Singapore non-oil exports down 8.9% in August, better than expected

SINGAPORE'S non-oil domestic exports (NODX) fell 8.9 per cent year on year in August, performing better than economists' expectations of a 10.6 per cent fall and breaking a five-month streak of double-digit declines, according to Enterprise Singapore figures on Tuesday.

But with the improved performance coming on the back of gold exports, economists remain divided on whether Singapore will dodge a technical recession - two consecutive quarters of sequential decline - in the third quarter.

Maybank Kim Eng economists Chua Hak Bin and Lee Ju Ye noted that "the improvement was inflated by a surge in gold exports to China", with the weakening yuan possibly having increased demand for gold as a safe haven. Thailand's recent exports numbers also show a surge in gold demand, they added.

The August NODX decline eased from July's 11.4 per cent fall, in the second consecutive pickup since June's six-year low. On a month-on-month seasonally adjusted basis, NODX rose 6.7 per cent in August, strengthening from July's 3.5 per cent growth.

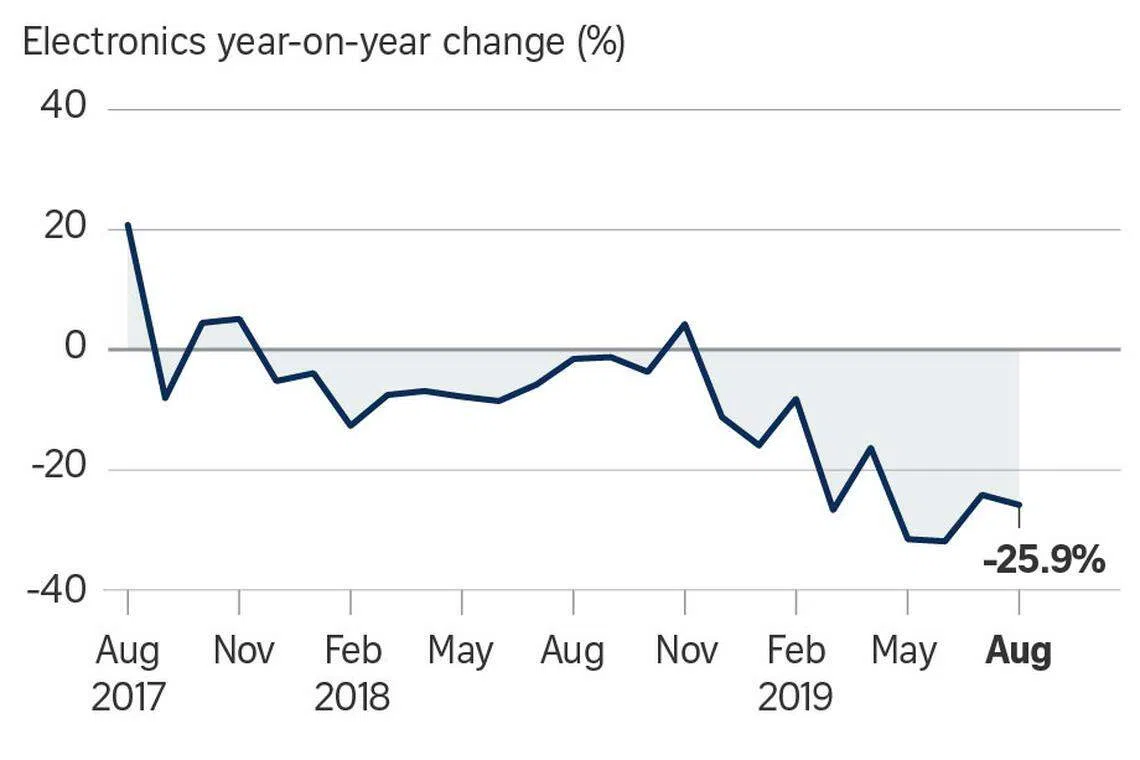

Electronic NODX was down 25.9 per cent year on year in August, steepening from the previous month's 24.2 per cent fall. Contributing the most to this decline were contractions in exports of integrated circuits (-32.1 per cent), PCs (-28.6 per cent), and disk media products (-11.9 per cent).

However, economists noted that this was due partly to a high base effect from 2018, with OCBC Bank head of treasury research and strategy Selena Ling adding that "the underlying electronics momentum appears to be stabilising with the second month of month-on-month growth".

The Maybank economists also see tentative signs of a bottoming-out in electronics NODX, with export levels reaching the highest since January.

Non-electronic NODX declined 2.2 per cent, easing from the previous month's 6.7 per cent fall. Contributing most to the decline were pharmaceuticals (-23.6 per cent), petrochemicals (-20.8 per cent) and primary chemicals (-29.3 per cent).

Barclays economist Brian Tan highlighted the boost given by exports of non-monetary gold, which more than doubled in August (up 133 per cent). "Excluding pharmaceuticals and gold, NODX would have fallen more sharply, by 15.5 per cent year on year in August compared to the 9.2 per cent drop in July," he noted.

NODX to nine of Singapore's top 10 markets declined year on year, with China being the exception with 38.5 per cent growth. The fall was led by Hong Kong (-32 per cent), the United States (-15 per cent), and Malaysia (-19.7 per cent).

It remains to be seen if the NODX growth rebound for China - from a 5.1 per cent fall in July - can be sustained, said Ms Ling: "At this juncture, it is difficult to determine how much of the pickup was due to front-loading activities ahead of the Sept 1 tranche of US tariffs against Chinese imports or due to the lower NODX base in H2 2018."

Economists are divided on whether the economy will avoid a technical recession in the third quarter, but agree that the Monetary Authority of Singapore is likely to loosen monetary policy at its upcoming October meeting regardless.

Oxford Economics economist Sung Eun Jung noted that non-oil import volumes contracted 3.6 per cent year on year in August, "hinting at weak domestic activities", in line with its view that manufacturing activity will remain very weak. Oxford Economics expects Singapore to dip into a manufacturing-led technical recession in Q3, with full-year gross domestic product growth at about 0.5 per cent.

In contrast, Barclays' Mr Tan, Citi economists Kit Wei Zheng and Ang Kai Wei, and the Maybank economists think a technical recession can be avoided. The Maybank economists see this happening on the back of front-loaded exports, stronger ACU (Asian currency units) lending and a diversion of visitors from Hong Kong.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Economy & Policy

Daily Debrief: What Happened Today (Apr 26)

Singapore must prepare for slower growth at higher costs: MAS

Outgoing Singapore, Indonesia leaders to hold their final retreat in Bogor on Apr 29

Singapore factory output reverses into negative territory in March, down 9.2%

Singapore’s growth should strengthen to ‘around potential rate’, output gap to close by end-2024: MAS

Gan Kim Yong visits US and Canada; to mark 20th anniversary of US-Singapore FTA