🎯 Is saving S$100,000 by 30 possible?

- Find out more and sign up for Thrive at bt.sg/thrive

🧮 Is it possible?

Having S$100,000 by the time you turn 30 has somehow become a shared milestone for many Singaporeans. The truth is, there isn’t any particular mathematical basis to those numbers. Nor is anything magical going to happen to you once you hit that Chad six-digit status.

According to financial independence advocates, the idea behind this goal is that it’s relatively achievable even without a fat salary.

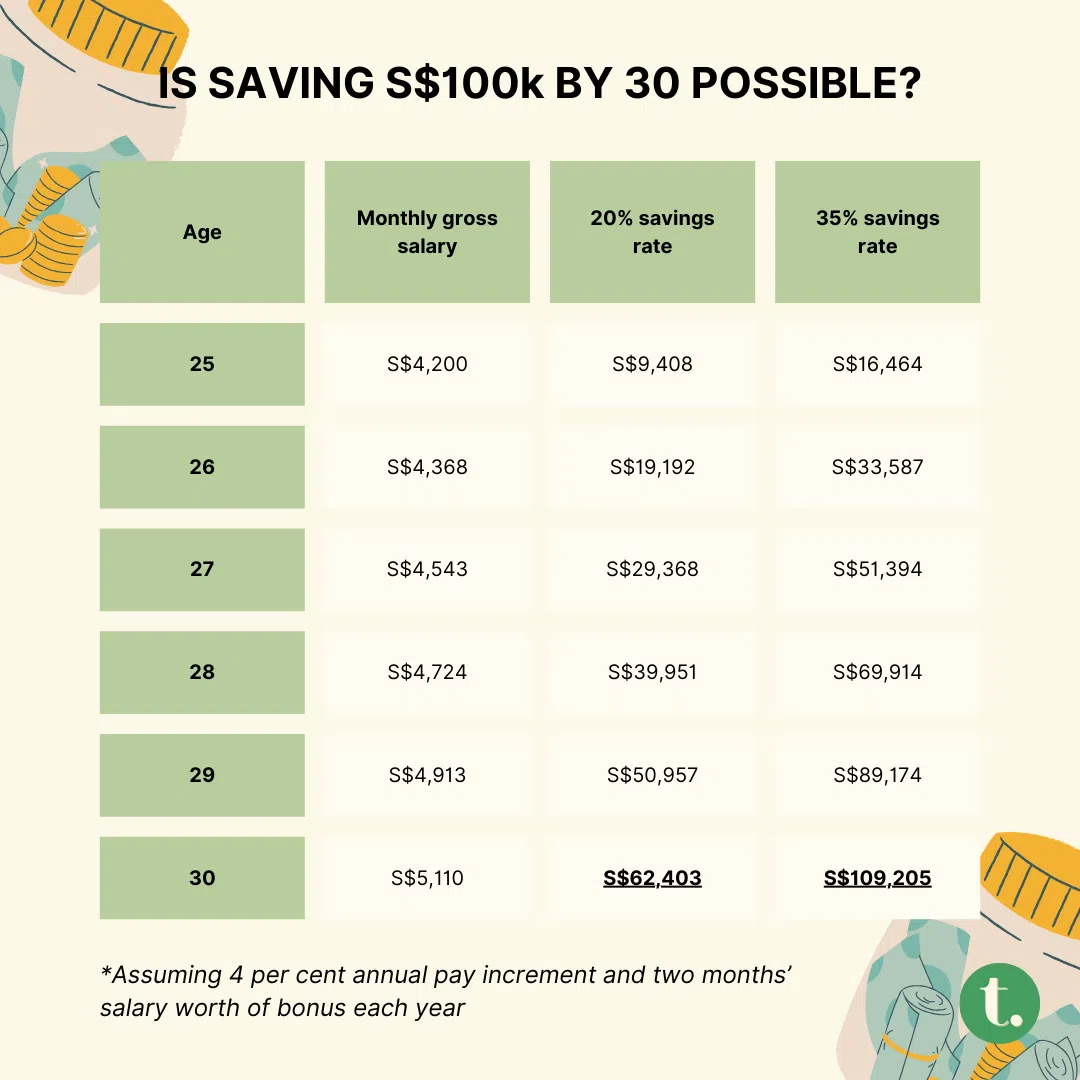

I decided to run some numbers to see if that is true 🤓. As a starting point, let’s base the calculations on a male fresh graduate starting work at 25 and earning S$4,200 – the median gross monthly salary for university graduates in 2022. We’ll call him Joe.

Let’s also assume that Joe receives annual pay increments of 4 per cent and gets two months’ salary worth of bonuses each year.

My calculations showed that if Joe saved 20 per cent of his take-home salary after Central Provident Fund (CPF) contributions, he would only have saved just S$62,403 at age 30.

But if he bumped that savings rate up to 35 per cent of his income he would have exceeded his savings goal with S$109,205 at 30. And that’s without accounting for any gains made from investing those savings.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

What did we learn from the number crunching? It is possible for the average university graduate to save S$100,000 by 30, but not without some effort to religiously set aside about a third of one’s monthly salary.

Before the brickbats start flying, the calculations also come with big caveats – which also means you shouldn’t beat yourself up for not achieving this goal.

🖐️ The ‘buts’

There are several things the calculations don’t take into account.

- People have different starting points in life. For one, Joe in the example above doesn’t have to worry about student loans because his parents paid for his university education.

- People start work at different ages. If Joe had gone to a polytechnic instead of a junior college and gone to university after that, he would have started work at a later age.

- Not everyone goes to university. The median gross monthly salary for polytechnic graduates was lower at S$2,800 last year, but poly grads also typically start work at an earlier age.

- People have different priorities. Because Joe was so focused on saving S$100,000 by 30, he doesn’t have a partner and has no mortgage to pay.

- People have different definitions for what makes up S$100k. For some, the S$100k figure refers to net worth, or assets less liabilities. For others, it’s just pure savings in their bank accounts. There are also those who include just cash and investments without taking into account CPF.

There’s one more caveat that you may have noticed I’ve yet to mention, given how much it’s been talked about lately – inflation.

This “S$100k by 30” goal has been on people’s lists for more than a decade but that number has never changed. This goes to show the arbitrary nature of the goal.

Adjusting for inflation with 2013 as the base, that goal should really be updated to above S$110,000, which means Joe saving 35 per cent wouldn’t even cut it.

🧗 Is there merit to such goals?

Despite the shortcomings, financial advisor Tan Chin Yu believes there’s merit to the “S$100k by 30” movement, except not so much as a goal to fixate on but as one of several benchmarks to tell where you’re at with your savings.

“It’s more of a comparison against how society is doing versus yourselves and whether you’re far off,” says Tan, who leads the advisory team at fee-only wealth advisory Providend, though it’s hard to tell how many people actually do reach that target.

Tan adds that the more important benchmark we should be looking at is our savings rate, which is a better predictor of a person’s personal finance success 🎖️.

“Because if you earn a lot, it’s easier to reach that S$100,000. But if you also spend a lot, that S$100,000 is not going to be enough in your personal situation,” he says.

Tan recommends saving at least 15 per cent to 20 per cent of your salary, which should put you in a good position by the time you’re in your 40s and 50s 😉.

Instead of relying on arbitrary targets like saving S$100,000 by 30 or S$1 million by 65, Tan believes we should be more intentional with our goals.

Work out how much you’ll need at different key stages of your life – for a house, home renovations, raising children and their education, and so on. Also, decide when you want to retire and what sort of lifestyle you want in retirement.

From there, you’ll have financial goals that are suited to your individual situation and needs.

If you find that you’re not on track with your goals, closing up the shortfalls will involve re-prioritising your goals and figuring out the trade-offs, he says.

“It could be saving more today or shifting your expectations for the future,” he says. “That’s why it’s important to start planning early and be very intentional about it.”

TL;DR:

- Saving S$100,000 by 30 is possible, but not without some effort

- But everyone’s circumstances are different, and the goal doesn’t account for that

- You’re not doomed if you don’t hit the goal

- Instead, compare your savings against your personal needs and circumstances to see if you’re on the right track

Copyright SPH Media. All rights reserved.