GIC 20-year annualised return at 4.6%, highest in eight years

Sovereign wealth fund says it is focused on investments that protect from inflation

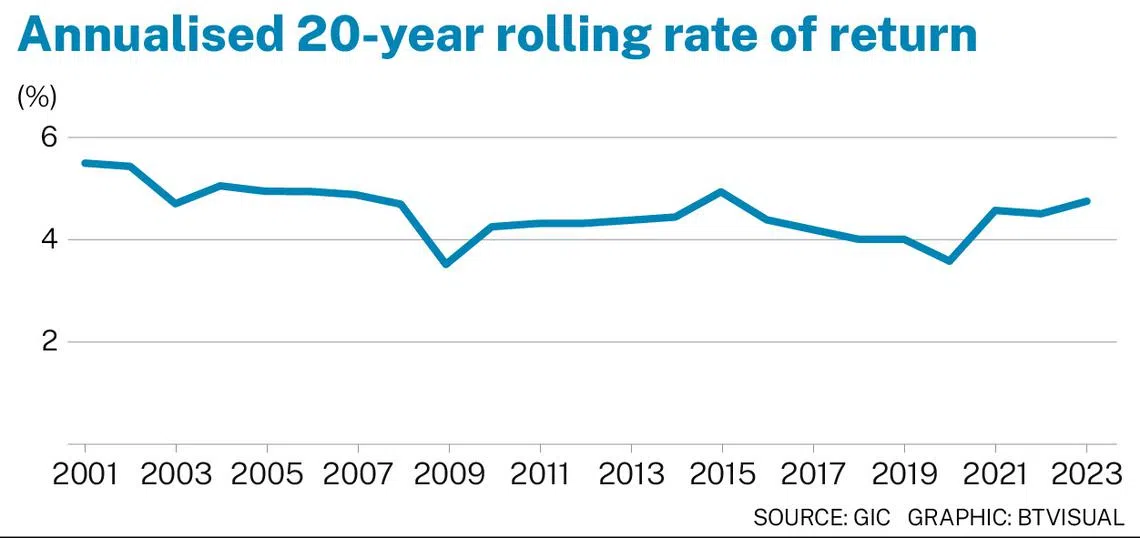

GIC reported an annualised rolling 20-year real rate of return of 4.6 per cent for its latest period ended Mar 31.

This rate of return – which accounts for inflation and spans the 20-year period from April 2003 to March 2023 – is up 40 basis points from the previous year, and is also the highest in eight years.

The annualised nominal rate of return, which does not account for inflation, stood at 6.9 per cent in US dollar terms for the 20-year period.

Nominal return for the five-year period was 3.7 per cent in US dollar terms.

In its annual report published on Wednesday (Jul 26), GIC said the five-year period was weighed down by a slowing of the global economy from the end of FY2022 into FY2023 – although there was a slight recovery towards the end of the financial year.

While the investment environment has remained uncertain since last year, it is looking to be worse than expected amid sticky inflation, higher-for-longer interest rates and chronic geopolitical risks, said GIC group chief investment officer Jeffrey Jaensubhakij.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

GIC chief executive Lim Chow Kiat noted that 2022 was a weak year across most asset classes due to the rapid rise in interest rates.

Increasing the portfolio’s resilience was a key focus for GIC amid the uncertainty, Lim said. “This is why we had raised liquidity and focused on finding investment opportunities with stable long-term returns, including investments in real estate and infrastructure to protect our portfolio from inflation,” he explained.

The portfolio’s share of real estate investments increased to 13 per cent, from 10 per cent in the previous year.

SEE ALSO

Nominal bonds and cash fell to 34 per cent of the portfolio, from 37 per cent a year earlier.

Allocation to inflation-linked bonds remained at 6 per cent, while private equity was unchanged at 17 per cent.

Allocation to developed market equities fell slightly to 13 per cent from 14 per cent a year earlier, while emerging market equities rose slightly to 17 per cent from 16 per cent in the year-ago period.

Dr Jaensubhakij noted that GIC is focused on ensuring the investments it makes have the best chance of generating consistent returns.

“The inflation resilience (of infrastructure) actually offers something to GIC’s portfolio which (it) otherwise doesn’t have enough of,” he said.

For example, rising inflation could boost rental income for GIC’s infrastructure investments. Many infrastructure assets are also services that are needed even during an economic downturn.

GIC is also looking at new investments that will deliver a good risk-adjusted reward. Jaensubhakij noted, in particular, that bond yields and private credit returns have improved since last year.

“All of that is with the view that, whatever year drops out next year, the returns for the current year will be boosted by resilient assets (and) by these new things that we’re going into,” he said.

In terms of geographic exposure, 38 per cent of GIC’s portfolio was in the United States as at Mar 31, and 23 per cent in Asia excluding Japan.

Speaking on investment opportunities in China, Lim said he still sees “significant opportunities for GIC for a long period of time to come”, although the allocation mix will change as the economy evolves.

China is also of sufficient size to sustain a certain level of economic growth, and good entrepreneurs, Lim said, adding that valuations are also not stretched.

GIC chief economist Prakash Kannan said he expects the investment outlook to remain challenging, as inflation will likely stay at relatively high levels amid a strong labour market.

The resilience of the economy “has been remarkable”, with a large part of it being the legacy of the economic stimulus during the pandemic, he added.

Lim said: “Recognising that it’s very hard to predict something like (the possibility of a recession), especially over the short term, we want to prepare for different kinds of scenarios. And sticky inflation is certainly one scenario that we’re preparing for, which partly explains the emphasis on inflation-resilient assets.”

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.