Singapore's Budget 2020 'helped avert 12.4% shrinkage in GDP and reduced inequality'

SINGAPORE's gross domestic product (GDP) could have plunged by more than 12.4 per cent and resident unemployment rate soared to 6.1 per cent - if not for fiscal and monetary policies in 2020, the Ministry of Finance (MOF) has said.

On Thursday, ahead of Budget 2021 that is due to be unveiled on Feb 16, the ministry released a paper assessing the impact of Budget 2020 measures to combat Covid-19. The government had committed close to S$100 billion - or 20 per cent of GDP - in economic support (S$73.5 billion), social support (S$10 billion) and public-health measures (S$13.8 billion) across five Budgets in 2020.

Deputy Prime Minister and Finance Minister Heng Swee Keat, speaking at Shangri-La Rasa Sentosa the same day, said: "While many schemes are ongoing, our early findings are that the measures have helped to cushion the impact of the recession."

He added: "Job losses were averted, and shocks were cushioned. More help went to support families in need, which went some way to mitigate inequality."

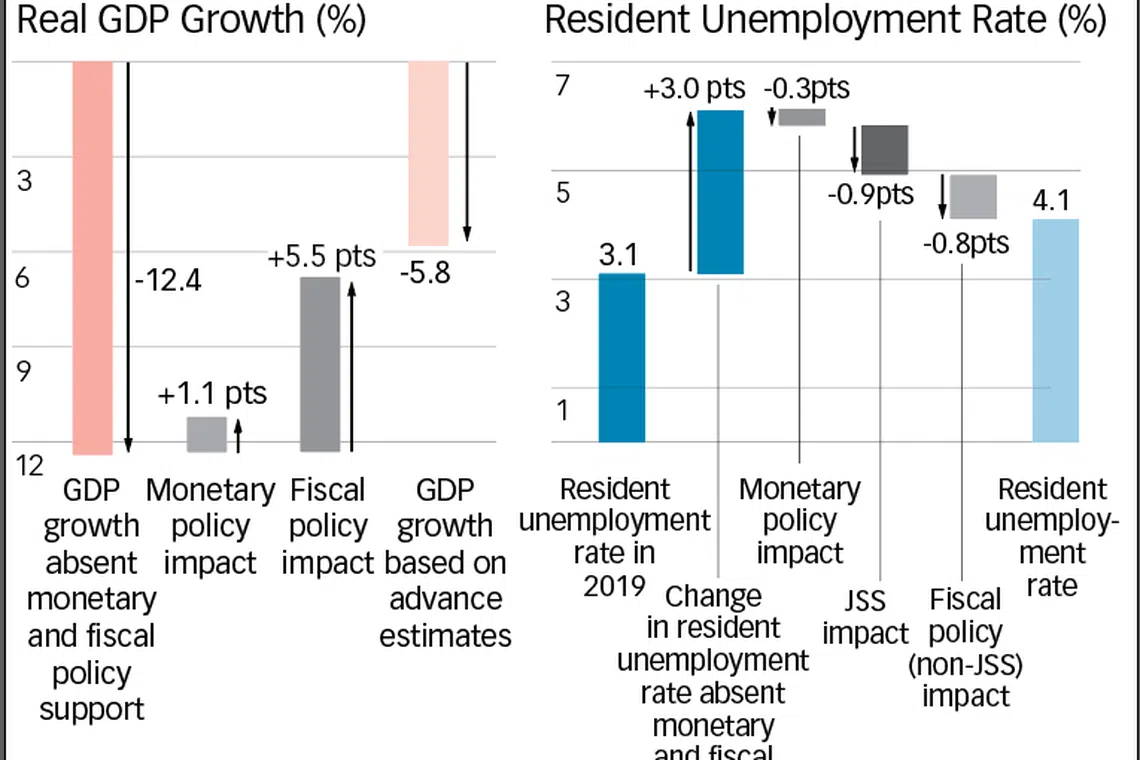

MOF's paper disclosed that without the policy interventions, Singapore's GDP would likely have shrunk by at least 12.4 per cent. Instead, it contracted by a smaller 5.8 per cent. An accommodative monetary policy contributed 1.1 percentage points to growth, and fiscal measures contributed 5.5 percentage points.

Similarly, the resident unemployment rate could have clocked in at 6.1 per cent in 2020, instead of the eventual 4.1 per cent. Monetary policy trimmed 0.3 percentage points from resident unemployment, and fiscal measures contributed the remaining 1.7 percentage points.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

For comparison, a higher resident unemployment rate of 5.2 per cent was recorded in 2003 due to Sars, and 4.3 per cent in 2009 due to the global financial crisis.

These estimates were derived using the Monetary Authority of Singapore's flagship Monetary Model of Singapore, which is used to analyse macroeconomic policy effects over time.

The numbers crunched do not account for measures such as liquidity and credit relief to firms, nor rental and other relief under the Covid-19 (Temporary Measures) Act. Otherwise, Singapore's potential GDP contraction would likely have been even steeper than simulated.

To mitigate the uneven impact of the recession, the government tilted its support measures towards more affected sectors, smaller firms and lower-income households.

In total, firms received S$27.4 billion in grants, up from the S$1.5 billion disbursed in 2019. This includes S$22.6 billion in Jobs Support Scheme (JSS) grants disbursed between April and December, under the S$26.9 billion scheme. The remaining grants disbursed included the foreign worker levy rebate, wage credit scheme and rental grants for small and medium-sized enterprises.

Firms in the hard-hit aviation, aerospace and tourism sectors, dubbed "Tier 1" firms, received the largest amounts of JSS payouts on a per-firm and per-worker basis - S$1 million per firm, and S$20,000 per local employee on average. Tier 2 firms received S$100,000 per firm and S$9,000 per local employee, as did Tier 3 firms.

After JSS payouts began, Tier 1 firms' share of total job losses in the economy shrank from 12 per cent from January to March (pre-JSS), to 6 per cent from March to July; this suggests that the payouts helped them retain workers.

Tier 2 firms' share of total job losses similarly decreased from 30 per cent to 16 per cent in the same period.

Besides grants, the government also risk-shared enterprise loans. Over 20,000 firms accessed some S$17.4 billion in loans from March to December, compared to S$1.3 billion for the whole of 2019. About 90 per cent of enterprises supported were micro and small and medium-sized ones.

For job seekers, the government introduced the SGUnited Jobs and Skills Package in May, and the Jobs Growth Incentive in August. The former offered jobs and training places; the latter provided salary support for new local hires.

Just as the government tilted its economic support to harder-hit firms and job seekers, it also tilted social-support measures towards lower-income groups. Two forms of support were provided. The first was the broad-based Care and Support Package, with cash and non-cash components (like utilities rebates), received by all Singaporean households.

The second comprised more targeted schemes for individuals who had lost their jobs, suffered drops in their incomes, or who were self-employed with less means and family support. The initial Temporary Relief Fund offered a one-off S$500 to individuals who needed urgent help. Subsequently, the Covid-19 Support Grant and Self-Employed Person Income Relief Scheme gave cash assistance to eligible workers and self-employed persons respectively.

On average, each member of a Singaporean household received about S$2,000 from these two forms of support combined. Households in the bottom income quintile received a higher sum of S$2,500 per member, compared to those in the second quintile (S$2,800), third (S$2,200), fourth (S$1,600) and top quintile ($1,100).

While bottom-quintile households received less than those in the second quintile, MOF said this was because many in the bottom quintile were retirees. They did not qualify for benefits given to those who suffered job losses or decreases in income, but received separate support, such as through the Silver Support Scheme.

The progressive tilt of these transfers helped to significantly reduce Singapore's Gini co-efficient this year, from 0.452 prior to taxes and transfers, to 0.375. This is a larger reduction than seen in 2019, when taxes and transfers brought the Gini co-efficient from 0.452 to 0.398.

The Gini co-efficient is a measure of income inequality, with zero indicating total equality, and one indicating total inequality. In other words, despite Covid-19's outsized impact on lower-income workers globally, Singapore ended 2020 with less income inequality than in the year before.

Read more:

Real household incomes decline for first time in more than 10 years

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.