Oil stress yet to hit bottom

OCBC chief sees reality check hitting oil-and-gas sector, but flags doubts over additional capital injections

Singapore

OIL-and-gas players may not attract the capital they now need to tide them over this difficult period if oil prices do not recover and go past US$60 per barrel, OCBC chief Samuel Tsien said on Tuesday, as he warned of more distress and uncertainty ahead.

This comes as OCBC reported an 18 per cent fall in net profit for the fourth quarter, with the lower-than-expected earnings hurt by higher provisions for the oil-and-gas sector. The shares of Singapore's second-largest bank dropped 3.3 per cent or 32 cents to close at S$9.43.

Mr Tsien, when asked if there was now more clarity over the sector's situation, and whether a tipping point has been reached that separates the survivors from the ones heading for a collapse, replied: "The clarity is that everybody comes to reality.

"We have been fairly straightforward with what we expect the reality to be, and I think now, there is some convergence to the view that we have previously expressed. That clarity, in and of itself: I don't know if it will attract additional capital."

This comes as offshore support companies have tried to seek out investors to keep themselves afloat.

Swiber Holdings, now under judicial management, has failed to secure a white knight to pump in capital to repay a bridging loan from its major bank, DBS.

Eyes are now on Ezra Holdings, which has loans from all three Singapore banks. The Business Times reported this month that Ezra's subsea joint-venture firm had identified a white-knight investor, but soon after, Ezra's Japanese partners issued warnings of write-downs on their investments, including shareholding loans, triggering a sell-down on Ezra and stoking jitters once again.

This week, that troubled unit, Emas Chiyoda Subsea (ECS), is said to have lost a charter; a second trade creditor is also seeking to wind up ECS's unit.

Mr Tsien, without referring to any oil-and-gas company or creditor, called for "more sustainable and more responsible parties" to be involved in this sector, noting that lenders here have been supportive.

"What we would like to see is some accommodation by most of the creditors" to support an industry that has been developed in Singapore over 20 years, he said.

"This industry continues to have a future. We probably need to make some tweaks to the operating model, and if oil is not something that will be in significant demand, many of these capital investments that we have made can be modified to suit other purposes within the oil-and-gas industry as well.

"It is too soon for anybody to say this is an industry that Singapore does not need."

Mr Tsien noted that the supply overhang includes offshore support vessels that are still in the shipyard, most of which are not yet completed.

"I have some doubt as to whether those will be completed. I'm not too worried about the supply side.

"It is really the demand side, which is not adequate to drive the long-term charter rates."

For vessel operators to generate a reliable cashflow, oil prices need to stabilise at US$65 per barrel (bbl) and climb steadily higher, Mr Tsien added. Then, charterers would be more willing to commit over a longer period. Oil prices are now hovering at about US$55/bbl.

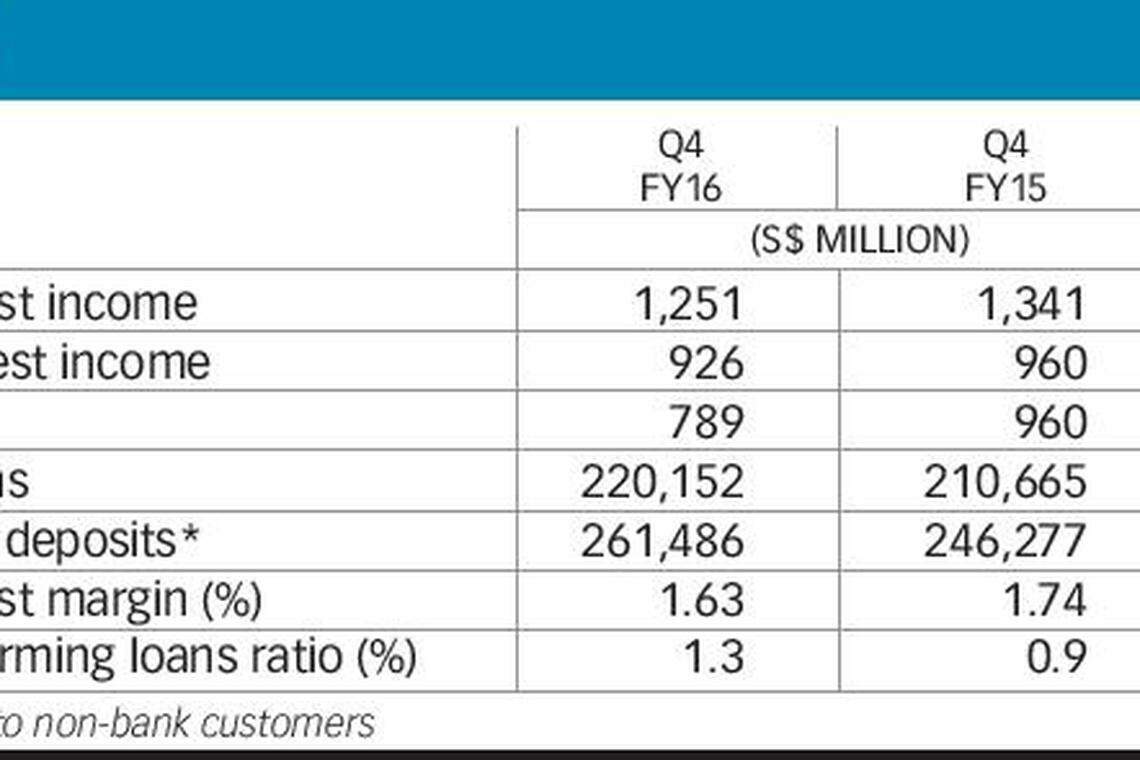

OCBC's net profit for the three months ended Dec 31, 2016, fell 18 per cent to S$789 million. This missed estimates from analysts polled by Bloomberg at S$864 million, and that from Reuters at S$856 million. The results translated to annualised earnings per share of 73.6 cents, down from 90.7 cents a year ago.

Net allowances for loans and other assets rose 57 per cent to S$305 million, with most of it reflecting provisions set aside for oil-and-gas firms. Mr Tsien did not give a figure for the bank's special provision for its oil-and-gas exposure, but said it was adequate. The stress remains contained in the same firms identified in previous quarters.

The offshore-support vessels sector made up 39 per cent of the bank's oil-and-gas balance sheet exposure as at Dec 31, 2016. Of that, 22 per cent was classified as non-performing loans (NPL).

Most of its new NPLs are associated with the sector, with the NPL ratio up to 1.3 per cent from 1.2 per cent in the previous quarter, and 0.9 per cent a year ago. To be clear, just over half of the oil-and-gas NPLs at OCBC are still being serviced.

Amid slowing growth, the rest of the portfolio remains sound, but OCBC is watchful, Mr Tsien said.

Net interest income was 7 per cent lower from a year ago at S$1.25 billion, amid lower net interest margin. Spreads are set to stay tight as banks compete to lend to larger, stronger companies. Loan growth is expected to come in a mid-single digits this year, spurred by Singapore companies investing abroad, he said.

Non-interest income was down 4 per cent from a year ago at S$926 million, as fee income growth was more than offset by lower net trading income and life assurance profit.

Assets under management (AUMs) now stand at US$79 billion, boosted by the acquisition of Barclays' wealth business in Singapore and Hong Kong. Excluding that, OCBC's Bank of Singapore had an 18 per cent organic boost in AUMs over the year.

Full-year net profit was 11 per cent lower at S$3.47 billion.

The bank has declared a final dividend of 18 cents per share, unchanged from a year ago.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Banking & Finance

Money laundering accused Zhang Ruijin slapped with 5 more charges days before scheduled guilty plea

Japanese yen slides back towards 34-year low after brief spike

China’s Bank of Communications Q1 profit rises 1.44%

HSBC’s private bank shuts independent asset management business in HK, Singapore

Nomura Q4 net profit jumps almost eight-fold on retail income surge

Rescue pup to meme star: the real-life ‘Dogecoin’ dog