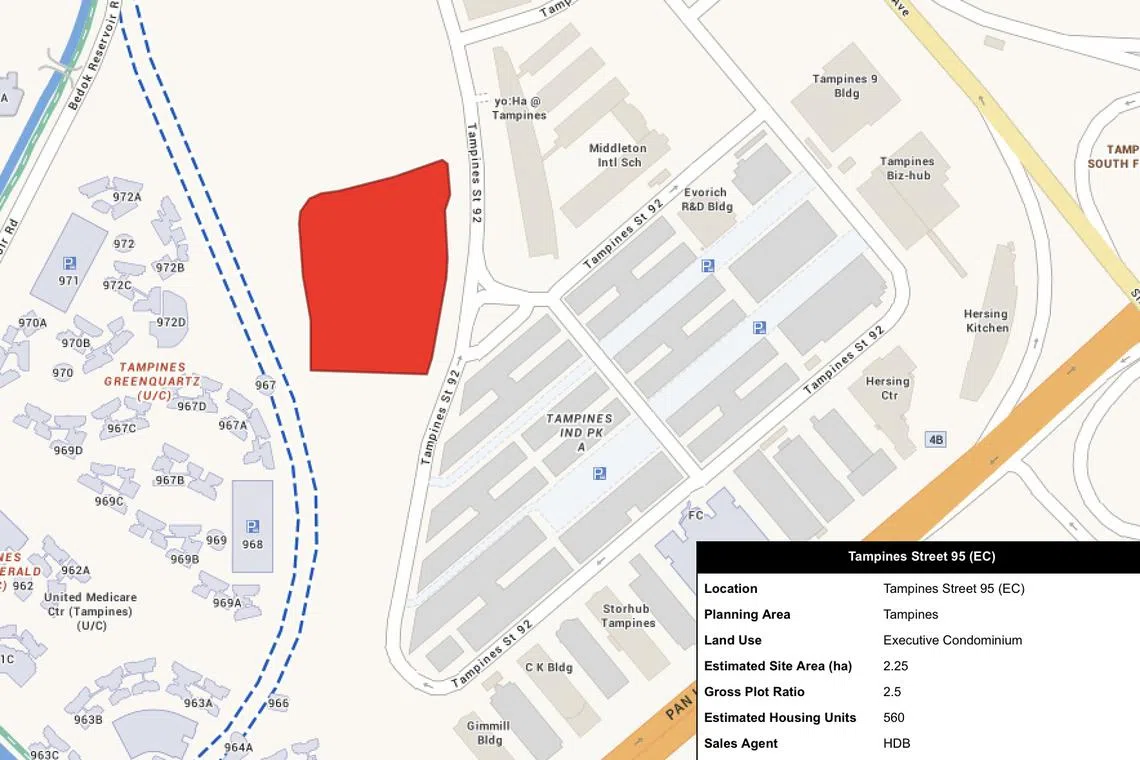

The four new sites on the H2 2023 reserve list are an executive condo (EC) parcel in Tampines Street 95 for 560 homes, and three private-housing plots:

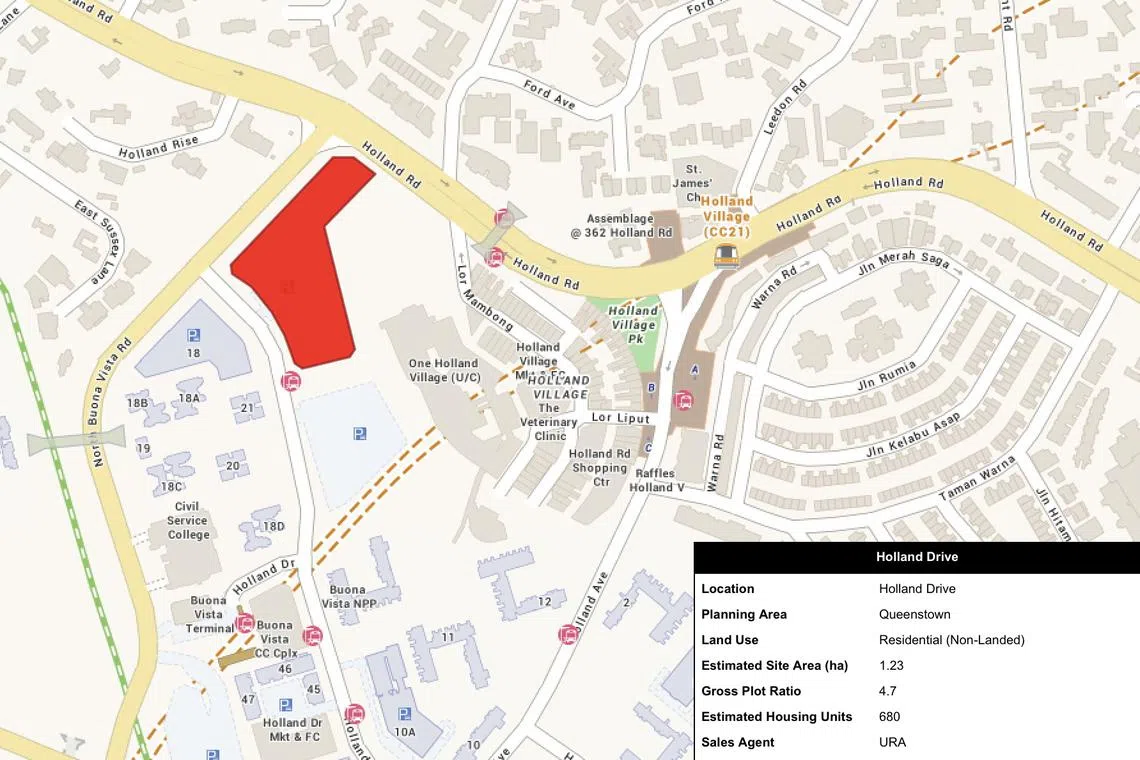

- A 680-unit plot along Holland Drive, near Holland Village MRT station, spanning 1.23 ha;

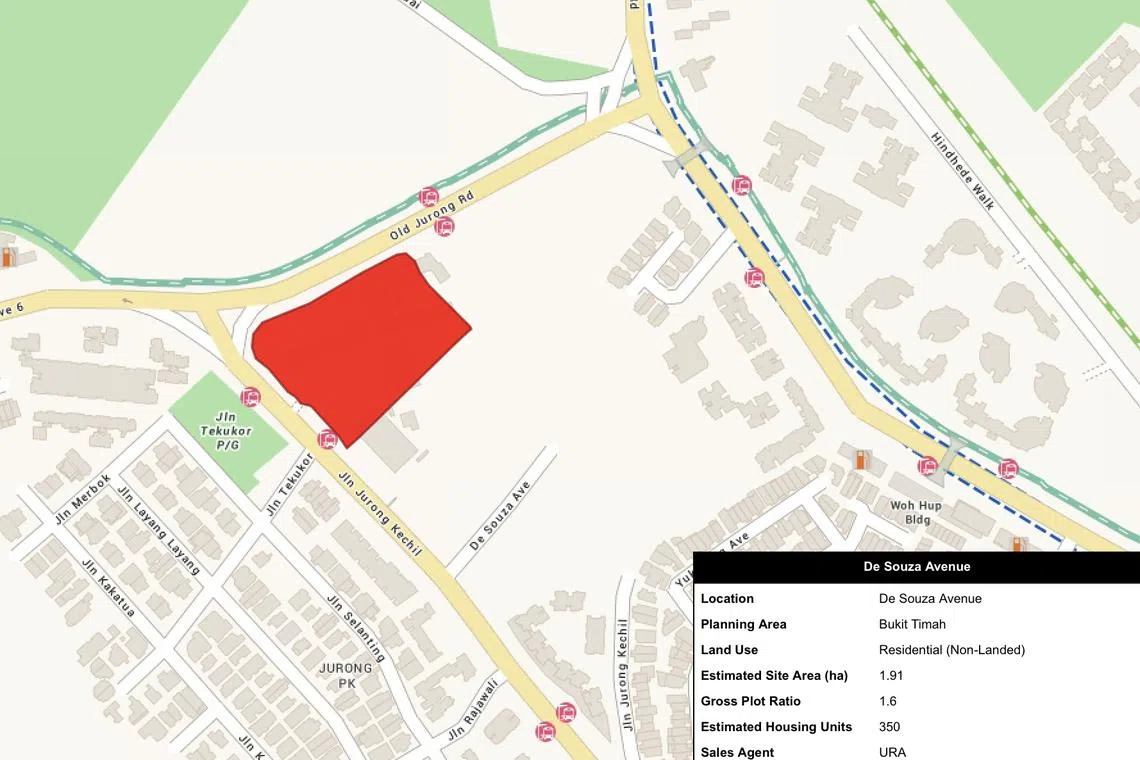

- A 1.91 ha land parcel along De Souza Avenue in Upper Bukit Timah for 350 homes, with a minimum 500 sq m GFA for childcare centre services; and

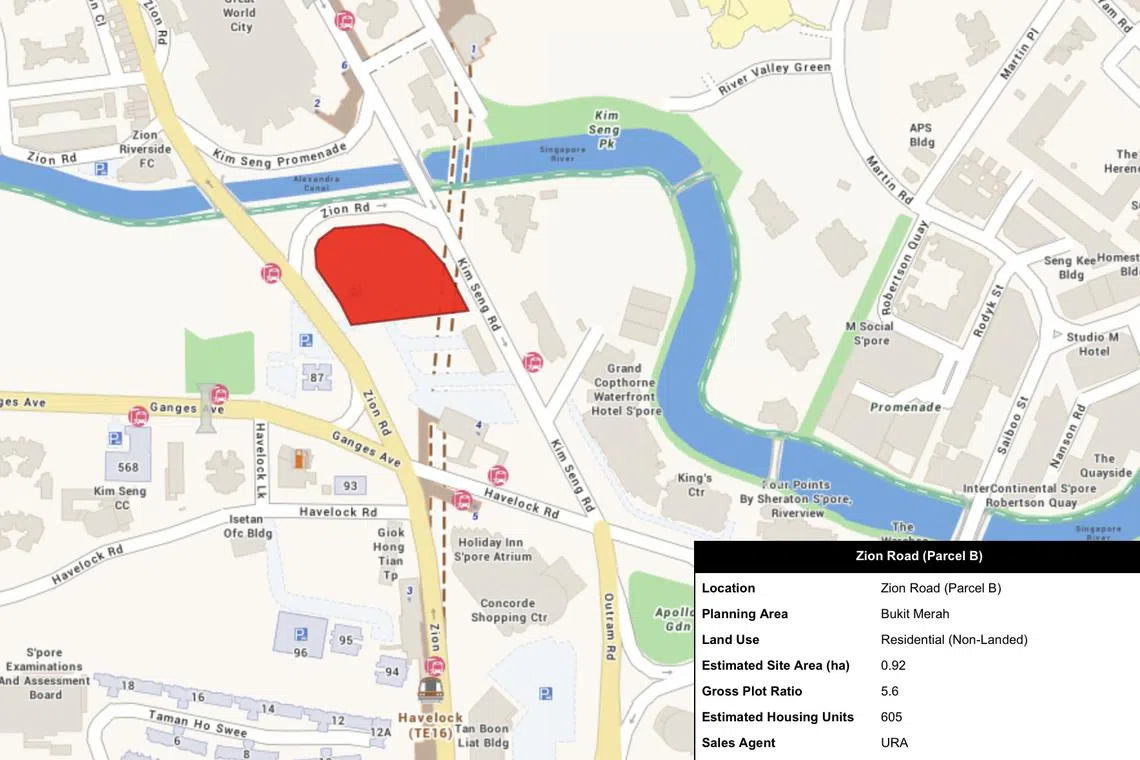

- Zion Road (Parcel B), a 605-unit plot spanning 0.92 ha.

Some analysts say that the Tampines Street 95 site is the only one of the four likely to be triggered for tender.

Demand for ECs in the island’s eastern region remains strong, as evidenced by the strong take-up rate of Tenet EC, pointed out Wong Xian Yang, Cushman & Wakefield head of research for Singapore and South-east Asia. Tenet sold 72 per cent of its 618-units on its first day of launch last December, at an average price of about S$1,360 psf.

CBRE’s Song, on the other hand, believes that none of the reserve sites will be triggered for tender this year, given the “ample supply” on the confirmed list, as well as lack of attractive suburban sites on reserve.

The Zion Road (Parcel B) site, for instance, is beside Zion Road (Parcel A) on the confirmed list, while the Holland Drive site is next to mixed-use development One Holland Village, said Song. One Holland Village had drawn 15 bids from 10 consortiums in May 2018, with a winning bid of S$1.2 billion or nearly S$1,888 psf ppr. Under this latest round of the GLS Programme, the projected number of private homes, including ECs, will go up by around 26 per cent to 5,160 units, from 4,090 units in H1 2023. Of the 5,160 units, 2,400* were carried forward from the H1 2023 GLS Programme, and 2,760 are from new sites.

Edmund Tie’s Lam said: “The greater injection of supply complements earlier measures to raise public housing supply and reduce waiting times to meet the growing housing needs of the population.”

“With the exception of one site (at Orchard Boulevard), the rest of the sites could each yield at least 500 dwelling units.”

*Amendment note: An earlier version of this article incorrectly stated that 2,346 units were carried forward from the H1 2023 GLS Progaramme, when it should be 2,400 units.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.