Reshaping the office market: De-densification and decentralisation

Offices will need to be revamped to support new ways of working. More occupiers are also providing satellite offices and on-demand spaces.

MORE office occupiers are opting for a hybrid-work approach, having experienced the effectiveness of remote working.

Based on Cushman & Wakefield's Experience per Square Foot insights, employees want to have the choice to work from home or office, and find it important to be in the office a few days a week. The office will therefore remain highly relevant in a post-pandemic world.

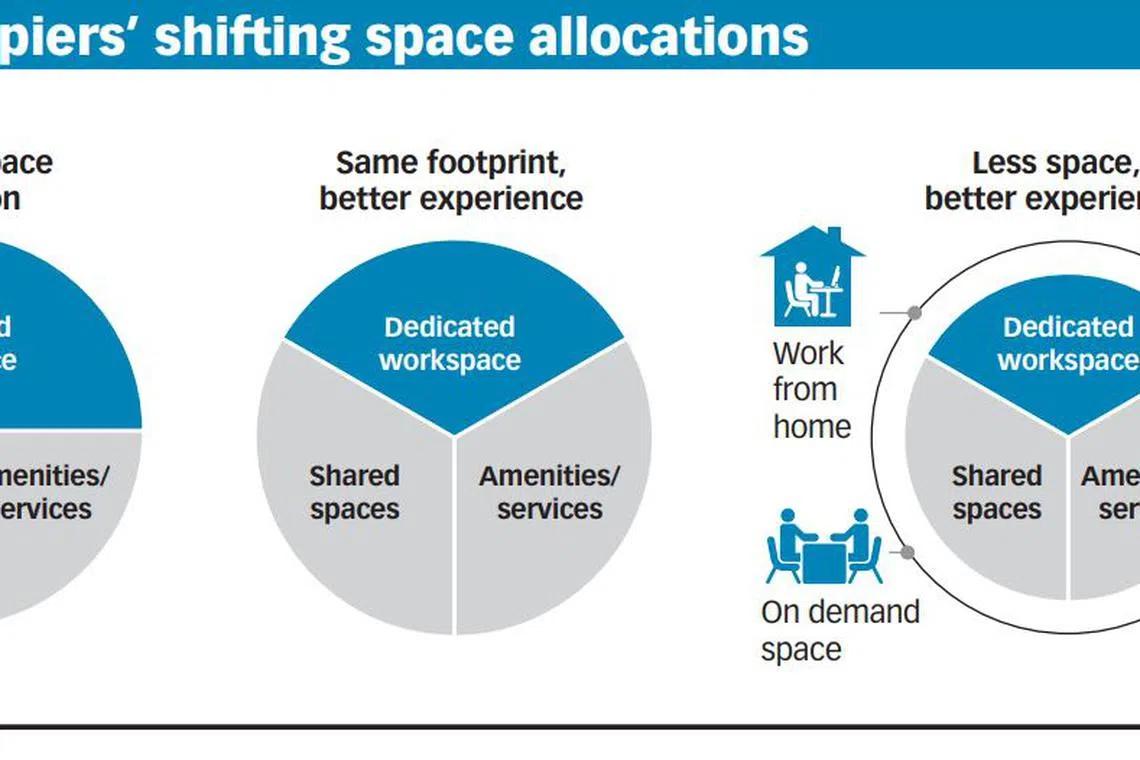

CHANGING SPACE ALLOCATIONS

The traditional office environment - with predominantly individual dedicated workspaces - will no longer be able to support the priorities of collaboration, knowledge-sharing, culture and connection that employees expect when they return to the office.

Offices will need to be revamped to support new ways of working.

We see companies adopting two potential solutions to redesign the office, with the aim of turning the workplace into a desired destination to enhance employee experience and drive business performance.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

One possibility is to realign the space within the same amount of real estate footprint to create better experiences.

Another option is the ecosystem approach whereby companies tap on external workspaces, such as through flexible working and working from home. Such hybrid work arrangements will not only help occupiers rationalise their space requirements, but also potentially improve employee satisfaction.

Both approaches involve changing space allocations by incorporating more collaborative or shared spaces as well as areas for amenities, at the expense of individual workspaces.

The rise of telecommuting could see fewer workers return to the office, resulting in lower physical occupancy. This provides an opportunity for occupiers to consider converting some of the dedicated workspaces into other uses.

DE-DENSIFY WITH MORE SPACE?

To determine whether there is an opportunity to trim its footprint, repurpose existing space, or even expand, each occupier will need to review these key components: past or present space utilisation data, the company's future direction of working, as well as the new definition of their offices' role and the safety protocol to be implemented as part of the employee experience.

After obtaining clarity on these components, occupiers will be able to further look into their existing office space allocation and redefine the workplace experience.

A company with a lower office density may have more options to realign its workplace according to its new way of working within the existing real estate footprint.

However, occupiers that are operating out of a smaller space and denser work environment may need to consider expanding their footprint, in order to bump up allocation for shared spaces. The likelihood of this happening will depend on the rental rates in that market.

Singapore's average office is fairly dense at 11 square metres (sq m) per desk, versus other major cities such as New York with a per-desk density of 16 sq m and Tokyo at 11.9 sq m. While there may be pressure for Singapore occupiers to make their offices less dense by increasing their footprint, the Republic's relatively high office rents would dampen this need.

Therefore, if the sole intention is to de-densify their offices, we will see limited decisions by Singapore companies to take up more space within the same submarket, as they strive to maintain cost efficiencies.

Instead, any increase in office footprint will mostly be driven by business growth.

HEALTHY DEMAND FOR DECENTRALISED GRADE A OFFICES

More occupiers are embracing the ecosystem approach - providing satellite offices and on-demand spaces - to better attract and retain talent.

As such, demand could go up for decentralised offices, which are near employees' homes and offer a cost-effective option for employers.

Occupiers can incorporate flex space into their workplace strategy and partner co-working operators to provide decentralised options. Already, more co-working spaces are opening in decentralised locations such as one-north and Tampines.

Also, office tenants such as tech companies which are expanding their footprint rapidly or planning to de-densify their offices would look towards decentralised locations, where rents are relatively cheaper.

As at the second quarter of 2021, central business district (CBD) Grade A office rents stood at S$9.60 per square foot (psf) per month, higher than decentralised Grade A office rents, which averaged about S$7.07 psf per month.

Furthermore, an expected rise in CBD Grade A rents could push some CBD occupiers to decentralise to contain costs. CBD Grade A rents are anticipated to grow 3-4 per cent per annum over the next few years, driven by strong economic prospects and limited new supply.

More ageing office developments are likely to be redeveloped, amid robust private home prices and tenants' strong preference for new and prime offices. Some of the existing tenants displaced from these ageing buildings could move to decentralised Grade A offices that command rents comparable to lower-grade CBD developments' rates.

However, the supply of new decentralised offices is expected to stay tight. Most of the office space at Rochester Commons in one-north, slated for completion in 2022, has been pre-committed by Sea Ltd. After that, the next major decentralised supply will come only in 2024, at SP @ Labrador Villa, located within the Harbourfront/Alexandra submarket.

While we see sustained demand for decentralised offices, not all such properties will perform equally. Growth prospects will be stronger for mature submarkets such as one-north and Alexandra/Harbourfront, which already enjoy a strong branding and are underpinned by a critical mass of industries such as tech, biomedical and finance.

The Paya Lebar Central precinct will also be one to watch as a Business Improvement District (BID) programme is expected to inject vibrancy into the area.

Other decentralised submarkets, which have not yet attracted a critical mass of industries, may lag behind.

To boost leasing demand, landlords of decentralised offices can invest in shared amenities such as multi-purpose collaborative spaces.

This would be attractive to occupiers, who will be able to use the amenities without including them within the companies' real estate footprint, allowing for cost savings.

For example, Rochester Commons has a purpose-built executive learning centre, Catapult, featuring technologies such as virtual and augmented reality.

While the performance across the decentralised office submarkets will be uneven, rents are broadly expected to return to growth by 2022.

On average, decentralised office rents are expected to rise about 2-3 per cent per annum, driven by limited new supply and increasing demand as more occupiers explore the benefits of decentralisation.

- Carol Wong is Cushman & Wakefield's total workplace lead for Asia-Pacific and Wong Xian Yang is the Singapore head of research.

READ MORE:

- Singapore office landlords embrace flexibility and tech as they spruce up properties

- CBD Grade A and B office rental gap to widen further

- Facelifts for office buildings

- Singapore property investment sales could return to pre-Covid levels

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.