Raffles Town Club site to be redeveloped for housing after lease expires in 2026

Vivienne Tay &

Jessie Lim

THE prime plot of land in Bukit Timah occupied by Raffles Town Club (RTC) will be sold for residential development after the expiry of its lease in October 2026.

While the site is expected to be sought after by developers, the move could lead to further collapse of the club’s membership price.

RTC memberships were sold at S$28,000 when the club opened in 2000. They are now being offered at S$7,000 to S$8,000 on the secondary market.

The lease of the RTC site, located at 1 Plymouth Avenue, expires on Oct 17, 2026.

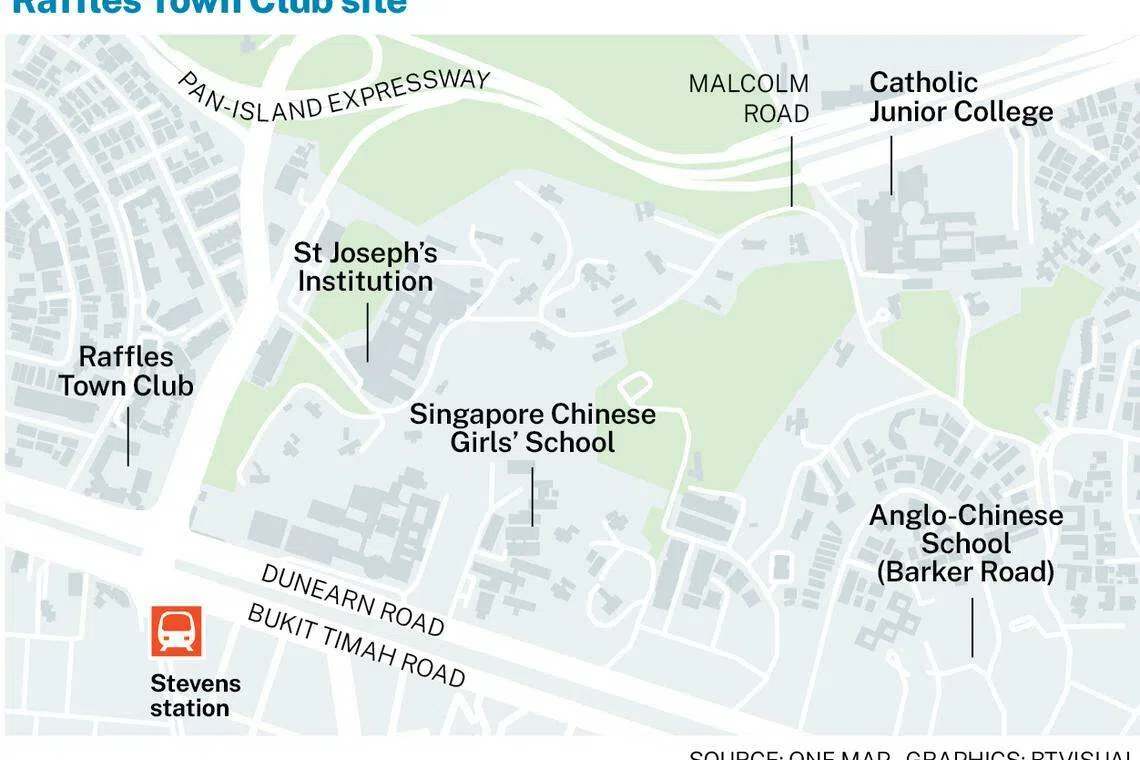

Tricia Song, CBRE’s head of research, Singapore and South-east Asia, said the parcel would be one of the rare 99-year leasehold residential sites to be offered on Bukit Timah Road, and is likely to be highly coveted given its proximity to an MRT station, popular schools and the Botanic Gardens.

Schools nearby include Singapore Chinese Girls’ School, Anglo-Chinese School, Nanyang Primary and St Joseph’s Institution.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Wong Xian Yang, Cushman & Wakefield’s head of research for Singapore and South-east Asia, estimated that about 200 residential units can be built on the 12,318 square metre site, assuming a plot ratio of 1.4 and a minimum unit size of 915 square feet.

The future development will likely be a prime luxury condominium project, said Lee Sze Teck, Huttons’ senior director of data analytics.

The number of units would depend upon the gross plot ratio allowed. The site’s gross plot ratio is currently subject to evaluation.

ERA key executive officer Eugene Lim said there was a possibility of a higher plot ratio being allowed on the site, perhaps up to 2.1.

Lim said: “The Raffles Town Club site is advantageously located at the corner and intersection of Whitley Road and Dunearn Road. A taller development may be built there to serve as a landmark for the intersection.”

If the site were to be launched for sale today, the winning land bid could be more than S$1,500 per square foot (psf) per plot ratio, said Huttons’ Lee. Assuming the project has a 99-year lease, finished units are likely to be sold above S$3,000 psf when completed, said Cushman & Wakefield’s Wong.

Condo units in a new launch nearby, the freehold Watten House project, were sold at an average price of S$3,230 psf at a private preview on Nov 18. Property developers UOL Group and Singapore Land Group sold 57 per cent, or 102 out of 180 units, of the District 10 condominium near Tan Kah Kee MRT.

The move to redevelop RTC is in line with Singapore’s focus of redeveloping brownfield sites as much as possible to meet future demand for land, including housing, the Singapore Land Authority (SLA) and Urban Redevelopment Authority said in a joint statement on Monday (Nov 20).

Redevelopment will support future housing demand and “enhance the residential character” of the precinct. Future residents will also be able to benefit from the transport infrastructure and connectivity to the city and around the island, they added.

In a statement to The Business Times, Raffles Town Club said its management will continue to provide services to its members, who may enjoy club facilities until the lease expires in October 2026.

SRI’s head of research and data analytics Mohan Sandrasegeran noted that the government had earlier announced plans to increase housing supply in key locations such as Pearl’s Hill and Bukit Timah’s Turf City.

RTC will be able to continue its operations until its lease expires, after which, it will be required to return the land to the state. SLA said it will work closely with the club on the return of land.

Sing Tien Foo, provost’s chair professor of real estate at the National University of Singapore (NUS) Business School, said that should RTC choose to relocate, there would be costs incurred such as land costs for the replacement site and rebuilding costs.

He said: “It will not be so easy to find land of a similar size in a central location. There is also the question of who will pay for it, and whether members will bear the cost.”

However, due to the 30-year lease on the land, current members should have expected that the lease would have to be renewed and made a decision on whether to continue their membership, Prof Sing said.

In 1996, Europa Holdings successfully bid for the site, zoned for sports and recreation use, for S$100 million.

The club has seen several long-drawn-out legal actions taken against its founding shareholders over the last two decades.

In 2000, some 5,000 members sued the club’s shareholders for breach of contract and misrepresentation. They claimed the club owners had said RTC would be a “prestigious private city club”, when it had 19,000 members. They demanded a refund of their S$28,000 membership fees, and won the suit in 2005.

Among other complaints against RTC, the falling membership price was one of the key issues that emerged during the lawsuit.

Membership price dropped from S$28,000 in May 2000, to S$16,000 the following month, according to court documents seen by BT. The price fell to S$13,000 in December 2000 and continued falling to S$7,300 in October 2003.

It is unclear when the club stopped selling memberships, but they are available on the secondary market.

Checks on Carousell showed that RTC memberships were being offered as recently as three months ago, for about S$7,000 to S$8,000.

In 2008, a S$130 million claim was brought against the four founders by Chinese investor Lin Jian Wei and Singapore businesswoman Margaret Tung, who had taken over RTC in July 2001.

The club, Lin and Tung had argued that the four founders had siphoned off the club’s funds through directors’ fees, as well as management fees to an external firm of which the men were shareholders or beneficial shareholders.

In November 2012, billionaire Peter Lim and the three other founders of RTC won an appeal in the action and the claim was dismissed.

On the future of the club, government agencies will engage RTC on the availability of suitable state properties through an open tender if it wishes to continue operations after the lease expires, SLA and URA said.

David Ng, 48, who bought a membership at RTC in the 2000s for about S$28,000, said the closure “came out of the blue” for him.

The company director said: “I’ll be very disappointed if they shut down. If they relocate, at least we will still have a club to visit and use the facilities – even though it may be a more inconvenient location to travel to.”

“I’m doubtful they can find another location that is next to an MRT (station) and in a central location. It will be a loss for sure.”

Ng hopes that members will be compensated or have an opportunity to exit their investment. He currently pays a monthly subscription fee of S$86.40.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.