More execs now concerned about cooling measures for Singapore private homes

WHILE overall sentiment in Singapore's real estate market improved in the third quarter this year, worries seem to be growing over possible government intervention for private residential properties.

That's according to findings from the Real Estate Sentiment Index published by the National University of Singapore Real Estate (NUS+RE), which represents the Department of Real Estate and the Institute of Real Estate and Urban Studies at the university.

The quarterly survey polled about 40-50 senior executives in the real estate sector who are closely following the pulse in the markets.

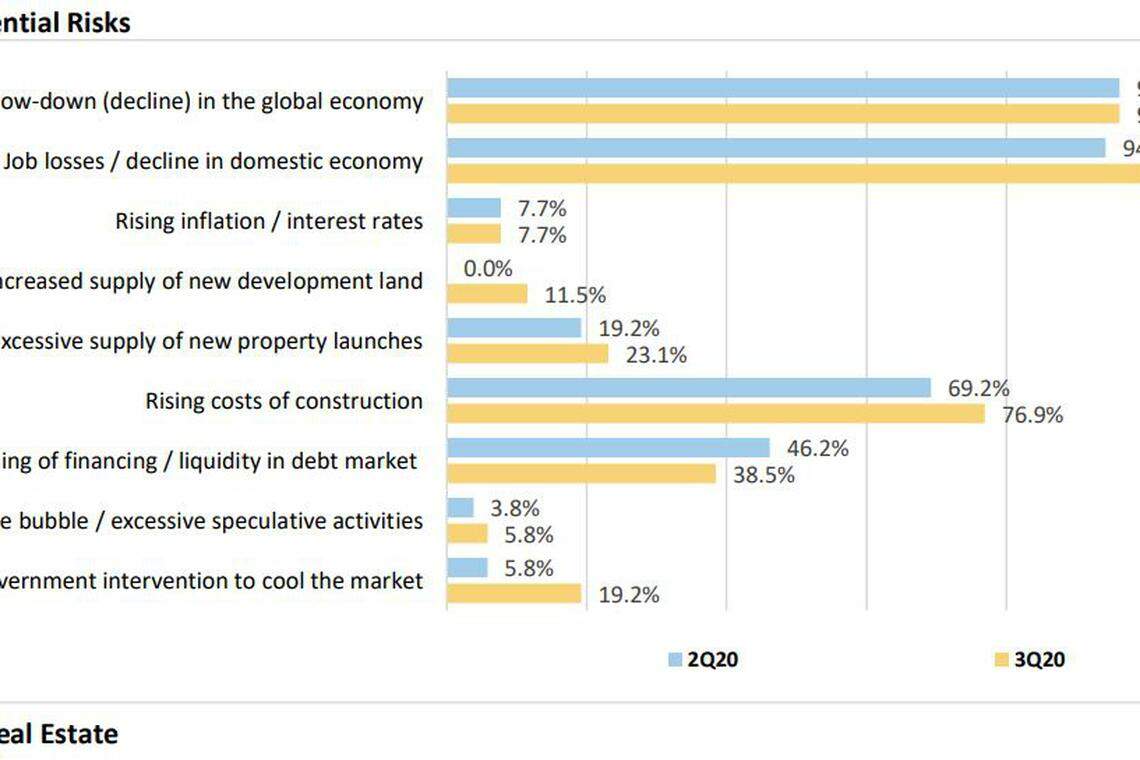

More respondents became concerned about government intervention to cool the residential property market in the next six months, with the proportion jumping to 19.2 per cent in the third quarter, from 5.8 per cent in the second quarter.

In a press statement on Thursday, NUS+RE said this was the highest quarter-on-quarter increase among the risk factors to sentiment in the latest survey.

On the other hand, the proportion of respondents who believed the tightening of financing and liquidity in the debt market will be a potential risk factor in the next six months shrank to 38.5 per cent, from 46.2 per cent in the previous quarter.

A NEWSLETTER FOR YOU

Property Insights

Get an exclusive analysis of real estate and property news in Singapore and beyond.

Nearly all those surveyed agreed that job losses and the economic slowdown in Singapore and globally would be the top risks that may put a dent in market sentiment in the next six months. Some respondents said that these risk factors may put pressure on real estate prices and sales.

As for high construction cost, a bigger proportion (76.9 per cent in Q3) also perceived it as a potential risk factor, up from 69.2 per cent in Q2.

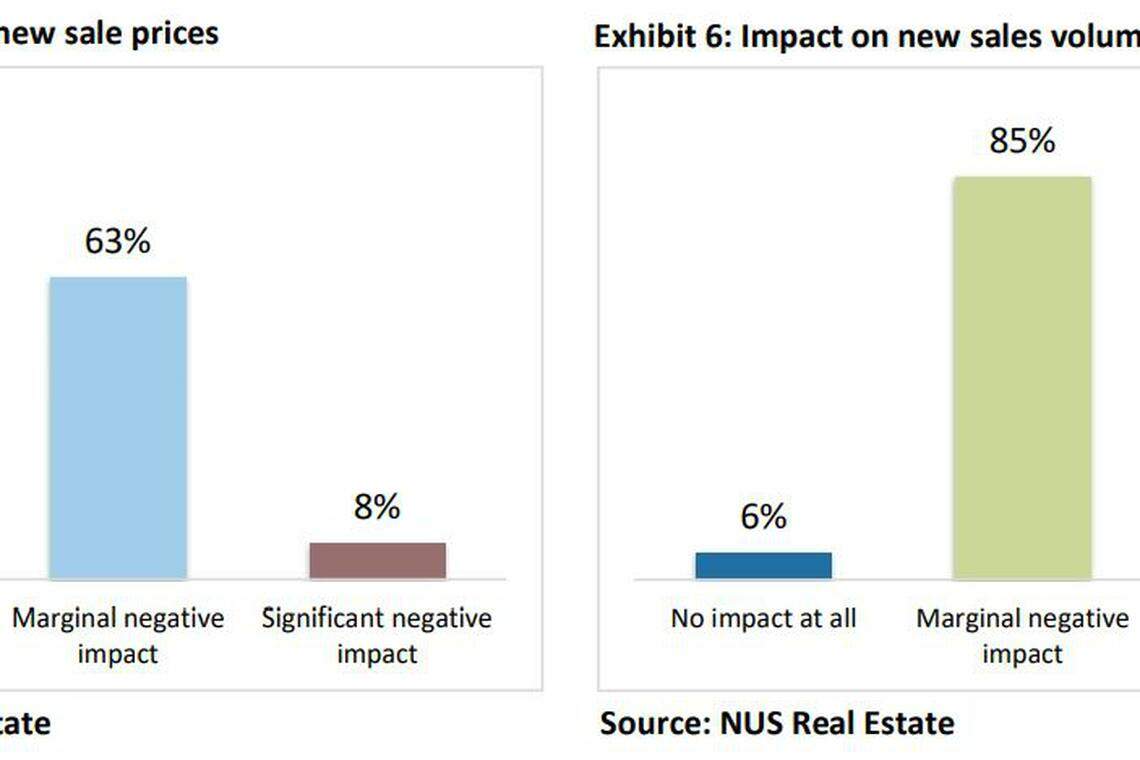

Meanwhile, the recent clampdown on the re-issuance of options to purchase (OTPs) may just have a marginal negative impact on new sale prices of private homes, according to about two-thirds (63 per cent) of the respondents.

About 85 per cent of respondents also believed the OTP restriction will have a marginal negative impact on new sales volumes.

Most of those polled said HDB upgraders will be the most affected by the OTP curb, compared to other buyers.

The authorities in September clamped down on the continual re-issuance of OTPs upon expiry - which had effectively allowed buyers to defer their purchases and payments - after months of persuading private housing developers not to indulge in the practice.

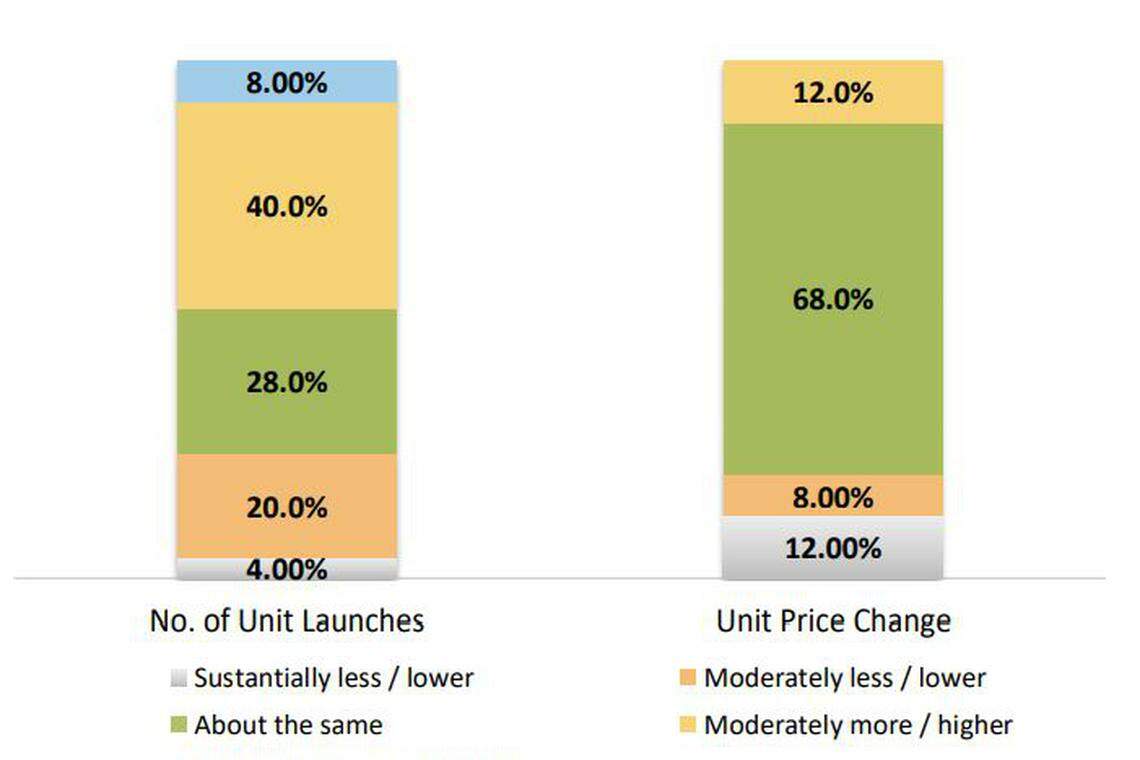

In terms of future launches and sales, close to half of property developers surveyed by NUS+RE expected more residential units to come to the market in the next six months.

Said one respondent: "In the near term, decisions of sale launches are expected to accelerate as the supplies from the land-sale transactions that took place two to three years back are expected to meet their respective deadlines."

Another respondent noted that there could be more launches as some had been deferred earlier due to the Covid-19 pandemic.

That being said, some 28 per cent of developers anticipated no change in the number of units launched.

Nearly seven in 10 of developers also believed the pricing of new residential launches will stay at current levels, in the next six months.

One of them said: "While some developers may have to reduce their prices to sell their units to avoid incurring costs, there are others who want to sell their products according to what they are worth, such as in high-end projects. Hence, the overall net effect is that prices are likely to stay at the same level."

Meanwhile, the work-from-home trend may only have a slight influence on prospective homebuyers' preferences for the attributes and features of their homes, according to some six in 10 respondents.

Still, if preferences are to change, more homebuyers are now likely to favour spaces that can be repurposed or reprogrammed, or may want more rooms to facilitate work-from-home arrangements, noted 42-54 per cent of the respondents.

The NUS+RE study found that overall sentiment in the real estate market "improved significantly" in the third quarter this year as the number of new coronavirus cases appeared to come under control.

The study's composite sentiment index, which is the derived indicator for the current overall real estate market sentiment, increased to 5.4 in the third quarter, from 3.7 in the second quarter.

The last time this index crossed the 5.0 level was in Q2 2018. A score above 5.0 indicates improving market conditions, while a score below that indicates deteriorating conditions.

The survey also includes a current sentiment index tracking changes in sentiment over the past six months. This went up to 5.3 in the latest quarter, from 3.1 in the previous quarter.

Meanwhile, the future sentiment index, which indicates changes in sentiment over the next six months, also picked up, reaching 5.4 in the July-September period, compared with 4.3 in the April-June quarter.

However, this recovery in market sentiment was not broad-based. While it improved for the suburban residential sector, the outlook for the office, retail and hospitality sectors remained subdued.

The prime residential sector scored a current net balance of -14 per cent, up from the -65 per cent in Q2, as fewer respondents in Q3 said the sector's condition had deteriorated.

The industrial and logistics sector and the suburban residential sector recorded positive current net balances of 29 per cent to 31 per cent.

In contrast, the office, hotel and serviced apartment and prime retail sectors had negative scores of -63 per cent to -69 per cent for the quarter. These three sectors remained adversely affected by safe-distancing measures and travel restrictions amid the Covid-19 pandemic.

Also, despite the uptick in overall sentiment, most of the property developers surveyed were still cautious as the external environment remained "highly uncertain", said Lee Nai Jia, deputy director of the Institute of Real Estate and Urban Solutions.

And on the other end of the spectrum, a number of respondents were concerned about the limited supply of real estate in the future, due to the lack of government land sales, Dr Lee added.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Property

Singapore retail rents slip 0.4% in Q1 as vacancy rates creep up

Country Garden plans to present debt revamp plan in H2, sources say

Hong Kong home prices rise for first time in 11 months after curbs scrapped

HDB resale prices accelerate, rising 1.8% in Q1 on stronger demand

Private home prices ease to 1.4% rise in Q1; rents fall a further 1.9%

OUE wins tender to lease, develop new ‘zero-energy’ hotel at Changi Airport’s T2