IPOs on SGX down, but cautious optimism prevails

Singapore

LIKE most exchanges globally, Singapore Exchange (SGX) has seen a slowdown in the number of initial public offers (IPOs) in the first-half of 2018, as rising geo-political tensions and trade risks dent confidence.

Max Loh, EY Asean and Singapore managing partner, said SGX attracted seven IPOs in the first six months of the year, down 30 per cent from H1 2017, when there were 10 IPOs.

Total proceeds raised climbed to US$0.4 billion from US$0.3 billion. This was anchored mainly by the listing of Sasseur Reit, an operator of China outlet malls, which raised some US$305 million.

"The other IPOs were predominantly smaller-cap listings, with a couple of IPOs in the health-care sector," Mr Loh said.

SGX remained sanguine.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Its spokesman said: "We are very pleased that total funds raised through equity primary and secondary fund-raising against a volatile market continued to be robust in Singapore, with funds raised growing more than four times in FY2018 compared with FY2017 (financial year ended June 30)."

Half the new listings on SGX this year so far were cross-border deals, with companies hailing from countries such as Germany, Korea, Myanmar, China and Malaysia.

"Looking ahead, we are seeing a very healthy pipeline of mandates in our leading sectors, including consumer, healthcare and technology, from domestic and international companies," said the spokesman, who added that SGX's partnerships with Nasdaq, Tel-Avi Stock Exchange and its recently announced dual-class share (DCS) structure have also accelerated interest for a listing in Singapore.

Underpinning SGX's optimism is also a 50 per cent increase in bond listings on the exchange in FY2018, which it says reflects market demand for fund raising through both debt and equity.

Tay Hwee Ling, Global International Financial Reporting Standards (IFRS) & Offerings Services Leader at Deloitte Singapore, shares SGX's optimism for the rest of the year, expecting interest from domestic and cross-border IPOs.

For EY's Mr Loh, the optimism is tainted with caution. "Encouraging economic conditions, equity market valuations, continued low interest rates and continued investor and issuer appetite bodes well for more robust IPO activity, but this could be somewhat weighed down by geo-political tensions, trade policy risks and emerging-market concerns."

Other than Reits, Singapore IPO activity is expected to be driven mostly by entrepreneurial companies coming to market.

Experts said the adoption of SGX's DCS listing rules would accommodate the listing of more high-growth companies in their quest to raise capital, while broadening investment options for investors and adding to the vibrancy of Singapore's capital market.

"This has to be a positive move in spurring new IPOs, but it cannot be seen as a single silver bullet. There are many other factors that companies take into consideration in determining when and where to list," Mr Loh said.

Corporate strategy, valuation, a capital market capability, a market's liquidity as well as initial and ongoing costs are some of the other factors determining IPO destinations.

During the first half of the year, seven Singapore companies sought listing in Hong Kong, up from three in H1 2017, Ms Tay noted.

According to EY's quarterly report, "Global IPO trends: Q2 2018", global uncertainties have led to a decline in global IPO activity, resulting in 660 IPOs in H1 2018, a 21 per cent fall from H1 2017.

IPO volume in the Asia-Pacific fell 37 per cent from a year ago to 302, raking in US$29.6 billion in proceeds, down 17 per cent on year. The region accounted for a 46 per cent share of global IPOs and 31 per cent of global IPO proceeds in H1 2018.

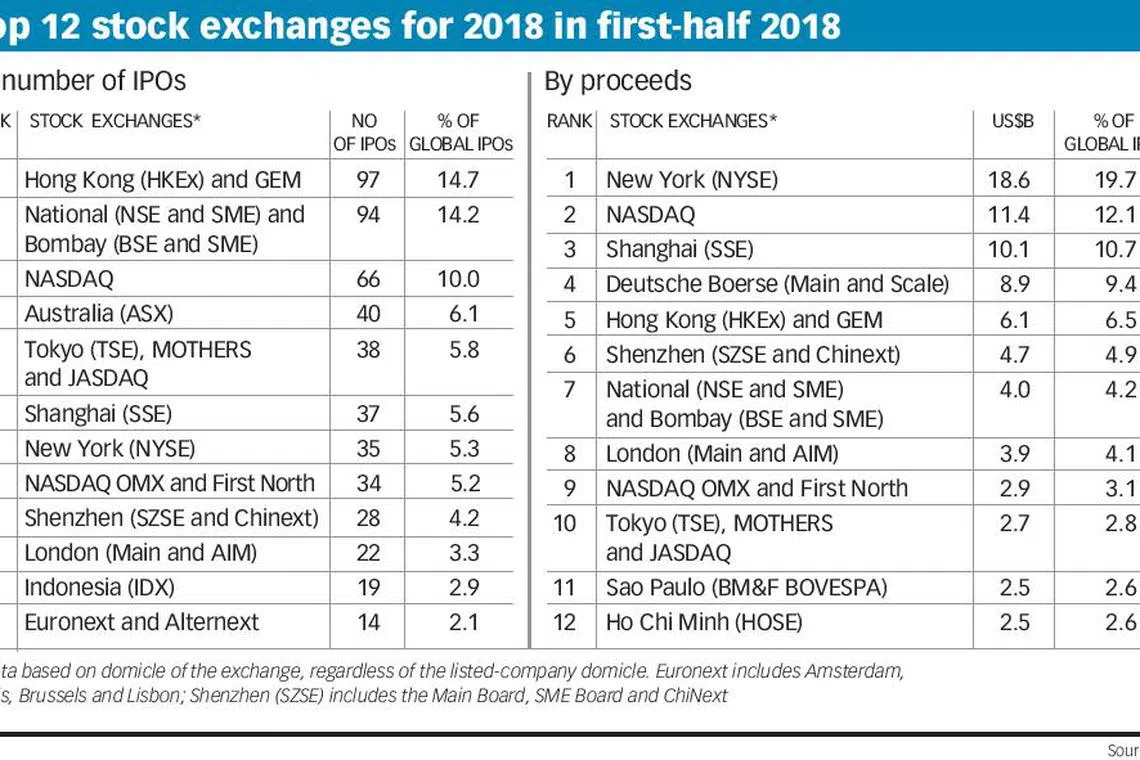

There were 97 IPOs in Hong Kong, which leads the global rankings in terms of the number of IPOs; it clinched 14.7 per cent of global IPOs. It beat Nasdaq and New York Stock Exchange (NYSE), which saw 66 and 35 IPOs respectively, in the first six months of 2018.

In terms of proceeds, Hong Kong slipped to fifth position, raising US$6.1 billion; NYSE and Nasdaq led the global rankings at US$18.6 billion and US$11.4 billion respectively.

EY's Q2 and year-to-date data is based on priced IPOs as of June 15, 2018, and expected IPOs in June.

EY forecasts a total of HK$200 billion in funds will be raised by IPO activities in Hong Kong in 2018.

Looking at the rest of the year, IPO activity levels in the region will depend, in part, on the mega IPOs, particularly as China looks to repatriate technology unicorns.

Biotech is the sector to watch among upcoming IPOs for Q3 2018. Issuers from the entertainment, mobile gaming and publishing sectors also have sizeable IPOs on the horizon.

IPOs in other parts of the region - Thailand, Indonesia, the Philippines, Malaysia and Singapore - will be predominantly small-cap listings.

"This is a trend we expect to continue in H2 2018 as geo-political uncertainty, trade tensions and macroeconomic conditions continue to dampen IPO activity," EY said.

Copyright SPH Media. All rights reserved.