Budget 2022 tax changes will help plug revenue-spending gap in FY2026-30: MOF

If there are new policy moves, even more revenue may be needed in the medium term, said MOF

Elysia Tan

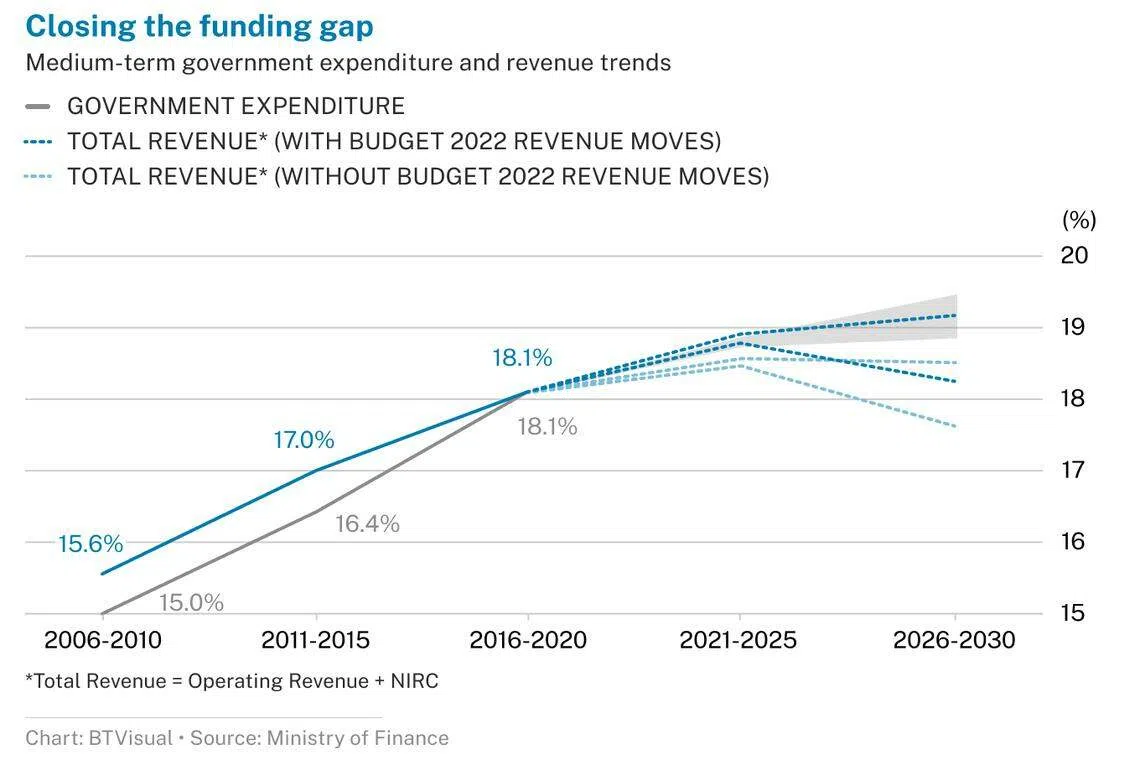

SINGAPORE’S government revenue would likely have fallen short for the FY2026 to FY2030 period and beyond, if not for tax changes announced in last year’s Budget, said the Ministry of Finance (MOF).

This is because government spending is rising, the ministry explained in an occasional paper released on Wednesday (Feb 8).

It projected that spending would rise to about 19 per cent to 20 per cent of gross domestic product (GDP) in FY2026-2030, driven by healthcare and infrastructure.

By FY2030, spending may exceed 20 per cent of GDP. But total revenue – comprising operating revenue and the net investment returns contribution (NIRC) – is about 18.5 per cent, before taking into account tax changes introduced in Budget 2022.

“This would not have been sufficient to cover the increase in government spending expected over the coming years,” said MOF.

To close the gap, Budget 2022 introduced a hike of the goods and services tax (GST) to 9 per cent; higher top marginal personal income tax rates; higher residential property taxes; and a new additional registration fee tier for luxury cars.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Currently, operating revenue is about 15 per cent of GDP, and “is likely to grow slightly slower than GDP”. But government spending is growing faster than GDP. So if this continues, “periodic moves to increase revenue would be needed”, said MOF.

Without the Budget 2022 moves, operating revenue for FY2026-2030 would have been 14.2 per cent to 15 per cent of GDP, according to MOF estimates.

With the changes, operating revenue is now expected to be 14.8 per cent to 15.7 per cent of GDP.

Meanwhile, NIRC has averaged about 3.5 per cent of GDP over the past five years, and is expected to continue. MOF said that growth of investment returns will likely slow on the back of investing headwinds, including slowing global economic and productivity growth, higher inflation and heightened geopolitical and trade tensions.

However, these spending projections “do not take into account future policy moves, such as additional spending to strengthen our social compact and economic competitiveness”, noted MOF. To fund additional moves, the government will either require more revenue, or “have to cut back in some existing areas and re-allocate funds to these new priority areas”.

“Overall, our fiscal space is now much tighter compared to the past few decades,” said MOF, adding that the government will continue to review and adjust its fiscal strategies.

Healthcare is expected to contribute the most to the rise in spending. Now around 2.3 per cent of GDP, it is projected to reach 2.9 per cent to 3.5 per cent in FY2026-2030. This is driven by the ageing population; higher healthcare utilisation due to changing lifestyles, increased screening and rising income; and higher per unit cost of healthcare due to medical advancements and labour costs.

In infrastructure, spending is expected to rise to around 4.4 per cent of GDP for FY2026-2030. But the fiscal impact is likely to stay at 4 per cent of GDP, because of the Significant Infrastructure Government Loan Act, which spreads out major long-term infrastructure costs across time.

The MOF paper factored in existing spending commitments for the coming years. These include the Progressive Wage Credit Scheme for employers of lower-wage workers, the enhanced Workfare Income Supplement, and spending on early childhood education. Together, these are expected to cost an additional 0.2 per cent of GDP per annum.

But the paper does not account for the impact of new global tax rules, due to “uncertainties” – though MOF noted that their net fiscal impact “may not be favourable”.

The Organization for Economic Co-operation and Development’s Base Erosion and Profit Shifting 2.0 (BEPS 2.0) initiative has two pilars. Pillar One re-allocates profits of large and profitable multinational enterprises (MNEs), from where economic activities are conducted to where consumers are located. Pillar Two introduces a global minimum effective tax rate of 15 per cent for large MNEs.

Under the first pillar, Singapore will lose revenue due to its small market. Under the second pillar, the long-term revenue impact remains uncertain and depends on how governments and companies respond. MOF added that any additional revenues from Pillar Two will likely be used to enhance Singapore’s competitiveness.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.