S'pore 2016 wage rise at post-crisis low; 2017 may also see drag

But prices slide helps lift real wages by 3.6%; MOM says proportion of profitable companies hits 10-year low

Singapore

THE bump in paychecks - taking into account inflation - that Singapore's private-sector workers saw last year was the smallest in three years, and the pinch is likely to continue - or intensify - this year, said economists.

This is because cyclical and structural pressures are expected to weigh on companies. They will be forced to balance profitability with how much more value they can extract from hiring labour.

"We were coming into the 2016 slowdown from a relatively weak position already with the restructuring that's going on, so this compounded wage growth pressures" said Nomura economist Brian Tan. "Moving into 2017, I won't be too optimistic either."

Economists' comments come after the Ministry of Manpower's (MOM) Manpower Research and Statistics Department released its Report on Wage Practices 2016 on Tuesday. Findings came from a sampling methodology that yielded an effective sample of 4,800 private establishments with at least 10 employees. Together, they employed 1.2 million employees.

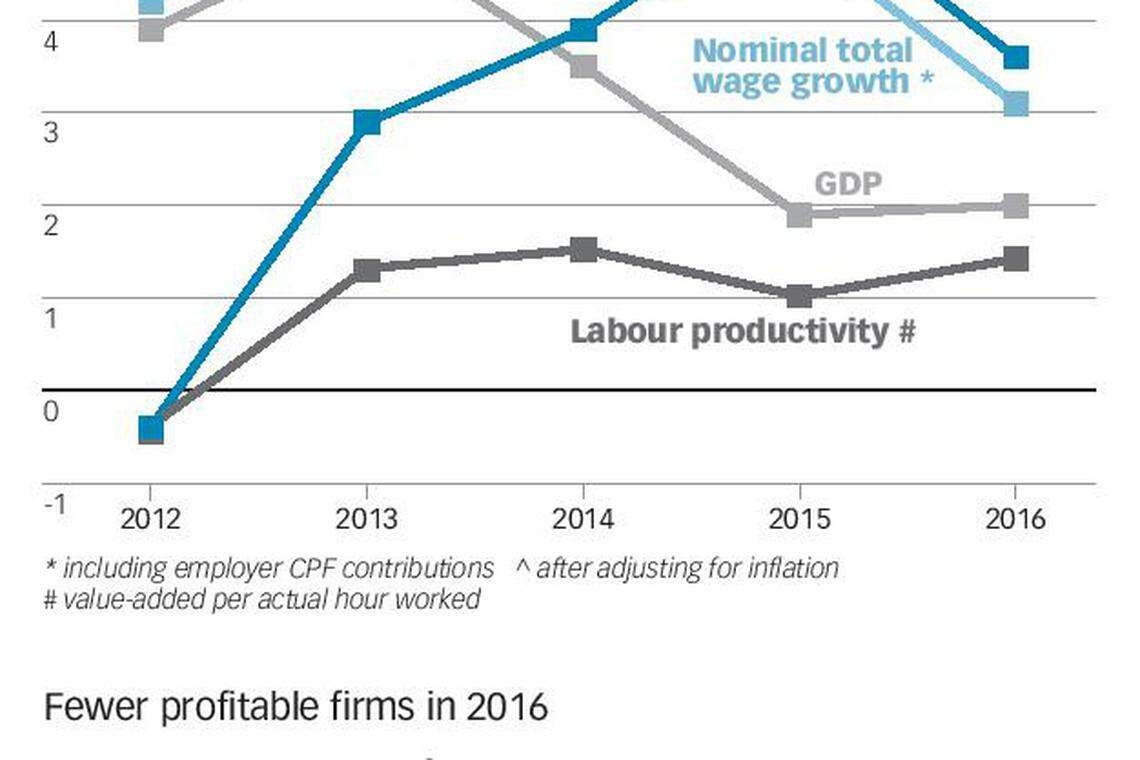

Judging from the report findings, 2016 was a year of superlatives - not in a good way. Total wages, including employer CPF, of private-sector employees last year grew at its slowest pace since the financial crisis. It was up by 3.1 per cent in 2016, compared with the 4.9 per cent increase in 2015. The last time the increase was smaller was in 2009 when it actually shrank by 0.4 per cent.

But these nominal figures do not factor in cost of living, which can eat into the nominal value of paychecks. With overall prices dipping by 0.5 per cent last year, real total wage growth was higher at 3.6 per cent. Yet this was still lower than the 5.4 per cent in 2015, and 3.9 per cent in 2014.

2016's real total wage growth, however, was better than 2013's 2.9 per cent, when prices rose by 2.4 per cent. Even as workers took home more value with their paychecks last year, firms were feeling the squeeze.

For much of 2016, the economy risked clocking a slower pace of growth than an already subdued 2015.

As a result, firms saw their margins being squeezed. The proportion of profitable companies dipped to their lowest in more than a decade, according to MOM's report.

Some 75.7 per cent were profitable, while the share was at 79.4 per cent in the throes of the 2009 financial crisis, and at 81.4 per cent in 2006.

Only 58 per cent of all firms raised total wages last year, down from 64 per cent in 2015.

For workers, 75 per cent of them saw increase in wages in 2016, down from 77 per cent in 2015.

But the increase in value derived from each actual hour worked last year did not meet the pace of wage increases. Labour productivity rose by 1.4 per cent in 2016, according to previous data released by the Ministry of Trade and Industry (MTI).

This gap crimps companies' profit margins, said ANZ economist Ng Weiwen. "And in a bad economic climate, businesses will close, workers will get laid off."

Moving into 2017, early productivity gains may provide some reprieve to halt the slide in wage growth. First-quarter data showed that labour productivity, when measured as value-added per worker, grew by 2.7 per cent year-on-year, MTI data showed.

But this may not translate into stronger wage growth this year.

Most of that increase in productivity was driven by gains in the manufacturing sector, said economists. Factories had automated more processes, or deployed advanced technologies to lessen their reliance on labour.

"It's easier for them to raise productivity because we're talking about advanced manfuacturing - more big machines, technology. Other sectors? I'm not so sure," said Nomura's Mr Tan.

And as Singapore continues to grind the wheels of economic restructuring to lessen its reliance on labour, economists think that the brakes on wage growth may exacerbate before the transformation is complete.

"With foreign labour restrictions in place, until the day when the local workforce becomes more productive or there is more automation, there will not be much room for wages to grow," said ANZ's Mr Ng.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Economy & Policy

US-Singapore FTA marks 20 years: a bridge ‘at the right place, right time’

Singapore’s employment growth eases in Q1, as tighter foreign worker quotas kick in for construction firms

Daily Debrief: What Happened Today (Apr 30)

Biden’s ‘worker-centred trade policy’ involves building ‘tripartism’: US trade chief

Daily Debrief: What Happened Today (Apr 29)

NTUC to help workers develop skills, adapt to new job opportunities