British pound rallies on May's Brexit setback

[NEW YORK] The British pound rallied on Tuesday after the lower house of parliament overwhelmingly rejected Prime Minister Theresa May's Brexit plan, while global stocks climbed.

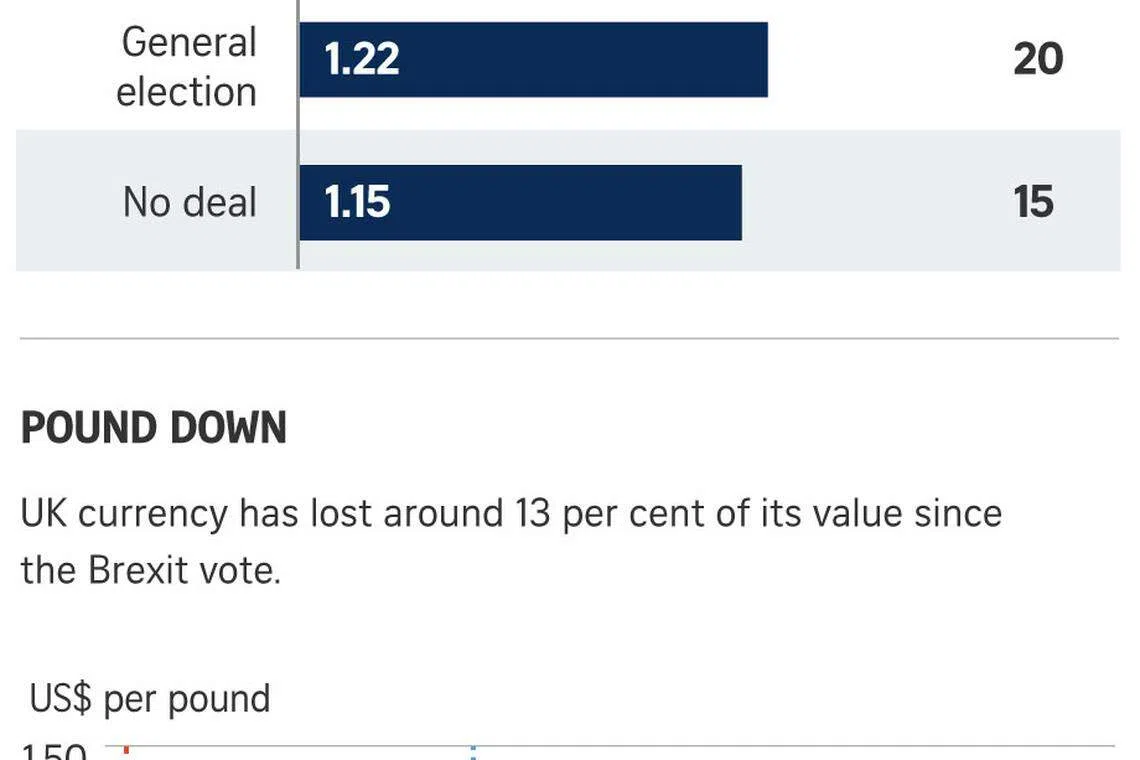

The pound's surge after the lopsided vote suggested traders still viewed a so-called "hard Brexit" - one with no agreement between the EU and Britain - as a remote possibility.

US stocks pulled back somewhat after the British vote tally but quickly recovered to join stock markets in Europe and Asia in moving higher following news that China planned tax cuts to boost the economy.

Near 2140 GMT, the pound stood at 88.66 pence to the euro, compared with 89.57 and 89.15 Monday night.

Against the dollar, the pound traded at US$1.2871 against US$1.2704 and US$1.2864 Monday night.

The House of Commons voted 432 to 202 against Mrs May's plan for taking Britain out of the European Union, one of the biggest defeats ever suffered by a British prime minister.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The negative vote had been expected but the margin was much bigger than Mrs May had hoped. Ahead of the vote, some analysts had predicted the pound could plunge with a one-sided defeat, such as 200 votes or more.

BK Asset Management's Boris Schlossberg said investors simply did not believe there was a realistic chance of a so-called "hard" Brexit.

"Markets project beliefs and the underlying belief is that nobody's going to be committing economic suicide," he said.

Jeremy Stretch, head of Group-of-10 currency strategy at Canadian Imperial Bank of Commerce, told Bloomberg the outcome boosted the odds of a delay, a second referendum or even no Brexit at all.

AFP

Share with us your feedback on BT's products and services