☔ You probably aren’t saving enough

- Find out more and sign up for Thrive at bt.sg/thrive

👿 You are not prepared!

If you’re between the ages of 18 and 24, chances are you don’t have enough money saved up for a rainy day. At least that’s according to a recent survey by insurance and investment firm Singlife, which found that three-quarters of young adults don’t have enough savings to tap into during an emergency.

The survey results, published in August, found that only:

- 37 per cent could maintain their current lifestyle or continue paying bills for at least 12 months in the event of unexpected circumstances

- 37 per cent had sufficient savings to tap for unexpected situations

- 40 per cent could afford hospital bills if they fall ill

Granted, it’s likely that many survey respondents were either students or had just started working, but the results are concerning when you consider how much young people are spending.

In an informal online poll by The Business Times in March, more than a third of the 72 young respondents said they spent more than 20 per cent of their monthly income on “non-essential” purchases, such as buying skincare products, dining at pricier restaurants , attending concerts and paying for fitness classes.

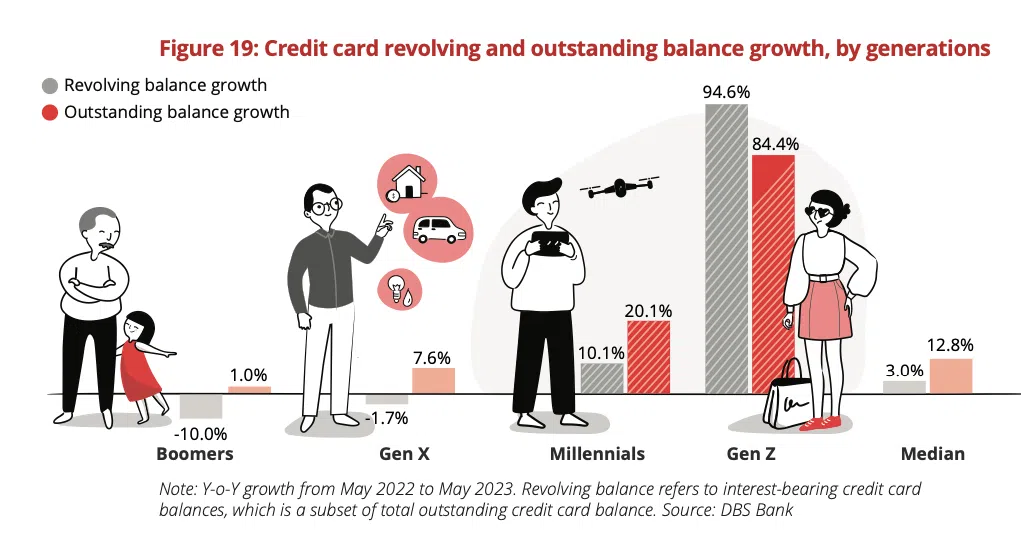

More recently, a report by DBS in July flagged Gen Zs as being more vulnerable to credit card stress. Customers aged 26 and below saw the sharpest growth in their outstanding credit card balances among the different age groups.

To be sure, DBS also found that Gen Z customers were spending a smaller proportion of their income compared with last year; the bank attributed this to a moderation of pent-up post-pandemic spending.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

What does this all mean?

While it’s normal to want to buy all the things you’ve always wanted now that you have adult money, being an adult – sadly 😢 – also means you need to start making smart financial decisions.

That’s especially true right now. With the high cost of property and owning a car right now, it’s all the more important to start saving earlier so you can reach your financial goals.

And just last month, Singapore announced higher water and public transport fees – more things to factor into your financial planning!

(One more statistic to back up this point: A survey by Etiqa Insurance Singapore found that close to half of Gen Zs and millennials are worried that their salaries are not keeping up with the rising cost of living.)

🧠 Get smart with your money

So where do I start? When it comes to financial literacy, there are generally a few main pillars.

Budgeting, a.k.a. not running out of money every month. Budgeting is having a plan for how much of your salary to save or spend. Some people like to follow the 50/30/20 rule, splitting their income into needs, wants and savings.

Protection. In case of costly emergencies, you’ll need to take steps to safeguard yourself. This entails having an emergency savings fund (many recommend three to six months’ worth of expenses) and having the appropriate insurance.

Managing loans and credit. Not all debt is bad. When you want to buy a house, taking up a loan can be beneficial even if you’re rich enough to pay for it in cash. But learning about your credit scores and building a healthy credit history – such as through using a credit card regularly – is often overlooked. This is important because it’ll affect how much banks are willing to loan to you for a house or car.

Savings and investments. Your future goals, such as buying a house or retirement, will often require large sums of money. Once you’ve protected yourself against emergencies, investing your money can help you reach your aspirations – provided you manage your risk well. Even if you need to start small, the earlier you start saving, the better.

Reading surveys and online posts about the amount you’ll need to retire or feel financially secure can seem daunting, but the good news is that it’s very doable.

According to Singlife’s survey, participants said they needed savings of S$566,640 on average to feel financially free. This translates to 27 years of savings based on median monthly savings of S$1,733 per month, per the insurance company.

This means that unless you’re above 35 years old now and starting from zero, chances are you’ll have enough to feel financially free before the retirement age of 63.

But if you have more ambitious goals, that’ll depend on your ability to earn more and how well you optimise your finances. 💪 You got this!

TL;DR:

- Three-quarters of young adults don’t have enough savings, a recent survey has found

- With spending on the up, young adults have been flagged as being more vulnerable to credit card stress

- Being financially literate is all the more important now as the cost of living rises

- Being smart with your money entails knowing how to budget, protect against emergencies, manage credit and save

Copyright SPH Media. All rights reserved.