Singapore dollar surge leaves market expecting pullback in H2

It's now in top quartile of MAS policy band; capital inflows likely to ease in H2 as US$ starts to recover

Singapore

HAS the Singapore dollar (SGD) gone up too much? Yes, say analysts, who believe that it would start to retrace against the US dollar in the second half of this year.

Philip Wee, DBS Bank senior currency strategist, believes that the greenback is oversold. Year to date, the local unit has surged over 6 per cent against the greenback. The SGD and Thai baht have proven to be the strongest South-east Asian currencies this year.

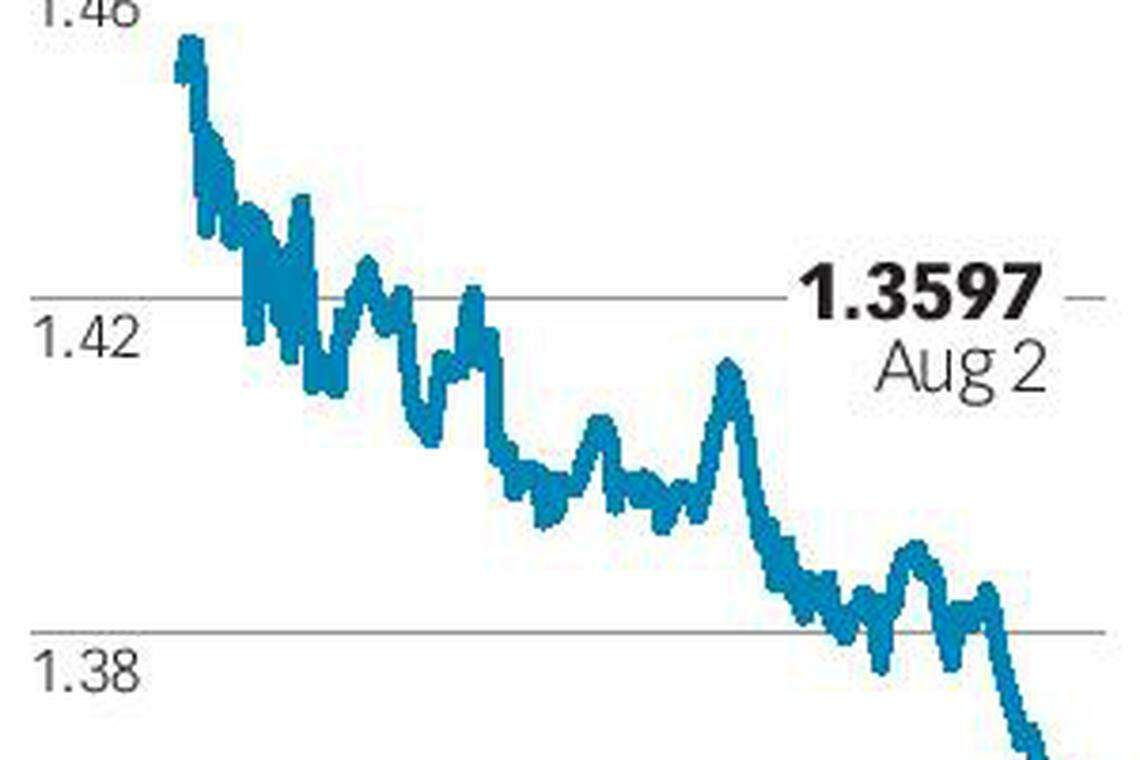

The SGD stood at 1.3597 on Wednesday, slightly off its year's high of 1.3553 on July 31.

Commenting that the SGD was "too strong", Mr Wee said that its rally in July "was inconsistent with Singapore's lacklustre economic and inflation data".

USD/SGD came under heavy selling pressure last month, lifting the SGD nominal effective exchange rate (NEER) into the strongest quartile of its zero appreciation policy band, he said.

Credit Suisse investment strategist Suresh Tantia shares Mr Wee's view, and is looking at a pretty big swing in the next three months. "Given that SGD NEER has risen to one per cent above the midpoint of the policy band, the risk-reward clearly does not appear favourable for the SGD.

"As such, we expect renewed weakness in the SGD and believe the recent strength provides an opportunity to hedge the USD exposure. We expect the SGD to depreciate to 1.42 and 1.44 in three months and 12 months, respectively."

Within Asia, the baht and SGD are not the only currencies that have advanced against the US dollar. It has also been a good year for the South Korean won and the Taiwan dollar, both of which led the appreciation in North-east Asia.

Mr Wee said: "These currencies share a common trait - healthy current account surpluses. One should note, however, that whenever these currencies have appreciated by 6 per cent year to date, they typically run out of steam."

In the case of Taiwan and Korea, Mr Wee cited export competitiveness for the gains. In Thailand and Singapore, currency strength was unwelcome because of low inflation, he said.

Despite the SGD's strength, the MAS is expected to maintain its neutral stance for its SGD NEER policy at its next review in October, said Mr Wee. "That's because trade is improving globally and the SGD NEER is still inside its policy band.

"Based on where our growth/inflation is, the SGD NEER should be closer to the mid-point rather than the ceiling of its neutral policy band."

USD/SGD should start to stabilise between 1.3370 and 1.3820 in H217, said Mr Wee.

According to Tan Teck Leng, UBS Wealth Management Asia Pacific FX strategist, the strength of many Asian currencies is a concern of many central banks.

"Easing US inflation pushed Asia-Pacific (APAC) currencies to new year-to-date highs against the USD, as markets pushed back their expectations for Federal Reserve tightening.

"However, several Asia-Pacific central banks have started to warn about the strength of their currencies."

UBS forecast USD/SGD at 1.38 over three, six and 12 months.

SGD strength is unlikely to continue unabated as another 5 per cent gain in the second half of 2017 is "too excessive", said Heng Koon How, United Overseas Bank head of markets strategy.

He expects the strong capital inflows into Singapore to slow down in the second half as the USD begins to recover.

The US Federal Reserve is poised to start balance sheet reduction (BSR) soon and coupled with another expected interest rate hike in H2, the USD should start to recover and "chances are that strong inflows into Singapore will moderate", said Mr Heng.

He also said that the MAS would stay pat in its October review as the SGD NEER, while it has risen some 1.3 per cent above the mid-point, is within range.

"I don't see any incentive to tighten or loosen the SGD," said Mr Heng. "Going forward, given the SGD's sensitivity to ongoing Fed policy tightening and the possible start of BSR, we can expect some gradual weakness in the SGD.

"As such, we see renewed SGD weakness from 1.36 to 1.42 by 2Q2018."

Divya Devesh, Asia FX strategist at Standard Chartered Bank, also said that the SGD run-up was coming to an end, and would "struggle to gain further in H2".

Since the start of 2017, the USD has been under pressure over disappointing US developments, as well as a strong euro, Mr Wee said. For the year to end-July, the dollar index has depreciated 9.1 per cent to 92.863. The dollar index is now near the floor of its two-year range seen before the the US presidential election last November.

Among the major currencies, the euro has been the best performer this year - up 12 per cent against the USD - which began as a relief rally from positive French election outcomes in April-May, easing EU break-up fears. The next bout of euro strength in June-July was attributed to a markedly more upbeat EU growth/inflation outlook by the European Central Bank.

The euro holds the largest weight of 57.6 per cent in the dollar index.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Banking & Finance

Money laundering accused Zhang Ruijin slapped with 5 more charges days before scheduled guilty plea

Japanese yen slides back towards 34-year low after brief spike

China’s Bank of Communications Q1 profit rises 1.44%

HSBC’s private bank shuts independent asset management business in HK, Singapore

Nomura Q4 net profit jumps almost eight-fold on retail income surge

Rescue pup to meme star: the real-life ‘Dogecoin’ dog