SMEs going global open door for banks to grow corporate credit cards

The cards, which are tagged to companies but come with personal perks, help SME bosses manage and reconcile expenses

Singapore

AS LOCAL small and medium-sized enterprises (SMEs) venture overseas, the travel and spending habits of SME towkays have caught the eye of several banks here.

A survey published by American Express and Singapore Airlines on Aug 1 found that SME owners travel at least once every six weeks for business, and 70 per cent of them have employees travelling two or more times per month.

These numbers could increase as SME owners indicate they are bullish despite the tough macro environment - over 74 per cent expect to grow their businesses over the next 12 months.

Banks are targeting SMEs, and their owners in particular, with credit cards that are tagged to their companies but come with personal perks that most commercial credit cards lack.

In May, United Overseas Bank (UOB) launched the UOB Regal Business Card for C-level SME executives, after conducting a joint survey with Mastercard on what such individuals use their commercial credit cards for.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The number of SMEs using UOB commercial credit cards has increased by more than 65 per cent over the last five years, and the survey showed that three in five of these SME owners use the cards for travel and business entertainment expenses overseas.

The survey also found travel and entertainment to make up the bulk of credit card spend for 69 per cent of business owners.

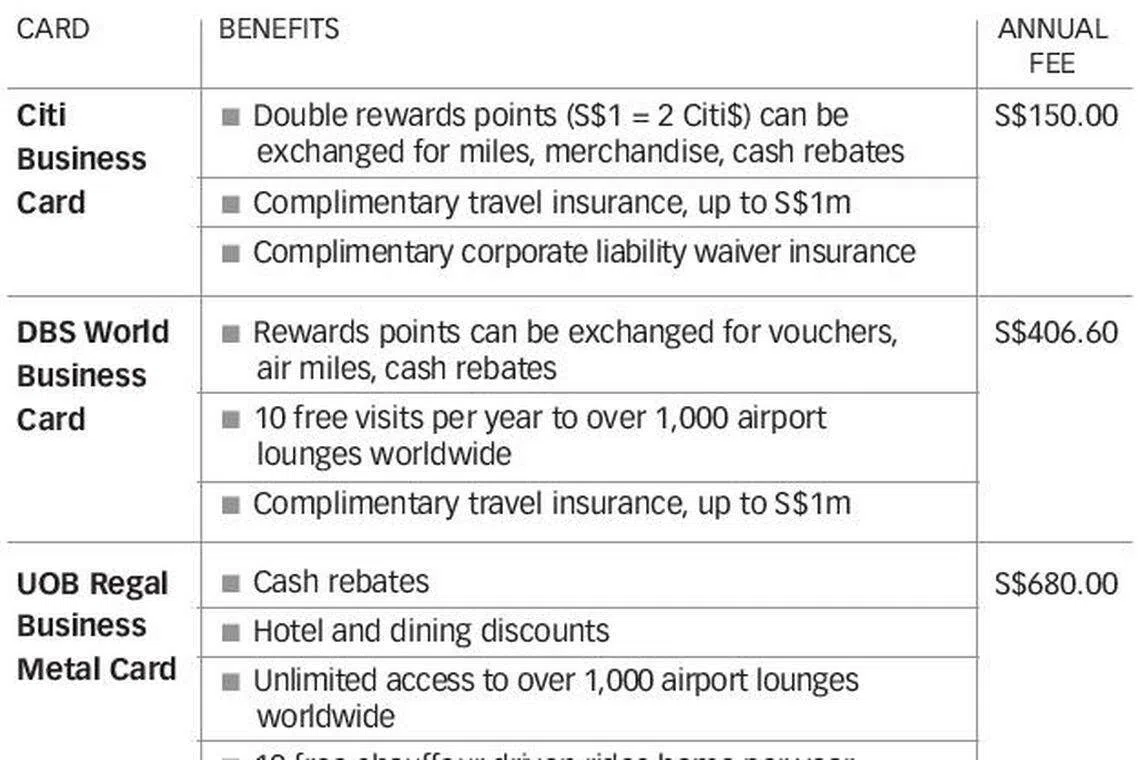

UOB saw an opportunity for SME owners to earn more benefits with their business expenditure, and designed the UOB Regal Business Card to offer privileges like unlimited access to airport lounges, complimentary chauffeur-driven rides, and rebates for dining spend both locally and overseas.

"One way SMEs can optimise their cash flow and gain more value on their business expenses is through the use of commercial credit cards... They can also use the suite of commercial credit card benefits that are designed for SME owners to draw greater value on their business expenses," said Choo Wan Sim, UOB head of cards and payments for Singapore.

At DBS, SME business owners and employees with an annual income of S$80,000 can sign up for the DBS World Business Card, which was relaunched in 2017.

It offers rewards points that can be redeemed for cash rebates, shopping vouchers or air miles, as well as complimentary access to airport lounges and complimentary travel insurance.

Joyce Tee, group head of SME banking at DBS Bank, said: "Managing expenses and reconciliation can be a hassle, and some of our SME customers spend up to 40 man-hours a month on this. It's even more tedious if they use their personal credit cards to make payments for expenses such as road tax or office equipment.

"With corporate credit cards, they can make these purchases without having to go through the hassle of paying out of their own pocket and claiming it back from the company afterwards."

Desmond Ong, CEO of local SME Galmon, said he enjoys using the DBS World Business card because it offers personal perks, while still keeping his company and personal expenses separate for easier accounting and consolidation.

"I often travel for work, so the lounge access is a nice luxury," Mr Ong added.

In June, DBS added a corporate instalment payment plan scheme for DBS World Business cardholders, allowing them to spread large purchases out over six to 12 months at zero per cent interest.

This will help companies manage their cashflow and stabilise business operations, the bank said.

Another card for SME business owners, Citibank Singapore's Citi Business Card, was launched in 2005 in an effort to offer relevant products and services to the many business owners in the emerging affluent and affluent segment.

It offers double rewards for every dollar spent, and reward points can be redeemed for miles, merchandise and cash rebates.

In addition, the card provides complimentary travel accident insurance and corporate liability waiver insurance.

Said Vikas Kumar, head of cards and personal loans at Citibank Singapore: "We see a big opportunity to capture a share of business expenses with the Citi Business Card and offer SME business owners the opportunity to better manage their cash flow with extended payment terms as well as savings in the form of rebates or rewards."

He added: "Since (its) launch, we have seen a steady double-digit growth in Citi Business Card customers' spend year-on-year."

Copyright SPH Media. All rights reserved.