Buy a Dior lipstick in three instalments? Here's how young consumers do it

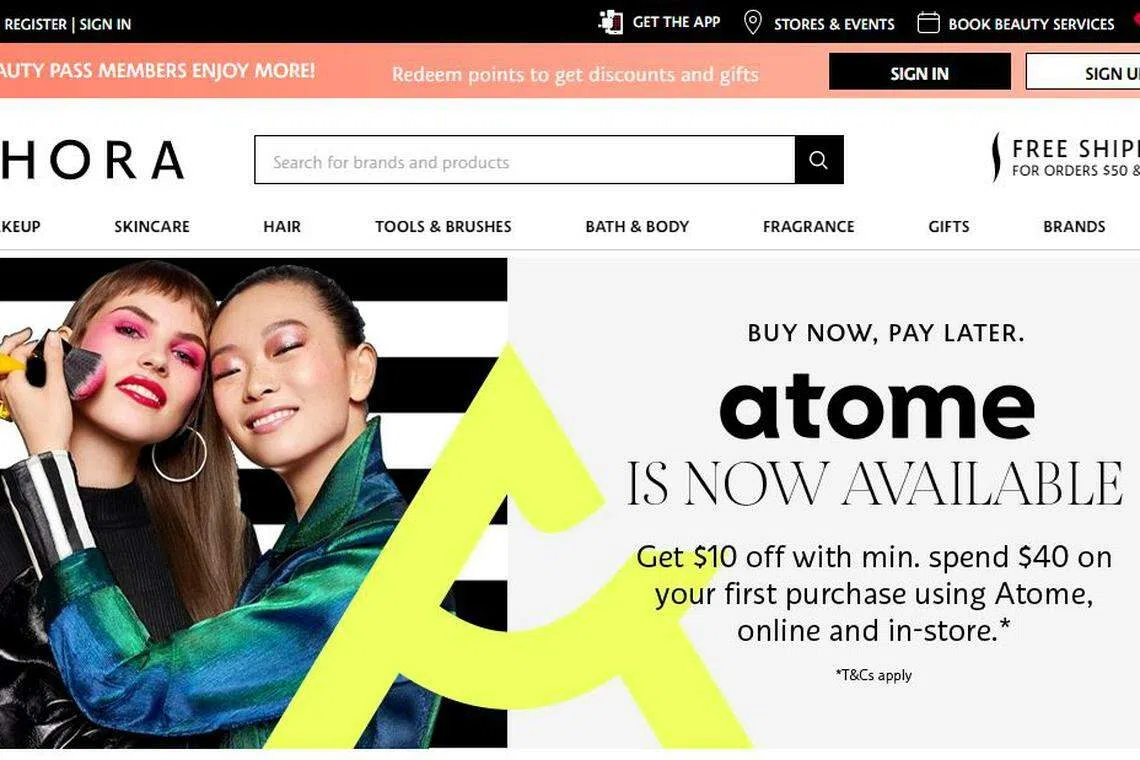

COSMETICS giant Sephora has begun advertising its buy-now-pay-later (BNPL) offering in Singapore, where customers can buy makeup and pay in three interest-free monthly instalments.

The service is done as a tie-up with Atome, one of a number of rising fintechs in Singapore that are latching on this BNPL trend.

These BNPL services have also triggered regulators' concerns.

The Monetary Authority of Singapore (MAS) told BT in February that it is, along with other government agencies, "reviewing the appropriate regulatory approach" for such schemes.

Funded mainly by venture capital, these fintechs charge merchants a fee, for paying to the merchants the price of a basket of lotions and potions checked out. In Sephora's case, the purchase can be split on BNPL terms if it is by a Singapore resident who is at least 18 years old, and who uses a Singaporean credit or debit card to make the purchase.

Retail customers opting for BNPL then pay for their purchases in instalments, with no interest or service fee.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

They are, however, subject to late-fee penalties if repayments are missed.

Some 38 per cent of Singaporeans, or 1.1 million people, have used a BNPL service, financial comparison platform Finder showed.

Since just a bank-linked debit card will do, the BNPL option appeals to those who do not yet qualify for a credit card, which includes young consumers.

And indeed, in Singapore, BNPL's key customer segment is between ages 18 and 35, with an average order value of around S$200 to S$300, checks by The Business Times showed. Across the Asia-Pacific, e-commerce transactions using BNPL are due to more than double by 2023.

It also allows for retailers to offer instalment plans for small-ticket items.

Hire purchase financing is common for retailers, but these are typically for large-ticket items, such as household appliances. This more traditional form of financing also usually comes with interest and late fees charged to consumers as well.

Checks by BT showed that there is some benefit to retailers, who have been stung by Covid-19's impact.

Atome, the consumer arm of digital bank hopeful Advance.AI, says that its 1,000-odd merchants have seen a 20 to 30 per cent increase in conversions, and as much as a 30 per cent increase in average order size. Its peer, hoolah, claims that transaction volumes have grown over 700 per cent year-to-date, with topline sales up more than 350 per cent.

hoolah CEO Stuart Thornton said the firm aims to help merchants increase their conversions and retain customers by offering BNPL solutions at checkout. "But we want to do that responsibly, not in a way where customers are spending wildly. We want to make sure that people are doing that within their means," he told BT.

As for late fees, hoolah charges a S$15 fee each time a customer misses an instalment. This applies to order values between S$100 and S$999.99. It also imposes a cap on late fees; hoolah had told BT it would update its terms and conditions that would clarify this cap.

A "large number" of late payment charges end up waived due to legitimate reasons for customers having delayed payment, such as health issues and change of employment status, according to the firm.

Atome will freeze a customer's account and charge a S$20 admin fee if an instalment payment is missed. If this admin fee and outstanding payment are not paid within seven days, an additional S$10 fee is imposed.

Atome's CEO David Chen told BT that defaults are low in Singapore, as most repayments work on an auto-debit basis.

Still, a survey by Finder showed that 27 per cent of 1,008 Singaporeans surveyed admit to being financially worse off when using a BNPL service, with impulse buying being the most common mistake. About 11 per cent also said they have overstretched their budget so far that they struggled to pay for other expenses.

A separate OCBC survey found that 41 per cent of millennials in Singapore struggle to stick to their savings plan. The ease with which younger consumers can access credit also raises valid concerns.

Analysts point out that these firms are able to tap into a wider net of consumers by providing credit for smaller amounts, and having lower requirements for information.

But the inherent risks of BNPL business models are high as their services are more likely to appeal to consumers with weaker credit profiles.

BNPL's key market of young millennials may not have built a credit history yet.

Analysts noted that if BNPL fintechs - which are backed by venture capital monies - are providing funding to merchants for them to in turn provide deferred payments to consumers, these firms would likely be exempt from current regulation.

That being said, if BNPL schemes grow increasingly popular, authorities could become more concerned about financial stability and prudence. They may, over time, require closer monitoring or restrictions on BNPL activities, analysts said.

BNPL pioneer Klarna is now the highest-valued fintech in Europe with a valuation of over US$10.6 billion. Australia's first mover Afterpay recently doubled its full-year revenue to A$519.2 million (S$497.8 million) for the financial year ended June 30, 2020.

READ MORE:

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.