CBD Grade A and B office rental gap to widen further

Growth of the flexible-workspace sector and accelerated expansion at technology firms due to the pandemic are among the factors boosting demand for Grade A office space.

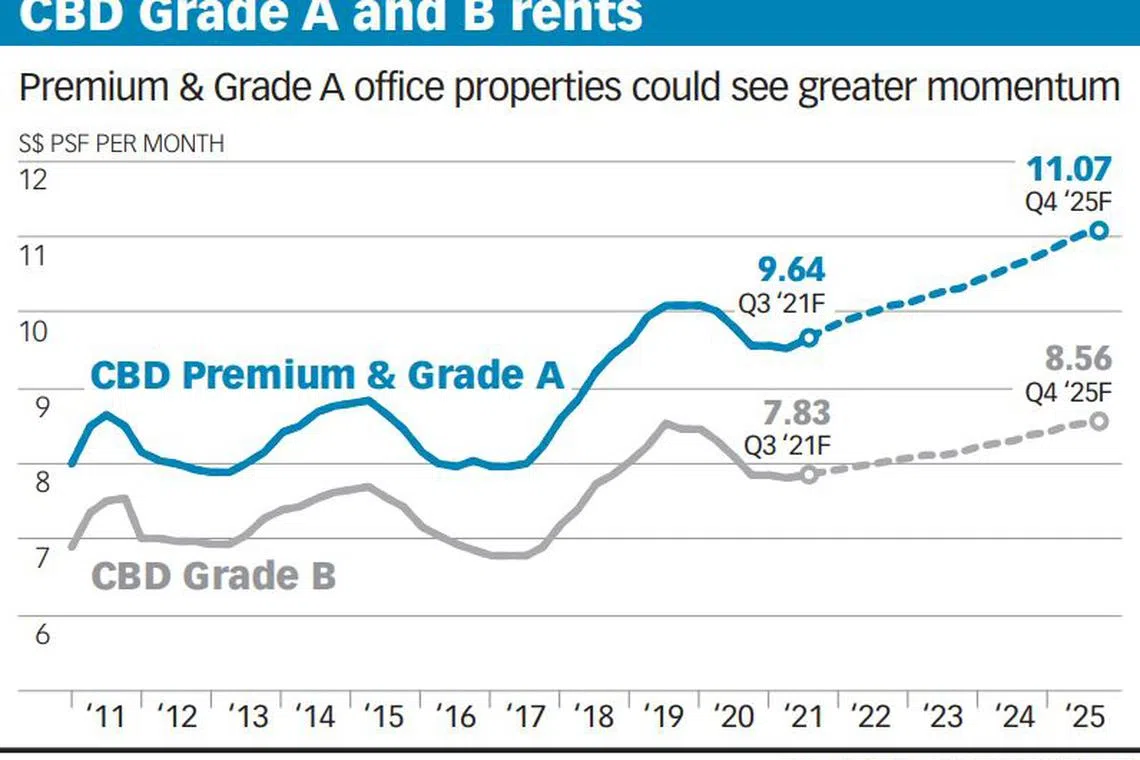

SINGAPORE'S office market has stayed relatively resilient in the first half of this year, along with the economic recovery. According to Colliers Research, Grade A office rents in the central business district (CBD) declined marginally by 0.5 per cent to S$9.52 per square foot (psf) in H1 2021, while Grade B rents fell 0.9 per cent to S$7.79 psf.

This further increased the rental difference between Grade A and B offices in the CBD. The rental gap between the two market segments has been widening in recent years, from 12.2 per cent back in 2015, to the current 18.2 per cent.

What has been driving this trend? For one thing, the growth of the flexible-workspace sector may be boosting demand for Grade A office space.

Even before the Covid-19 pandemic, Singapore's total island-wide flexible workspace within the commercial sector had already been posting annual double-digit growth since 2015, or a 31 per cent compounded annual growth rate (CAGR). Net lettable area (NLA) of flexible workspace tripled, placing it among the CBD's top six occupier sectors by 2019, and accounting for 5 per cent of CBD Grade A occupied space.

Most of these new flexible-work centres are located within Grade A space in the financial district, and accounted for the bulk of net office absorption in recent years.

TAKING UP MORE SPACE

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Looking ahead, amid a recovery in 2021, we forecast island-wide flexible workspace within the commercial space to grow by a further 3 per cent in NLA to reach 3.6 million square feet (sq ft).

Also fuelling demand for CBD Grade A offices was the accelerated growth at technology companies due to the pandemic. As they expanded, such firms took up more Grade A space, including some vacated by financial institutions that were rationalising their office footprint and exploring alternative workplace strategies.

Amazon, for example, took over 95,000 sq ft of Citigroup's office space in Asia Square Tower 1.

Twitter also added another floor, spanning about 22,000 sq ft, at CapitaGreen to its footprint.

At One Raffles Quay South Tower, ByteDance has expanded by another floor of about 34,000 sq ft. The Chinese tech giant also committed to additional seats with flexible-space operator The Executive Centre at One Raffles Quay North Tower, as well as to two floors totalling some 58,000 sq ft at Guoco Tower. This comes as ByteDance ramps up recruitment and builds its Asia hub in Singapore.

Indeed, we note that talent recruitment is a key consideration for tech companies, driving their preference for either Grade A buildings that are well-located, or high-quality business parks in fringe locations. An example of the latter is Razer's new South-east Asia headquarters at one-north, for which the gaming hardware firm would hire about 1,000 positions.

Meanwhile, Grade B office vacancies continued to increase, rising 90 basis points to 9.3 per cent in H1 2021. Demand for such properties remains lacklustre, resulting in some landlords struggling to backfill the vacant stock in these older buildings.

Besides the age, Grade B buildings also have smaller floor plates than Grade A properties, thus limiting the pool of potential leasing demand to small and medium-sized tenants. In addition, the stock of smaller office suites for lease is more readily available, hence occupiers seeking such offices have more choices.

Some of these companies could also be exploring flexible workspaces as an alternative to renting traditional offices at a Grade B building. This is considering flexible workspaces may offer a better location and working environment at a lower cost.

Grade A office vacancy rates also went up in H1 2021, gaining 40 basis points to 5.6 per cent, dragged by older stock in Raffles Place/New Downtown.

However, despite the higher vacancies, we note that selective landlords are still asking for higher rents for their Grade A offices, given the limited availability of large, premium contiguous space.

We expect CBD office rents to turn around and increase in the second half of 2021, with a two-tier recovery for the Grade A and B segments.

We forecast Grade A rents to rise 2 per cent in 2021, supported by strong economic growth, tech sector expansion and tight supply, while Grade B rents are likely to lag behind.

The supply of CBD Grade A space will likely be muted in 2021 and 2022, with annual expansion averaging 2.6 per cent of stock, slower than the 4.7 per cent for the last five years. Any redevelopments of the older commercial buildings in the CBD could tighten the supply further.

CHANGING HANDS

Part of the key supply for this and next year will come from CapitaSpring, which just obtained its temporary occupation permit in August and has 90 per cent of its NLA committed or in advanced negotiations. Guoco Midtown's office tower, targeted for completion in H2 2022, also has several active negotiations underway.

Within the CBD micro-markets, we see the Tanjong Pagar/Shenton Way area as having the highest potential for rent increments, given its ongoing rejuvenation. Already, we have seen the recent addition of a few new buildings, including Afro-Asia and 79 Robinson Road.

Many office properties in the Tanjong Pagar/Shenton Way area have changed hands in the past two years. Some are slated for refurbishment or redevelopment, encouraged by schemes such as the CBD Incentive Scheme. We expect more old office buildings to jump on the bandwagon.

In the longer term, the completion of the nearby Greater Southern Waterfront project and the Thomson-East Coast MRT line will also complement and enhance the attractiveness of the Shenton Way/Tanjong Pagar vicinity.

- Shirley Wong is senior associate director of research, and June Chua is executive director and head of tenant representation in Singapore at Colliers International.

READ MORE:

- Reshaping the office market: De-densification and decentralisation

- Singapore office landlords embrace flexibility and tech as they spruce up properties

- Facelifts for office buildings

- Co-working spaces among top six occupier sectors at 3.7m sq ft

- BT Explains: Why office landlords aren't fretting over banks cutting space

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.