Pharma shipments lift Singapore exports for third straight month

SINGAPORE'S exports unexpectedly jumped 9.7 per cent year on year in April, thanks to a surge in pharmaceuticals, according to data from Enterprise Singapore (ESG) on Monday.

The growth in April's non-oil domestic exports (NODX) marks the third straight month of expansion that again took private-sector economists by surprise. They had predicted a 5 per cent decline, according to a Bloomberg poll.

Nonetheless, economists believe that uncertainties surrounding the Covid-19 pandemic and renewed US-China trade tensions continue to cloud Singapore's trade prospects.

In comparison, March's NODX saw an expansion of 17.6 per cent, which also came as a surprise to economists at the time, as it defied the odds of a coronavirus-led slowdown.

For the month of April, non-electronic products grew 12.8 per cent, due to a 174.3 per cent surge in pharmaceuticals. The category of food preparations rose 66.3 per cent, while non-monetary gold went up by 25 per cent.

OCBC Bank chief economist Selena Ling noted that pharmaceuticals exports were lifted by the Covid-19 pandemic, with medical supplies being in high demand globally.

A NEWSLETTER FOR YOU

SGSME

Get updates on Singapore's SME community, along with profiles, news and tips.

Meanwhile, non-monetary gold exports were likely aided by bouts of risk aversion arising from the pandemic, US-China bilateral tensions, and central bankers' caution over the economic outlook, with US Fed chair Jerome Powell opining that a full recovery of the US economy could drag into 2021, she said.

Separately, ESG noted that pharmaceuticals formed the bulk of the growth in NODX in April, growing from the low base a year ago, but added that pharmaceuticals NODX are typically "volatile in nature and subject to fluctuations across months".

"NODX of pharmaceuticals at about S$0.9 billion in April 2019 were lower than the 2019 average of S$1.4 billion," ESG said.

DBS senior economist Irvin Seah noted that while the pharmaceutical industry has benefited from the pandemic, it has little spillover effect on the rest of the economy, apart from its contribution to the headline gross domestic product (GDP) growth.

"Non-monetary gold has almost negligible benefit to the real economy. While we expect the manufacturing sector to perform better compared to many of the services clusters during this pandemic, it is premature to conclude that this sector is out of the woods," he said.

Meanwhile, electronic exports declined 0.6 per cent in April on a year-on-year basis. The key drags were personal computers, diodes, transistors and disk drives, which fell 44.3 per cent, 13.2 per cent and 32.9 per cent respectively.

Barclays regional economist Brian Tan said the contraction did not appear to be severe.

"The relatively modest deterioration was unsurprising to us as the government's 'circuit-breaker' measures imposed on April 7 to contain the pandemic had included exemptions for electronics manufacturing activities," he said.

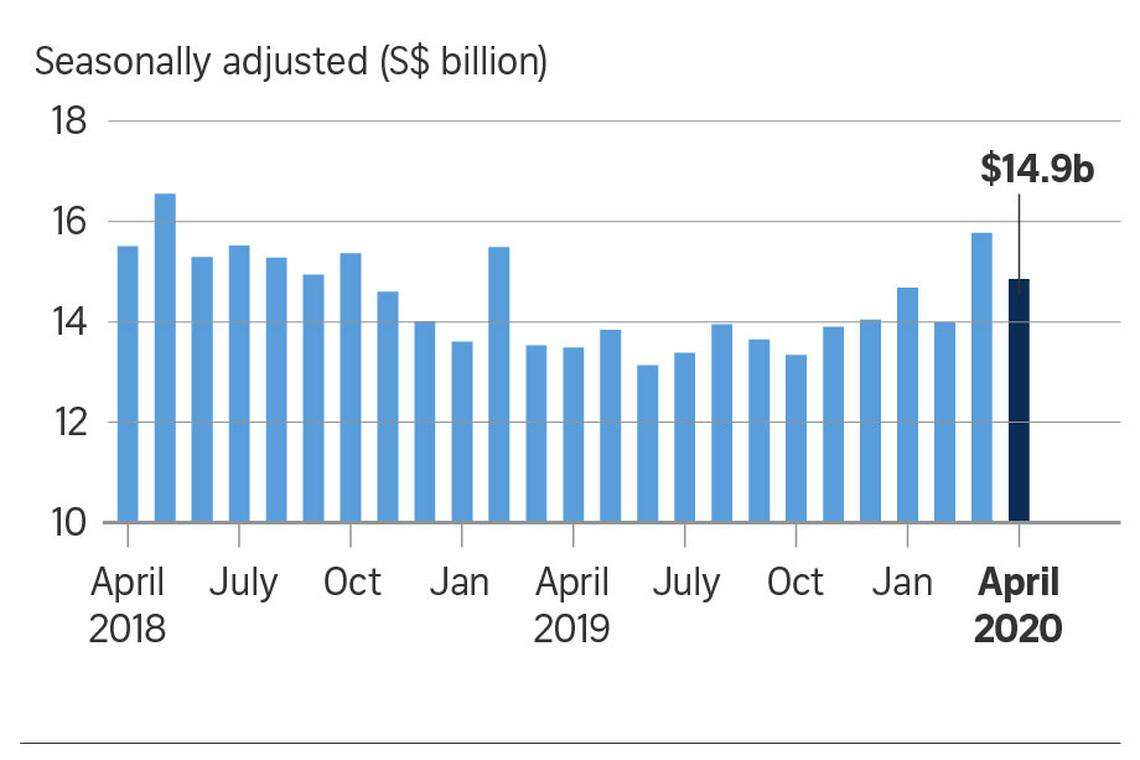

On a seasonally adjusted month-on-month basis, NODX fell 5.8 per cent in April, after the previous month's 12.8 per cent expansion.

Overall, non-oil exports to the top markets grew as a whole last month, though shipments to China, Hong Kong, Malaysia, Indonesia and Thailand declined.

Exports to the US expanded by 124 per cent in April, led by non-monetary gold, food preparations and disk media products. In addition, exports to the European Union rose 106.8 per cent, while exports to Japan grew 81.1 per cent.

On the whole, total trade decreased by 12.8 per cent year on year in April, following a 0.2 per cent decline in the preceding month. Total exports fell by 12.7 per cent, while total imports contracted by 13 per cent in April.

UOB economist Barnabas Gan said the bank is keeping its outlook for NODX to contract by 1 per cent with downside risks, should the pandemic become more widespread, severe and protracted than anticipated.

Barclays's Mr Tan expects the economy to contract by 4.5 per cent this year, following GDP growth of 0.7 per cent in 2019. This is below the Ministry of Trade and Industry's official 2020 GDP growth forecast range of -4 per cent to -1 per cent, he said.

Maybank economists believe the encouraging exports data for March and April suggests that the manufacturing sector may escape recession.

"The 'circuit-breaker' measures may be sparing manufacturing and exports from the full brunt of the lockdown, as they are largely regarded as 'essential services'. The Covid-19 pandemic will be defined as being more of a 'services recession'," Maybank economists Chua Hak Bin and Lee Ju Ye said in a report.

Even so, they are maintaining their forecast for a 2020 full-year GDP contraction of 7 per cent, due to the economic fallout borne largely by the services sector.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Economy & Policy

Daily Debrief: What Happened Today (Apr 26)

Singapore must prepare for slower growth at higher costs: MAS

Outgoing Singapore, Indonesia leaders to hold their final retreat in Bogor on Apr 29

Singapore factory output reverses into negative territory in March, down 9.2%

Singapore’s growth should strengthen to ‘around potential rate’, output gap to close by end-2024: MAS

Gan Kim Yong visits US and Canada; to mark 20th anniversary of US-Singapore FTA